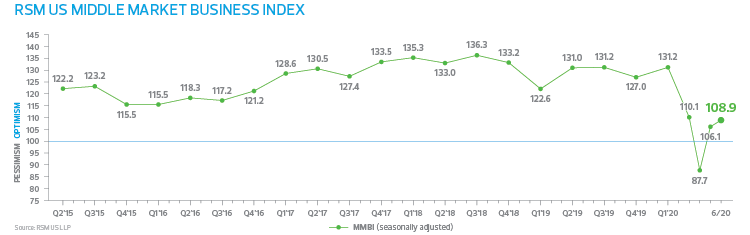

Middle market businesses are slowly emerging from the pandemic shock that caused the top-line reading of the proprietary RSM US Middle Market Business Index to drop in April to 87.7 from 131.2 in February. The lifting of lockdowns across the country and the release of pent-up demand in May were likely behind an uptick in the June MMBI*, a broad measure of middle market economic sentiment, which rose to 108.9 from 106.1 a month earlier. Despite the improvement, the underlying data indicates that the real economy is still mired in recession, with roughly half of the industrial ecosystems represented in the survey not yet achieving escape velocity from the recession’s nadir amid liquidity, labor and pricing challenges.

The share of survey participants expecting the economy to improve over the next six months, along with their gross revenues and net earnings, is encouraging and points toward a nascent recovery in the offing as long as the pandemic does not require massive reversals of reopening and another round of lockdowns. These numbers imply that middle market firms are well-positioned to step up economic activity over the next six months if conditions break in their favor. It is important to acknowledge that the shape and pace of economic activity going forward will not be driven exclusively by economic and financial considerations. Recovery is largely dependent on the direction and evolution of the pandemic.

Given the recent spate of rising U.S. infections associated with the pandemic, we have noted an easing of economic activity reflected in a range of alternatives and near real-time data that we track, including transit use, restaurant and hotel bookings, and similar readings. In addition, on or around June 24, household spending appeared to level off, which implies a frustratingly slow pace of economic activity ahead.

Near-term risk

The slowdown in consumption is the major risk to the middle market and economic outlook in the near term. Survey responses to the 10 questions that make up the index are consistent with an economy making progress, albeit from the depths of a deep recession.

Of the 12 middle market industrial ecosystems represented in the MMBI, retail, finance, construction, transportation, professional business services and wholesale trade appear to have entered growth territory; meanwhile, private services, manufacturing, goods producing, leisure and hospitality, education, health care , and information services are trailing. Given that middle market firms tend to lag in improvement behind their larger competitors, this is not surprising; it may be another one to three months before a clear majority of middle market industrial ecosystems emerges from the recession.

Beneath the top-line index, current views on the economy remain essentially unchanged from May. Only 21% of survey respondents stated the economy improved, while 56% expect it to do so over the next six months.

The outlook for gross revenues and net earnings was remarkably similar, with 28% and 30% of respondents, respectively, indicating an increase in those metrics during the month. Over the remainder of the year, 54% of respondents expect an improvement in both measures. This supports the 43% of executives who said they intend to increase capital expenditures over the next six months, even as the current-month indicator slid back to 26% from 28% previously.

Hiring, borrowing and pricing

Hiring and compensation data from the survey imply a difficult environment. Intentions to hire slipped, with only one-fourth of respondents indicating overall hiring level increases either somewhat or substantially, and a plurality of 42% expecting to boost hiring by the end of the year. On compensation, 29% of participants indicated an improvement, and 42% expected better times ahead.

Other notable findings include a visible uptick in the share of companies that plan to borrow, with 38% indicating that they expect to do so over the next six months, despite noting on net that it was more difficult to obtain funds. The questions on credit are consistent with the results of the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices; it shows that banks are tightening lending standards at a time when demand for credit is strong, as the economy struggles to emerge from the pandemic-driven recession. This is critical data that we hope the U.S. Treasury and Federal Reserve note as they continue to refine the small- and midsize-company focused Main Street Lending Program.

On the cost front, middle market businesses are observing an increase in prices paid, as the domestic economic engine restarted in May. This is not unexpected as the economy is nowhere near running at 100%, nor is the inability of firms to pass along those price increases, as noted in the prices received data. As such, firms are closely monitoring their inventories, with only 29% reporting an increase in stock building and 48% expecting to do so over the next 180 days.