As this latest episode of banking distress makes clear, the health of the U.S. economy depends on the health of the financial sector. Even if a business seems far removed from Wall Street, trends in the financial markets have important implications on that company’s fiscal health and operations.

U.S. economic history illustrates this connection—for better or worse.

In the 1930s, the public lost confidence in the banks, creating a series of bank runs that resulted in the Great Depression. In 2008, the inability of financial stalwarts Bear Stearns and Lehman Brothers to fulfill their obligations led to the freezing of the global financial system and the Great Recession.

We find ourselves experiencing familiar circumstances in 2023, with the closing of three U.S. regional banks and the near collapse of Credit Suisse, a systemically important financial institution that plays a substantial role in worldwide banking.

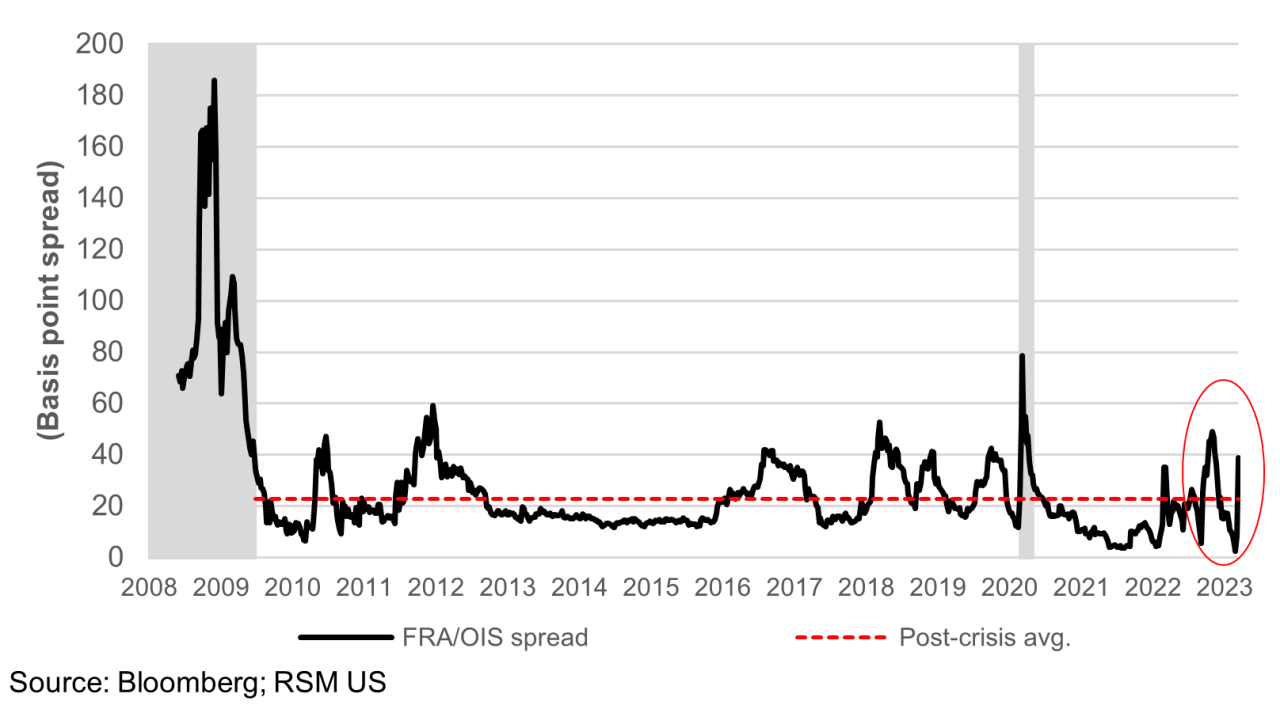

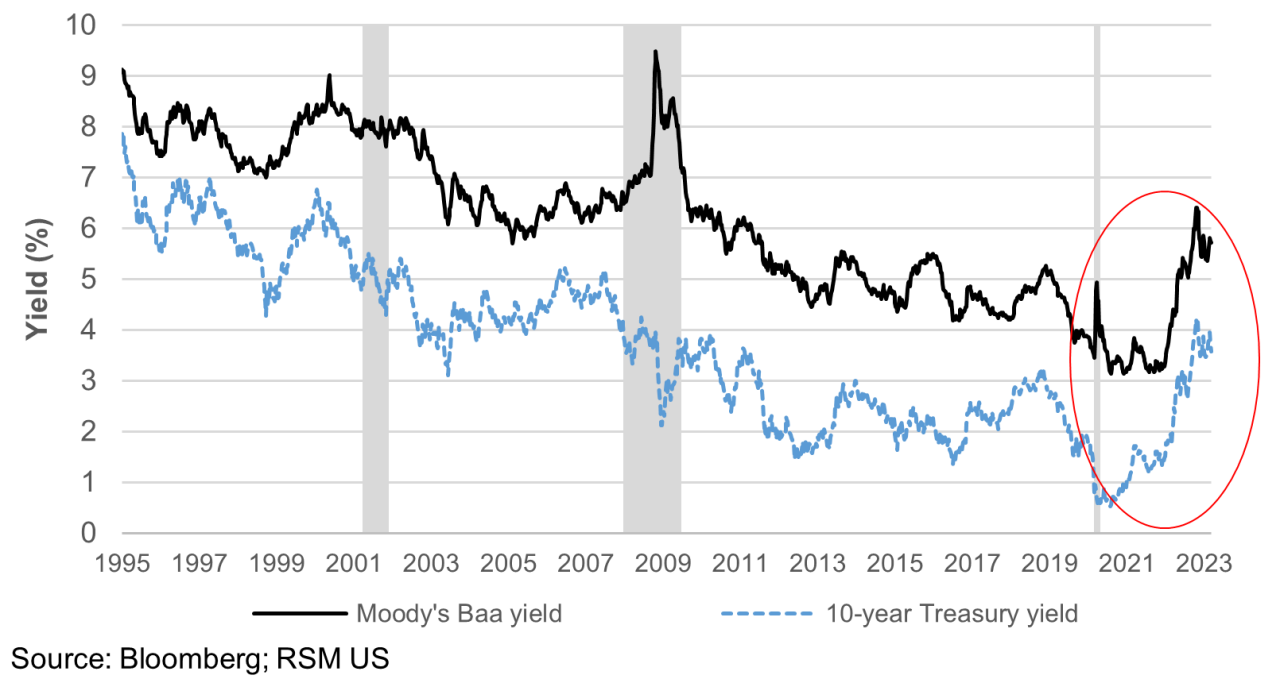

It is highly likely as the deposits of households and businesses shift from small and midsize banks to money funds and/or larger banks following the recent market disruption, a period of tighter lending standards will follow. Banks of all sizes will adjust to the post-crisis environment, and capital to meet payrolls and fund expansion will become scarcer and more costly.

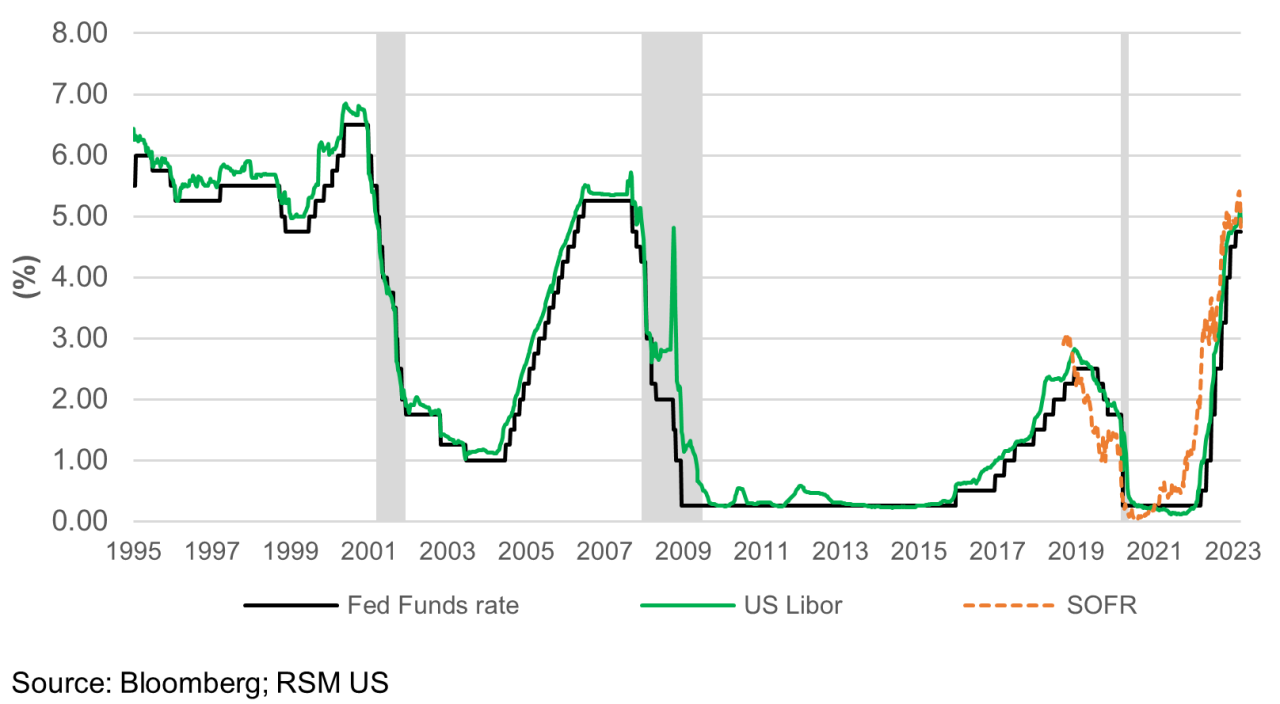

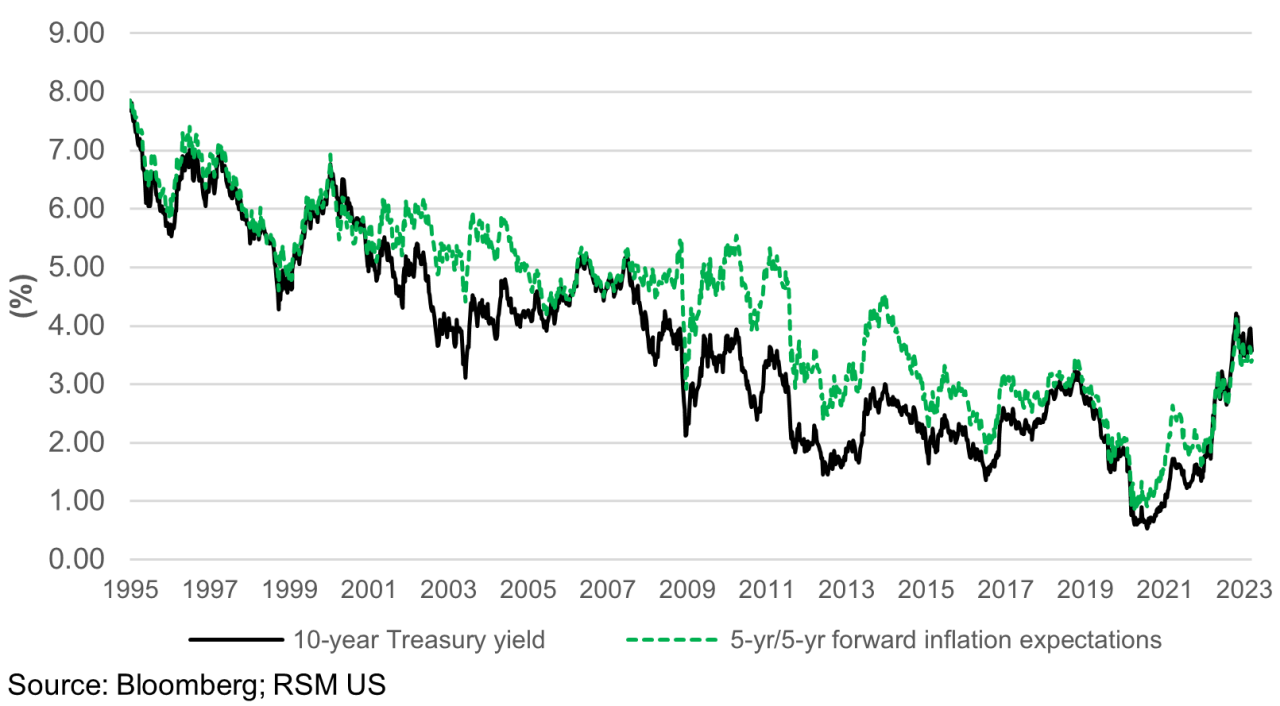

The financial channel that comprises bank lending to businesses is set to become a bigger economic headwind for those businesses, as the rising cost of credit, increased regulatory standards, and a reduced deposit base will lead to a net reduction in commercial credit for some time.

What to monitor?

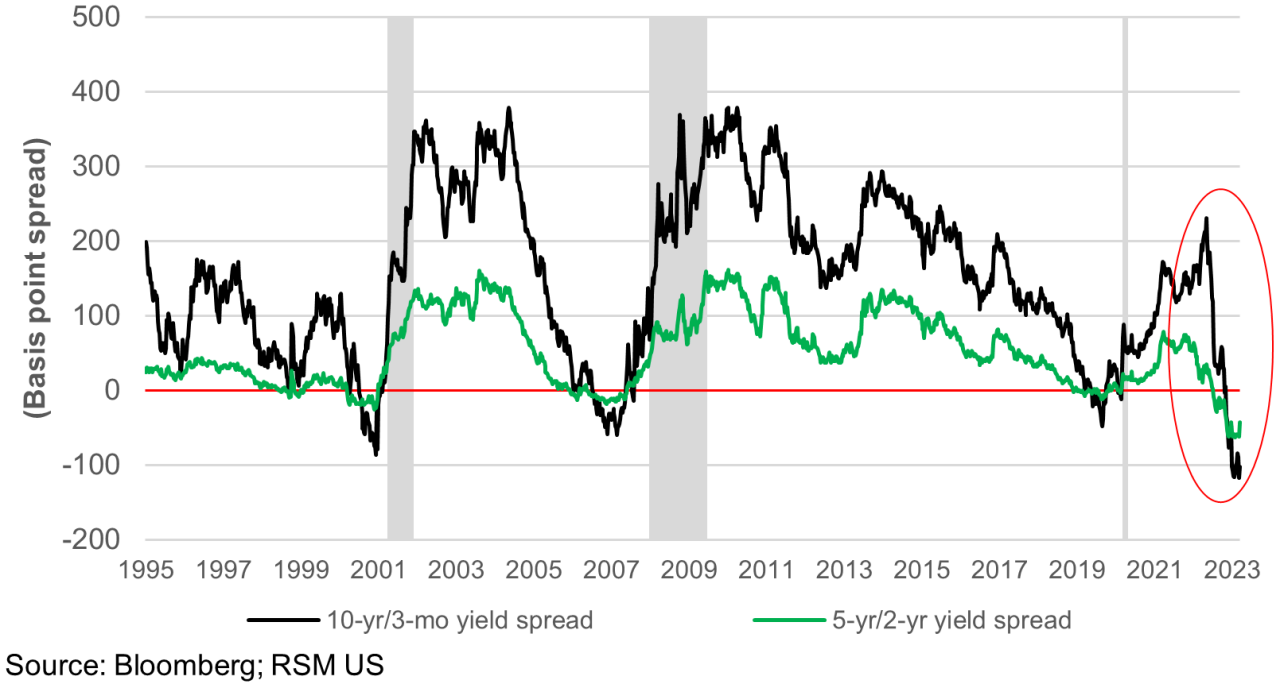

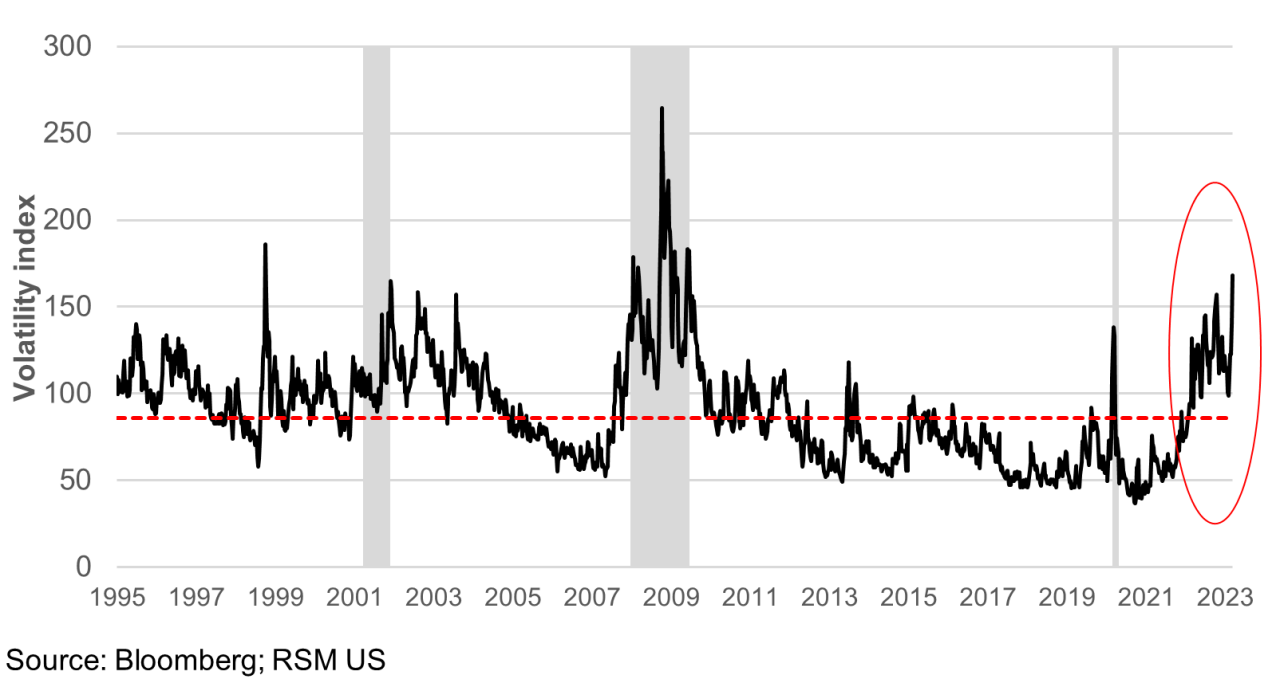

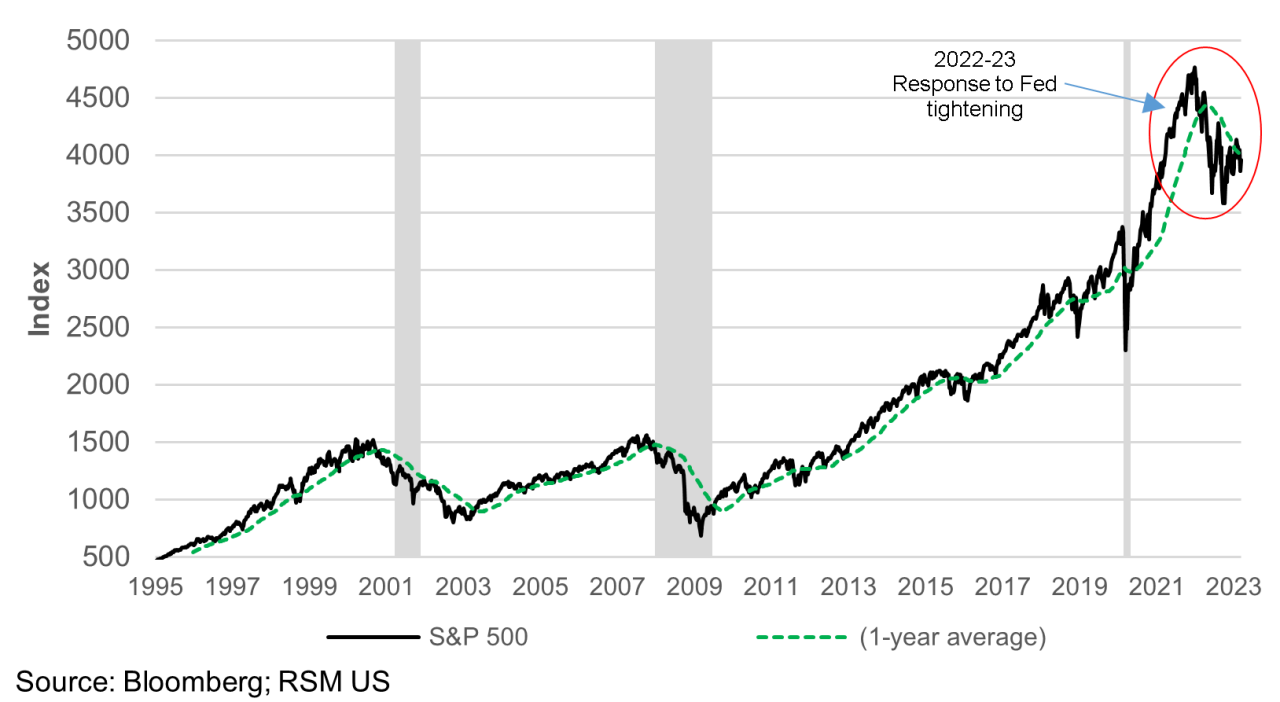

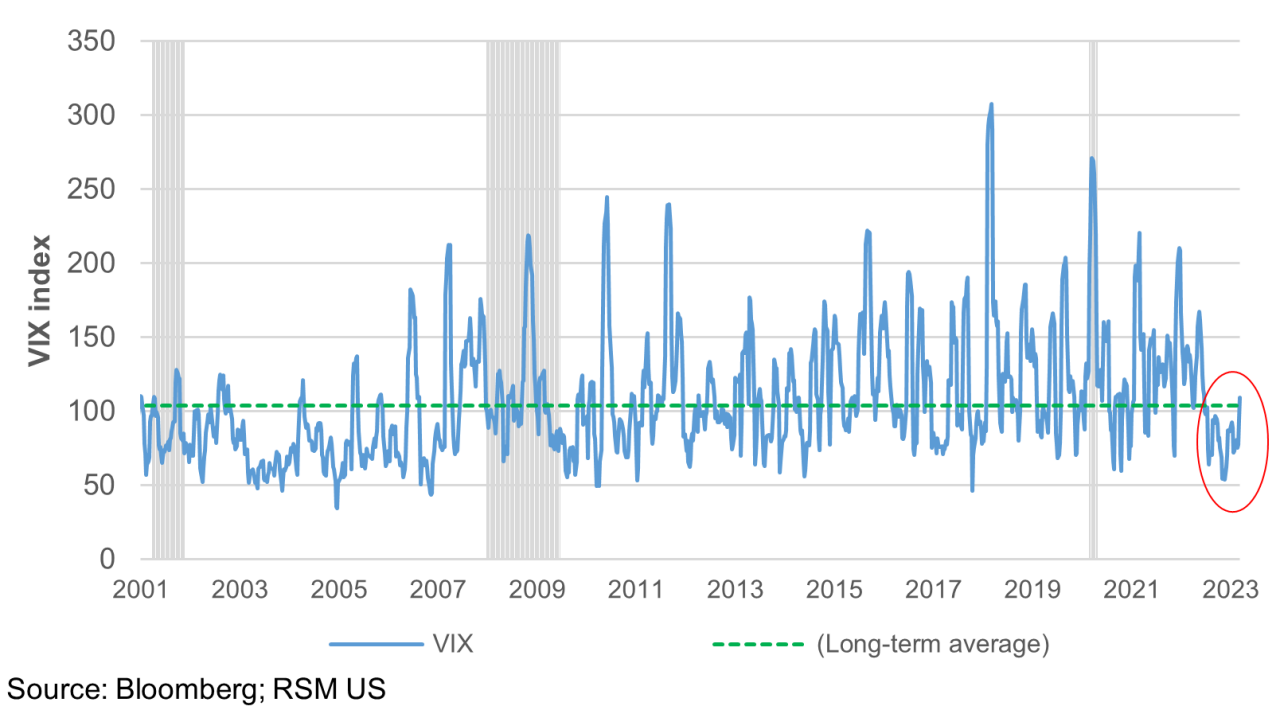

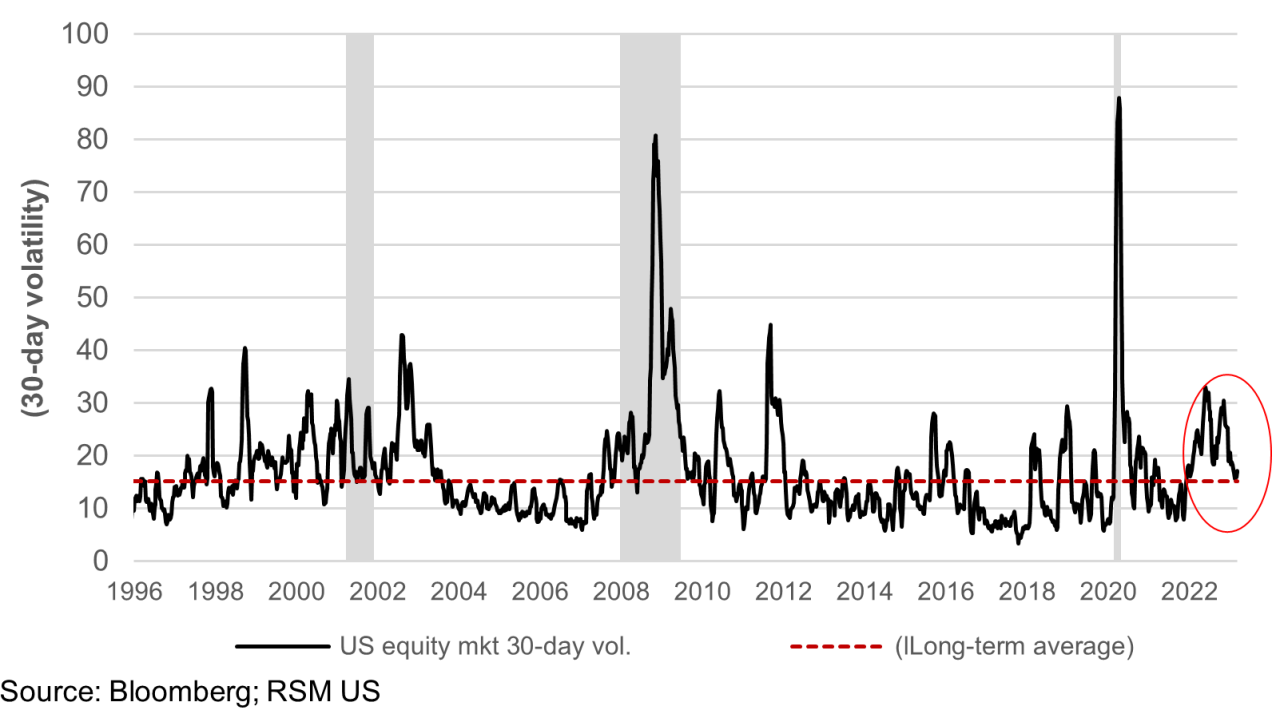

There is a host of financial indicators that will affect the ability of your business to borrow from local banks and meet payroll or short-term expense requirements. The RSM economics team monitors more than 75 different risk metrics across the fixed income, currencies, commodities, equities and assets markets.

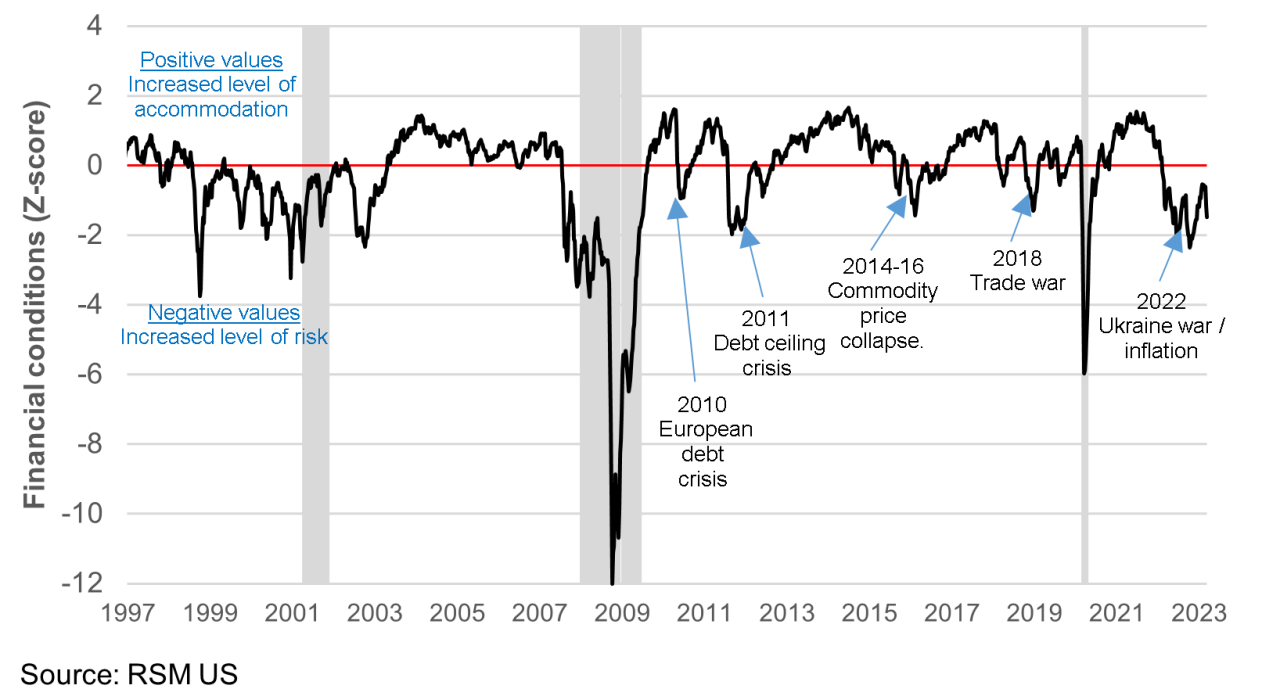

Our RSM US Financial Conditions Index summarizes the market action of those indicators. Financial indices are used by central banks to set policy; by financial institutions to manage portfolios and risk; and by businesses large and small to allocate capital.

Our index is a composite measure of risk (or accommodation) priced into the equity, money and bond markets. Negative index values imply excessive levels of financial market volatility and stress, and therefore a decreased willingness to borrow or lend. Positive values imply increased levels of financial accommodation necessary for investment and economic growth.

As of March 16, the RSM US Financial Conditions Index showed increased levels of risk in the financial markets equal to 1.5 standard deviations below zero. Zero is defined as normal conditions of risk and volatility expected to be priced into financial assets.

Note a reading approaching 2 standard deviations is considered statistically different from normal conditions; it occurs during periods of severe crisis. The current reading is nearing that point.