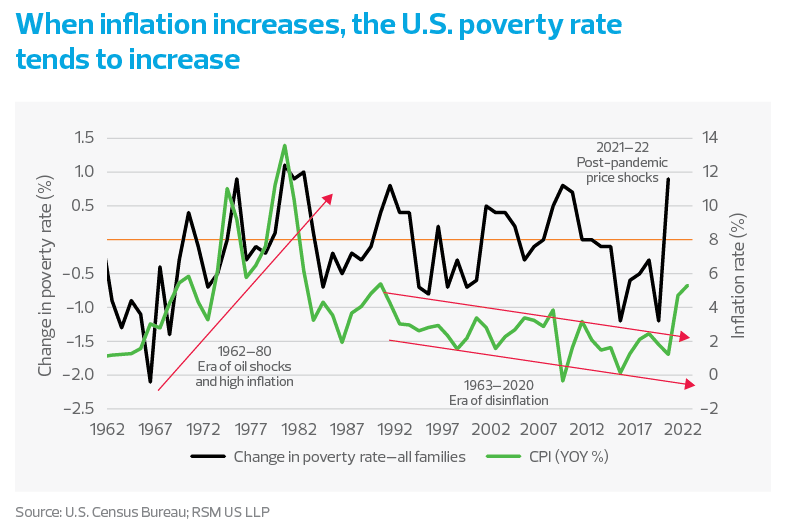

The war in Ukraine, the cutoff of Russian exports and the possible removal of roughly 4.3 million barrels of crude from U.S. and European markets are likely to harm household balance sheets.

Should the conflict continue, we expect it will result in price increases for everything from rare metals to crude oil, with the former affecting the cost of electronics and the latter likely to have an indirect effect on the cost of most other products.

As history has shown, steep price increases can lead to changes in consumer taste and behavior and result in self-rationing among households.

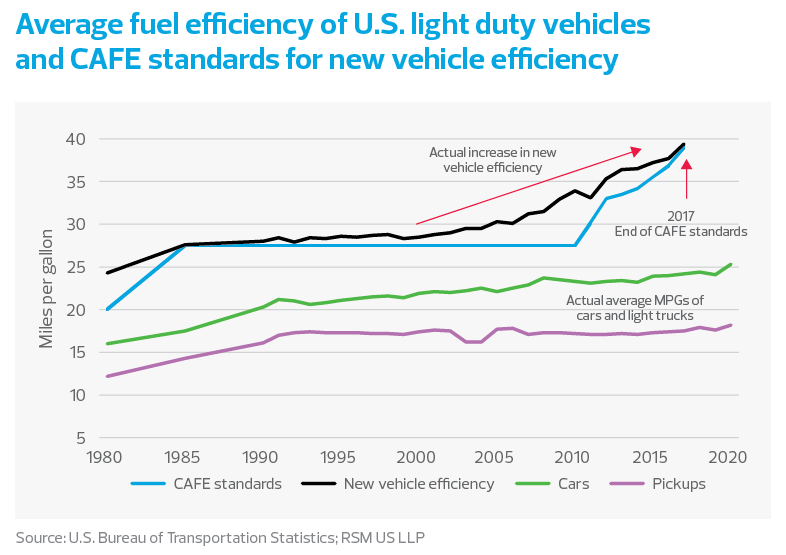

In the 1970s, your parents traded in that gas-guzzling car for a fuel-efficient import. These days that shift is happening with electric vehicles. But it’s not there yet, and since demand for energy and transportation is inelastic, corporations and the federal government will have to mitigate the price shock that households are experiencing.

We expect consumer behavior to facilitate a quicker pace of change in the energy sector and reshape domestic auto production.

The changing energy sector

The price of crude oil has surged since the invasion began. The removal of Russian exports from the market and the nonresponse of OPEC producers are likely to push the Brent crude benchmark higher.

If Russia continues to be ostracized from markets in the West, there is the potential for gasoline to reach $6 per gallon in the higher-cost Northeast and West Coast urban centers.

But what about the United States achieving energy independence? American imports of petroleum have declined as advances in fracking made the United States and Canada the swing producers for the world. (Canada exports 95% of its oil to the United States, where it is refined and then sold in other markets.)

But without price controls—used during World War II and the oil embargoes of the 1970s and 1980s—commodity prices will be determined by the global market.

As we have learned during the recovery from the pandemic, it’s not all that easy for producers to simply restart wells turned off when the drop in demand in 2020 sent the price of West Texas Intermediate crude to less than $17 per barrel. And over the longer term, the investment community faces growing pressure to stay away from fossil fuels.