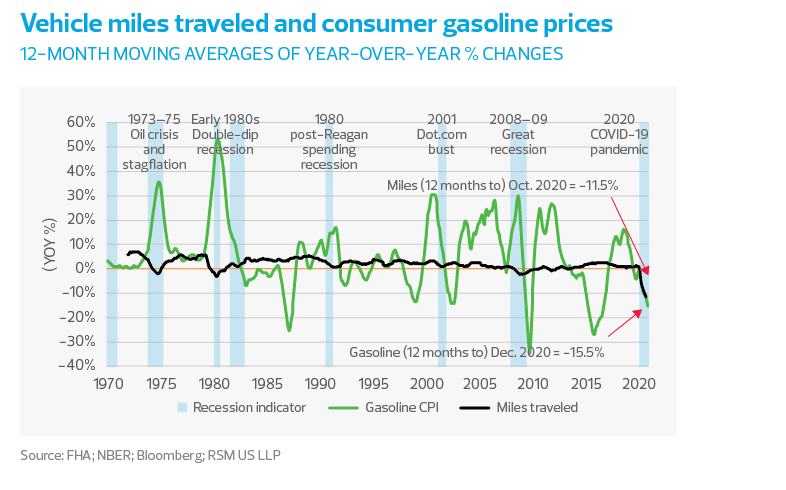

The price of gas continued to decline in December, falling 15.5% lower than a year earlier. According to recent data from the Bureau of Labor Statistics, gas prices for consumers peaked in late 2018 as the global manufacturing recession took hold and as Americans began to feel the effects of a slowing economy.

As shown in the chart, Americans’ demand for gasoline in normal times is somewhat inelastic. That is, most people will drive a certain amount of miles regardless of changes in the cost of gas.

But these are not normal times. The demand for gasoline dropped like a stone as Americans remained in their homes during the pandemic. We have driven 11.5% fewer miles over the past 12 months, according to the Federal Highway Administration, and that decrease is expected to grow larger as the pre-pandemic months in 2020 drop out of the calculation.

The drop in demand left OPEC in a quandary. Falling prices make American and Canadian fracking less profitable, which helps OPEC hold onto its market share. But the drop in demand also hurts the profits of the less affluent OPEC members, which rely on the higher revenue.

According to CNN, OPEC is now taking a bifurcated response, continuing the production cuts made by the major producers during the pandemic, while allowing Russia and Kazakhstan to increase their production.

The continuation of the production cuts was enough to push benchmark crude oil prices above $50 per barrel in mid-December for the first year-over-year price increase in a year. Combined with increasing uncertainty over the vaccination rollout, it’s reasonable to expect consumer demand for gasoline to moderate for a few more months.