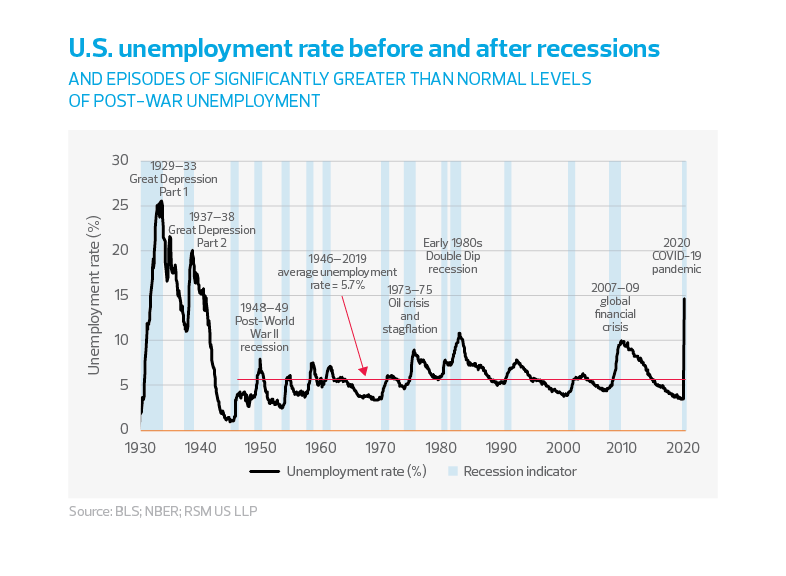

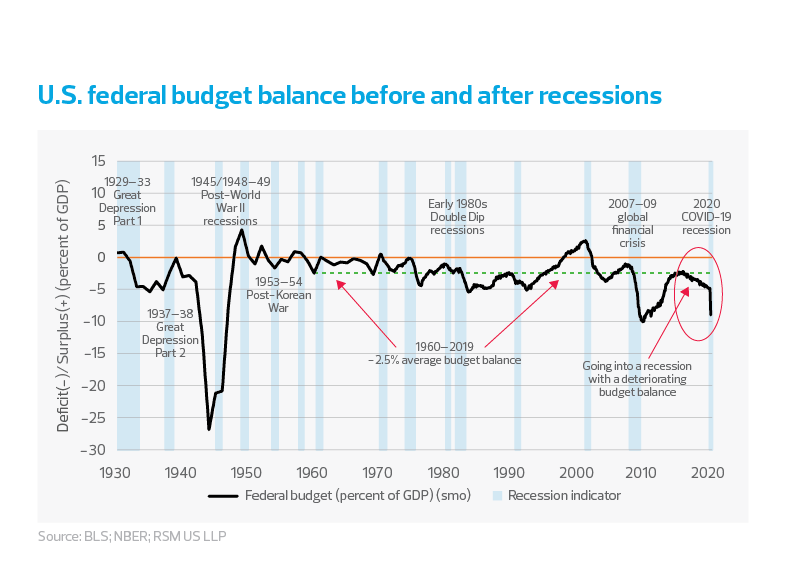

While we anticipate that Congress will approve a fifth round of fiscal aid to support the economy as the pandemic intensifies, it is now clear that this aid will not be put in place in time to prevent an air pocket in the economy later this summer.

The lapse in aid to 20 million Americans that pumped roughly $116 billion into the economy in June alone will result in a slower rebound in overall economic activity during the current quarter. That puts at risk our forecast of a 14.2% increase in U.S. gross domestic product in the third quarter.

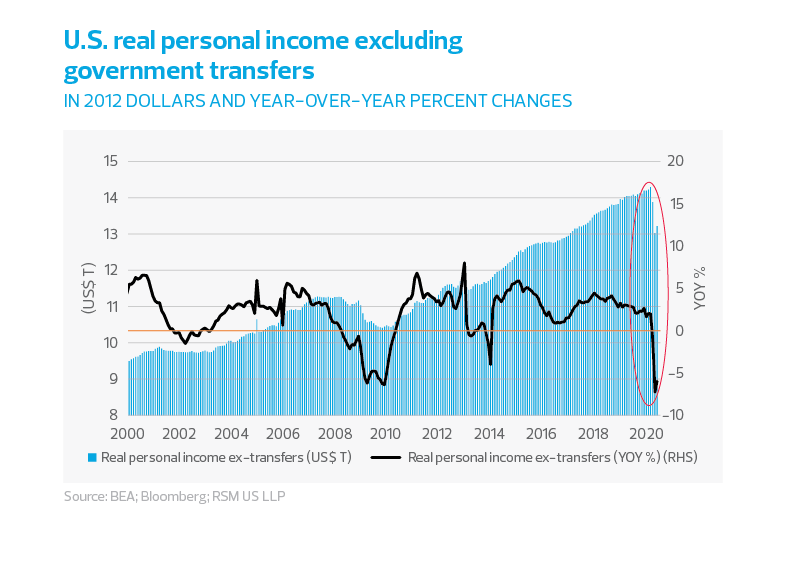

Through the first week of July, households at the bottom of the income ladder—the three lower-income quintiles— have reduced their spending by only 1.9% compared to the 10.8% reduction among upper-income households and 6.8% overall.

This goes directly to the heart of why fiscal aid was targeted at the unemployed—40% of households making under $40,000 per year have experienced job and income losses—rather than to the employed through tax cuts. It shows just how critical that aid is to supporting the economy. Absent a sufficient round of aid, investors should anticipate a significant slowing in household spending and another round of permanent job losses.

The last thing the economy, which began to level off in late June as the pandemic began to cause pullbacks, needs is a policy-induced downturn leading to rising unemployment and a slower pace of consumer spending.

MIDDLE MARKET INSIGHT Although we think the worst of the economic shock is in the rearview mirror, this economy is not yet out of recession and could very well remain in negative terrain if there is not sufficient policy support.

While bills for subsequent relief legislation move through Congress, the additional $600 per week aid to the unemployed under the Federal Pandemic Unemployment Compensation expired on July 25, just one day after the end of the federal moratorium on evictions, which puts at risk roughly 22 million people.