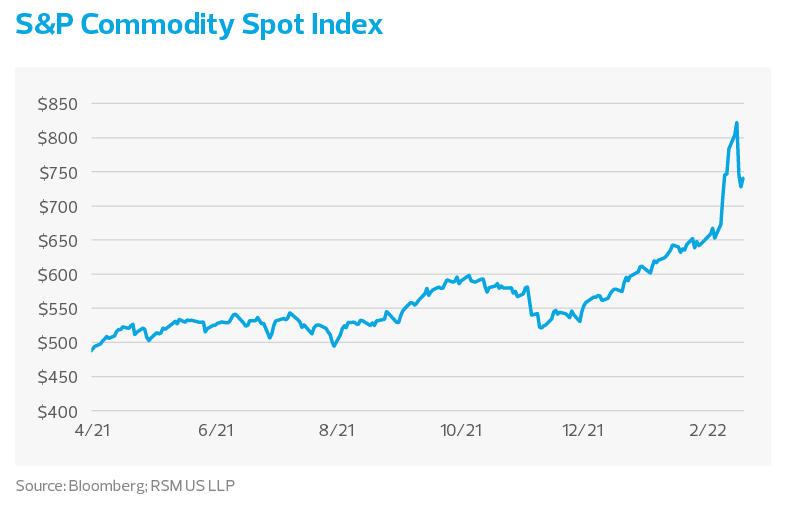

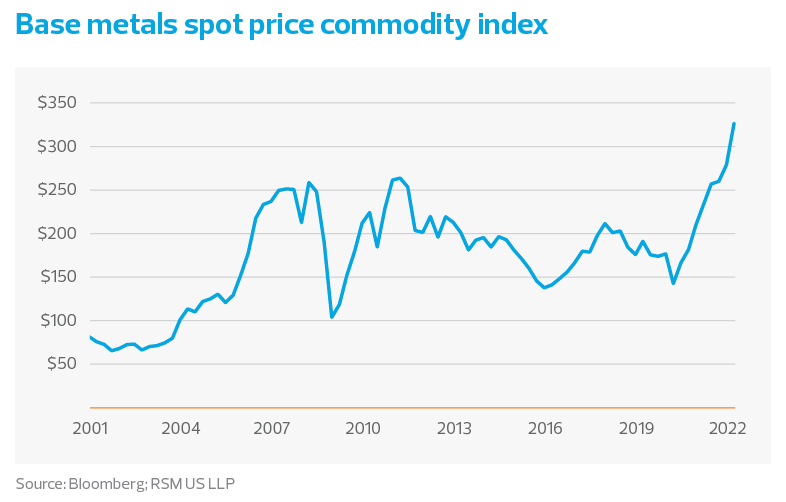

Russia is known for its commodity exports to the world, and the short- and long-term impact of the recent sanctions on the country are not yet completely clear.

But given the wide-reaching implications of these sanctions on everything from energy and metals to airplane parts and shipping, we can reasonably expect that manufacturers and companies in the broader industrial space will need to brace for impact—if they haven’t felt it already.

What, then, will the severe sanctions placed on Russia really mean for middle market industrial businesses?

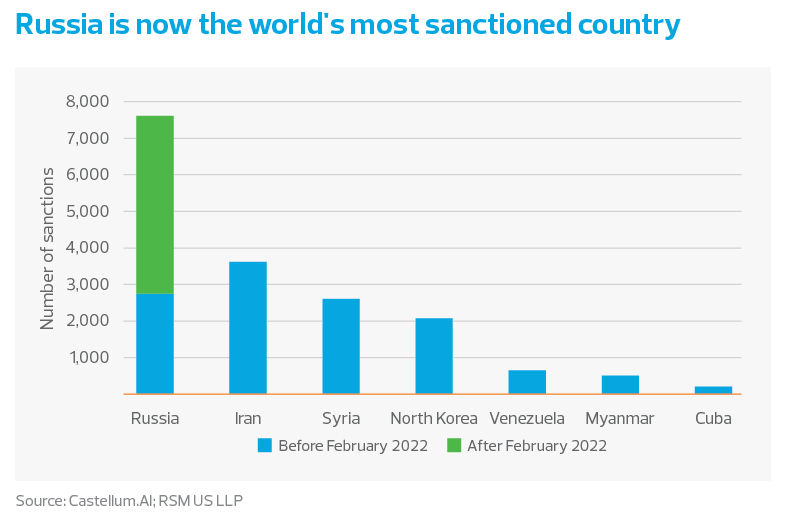

In less than two weeks, Russia became the most sanctioned country in the world. Before Feb. 22, Russia was already under 2,754 sanctions and was the second most sanctioned country after Iran. By mid-March, the number of sanctions doubled to over 6,330 and was still growing, according to a Russia Sanctions Dashboard maintained by Castellum.AI.

The U.S. Department of Commerce Bureau of Industry and Security issued controls in late February that “target Russia’s defense, aerospace, and maritime sectors and will cut off Russia’s access to vital technological inputs, [and] atrophy key sectors of its industrial base.”

These controls prohibit the sale of critical oil field parts, software, computers, telecom equipment, information security equipment and more. Businesses that sell controlled equipment or technology will need to know their end customers before selling their goods or services or risk running afoul of the export controls.

On the supply front, higher energy costs will induce longer lead times for purchasing certain energy-intensive materials as manufacturers try to cope with the increased costs. Industrial companies—along with other businesses that rely on industrial products, such as construction companies and contractors—need to assess their ability to pass these rising costs off to the end customer. In practice, organizations are inserting language in new contracts to help protect against continuing price volatility.

People and businesses sanctioned

Most of the 4,860 new sanctions at the time of this article were targeted directly at individuals, and 519 are entities, not including a handful of vessels and aircraft. Those entities include foreign-owned Russian or Belarusian subsidiaries, businesses outside Russia and Belarus that trade directly with sanctioned and unsanctioned entities, and those indirectly affected through supplier networks.