It's a central tenet of economics: We should expect prices to rise when the demand for goods and services increases, and to decline when demand diminishes. Price rigidity and the presence of product choices will dictate the speed at which price changes occur.

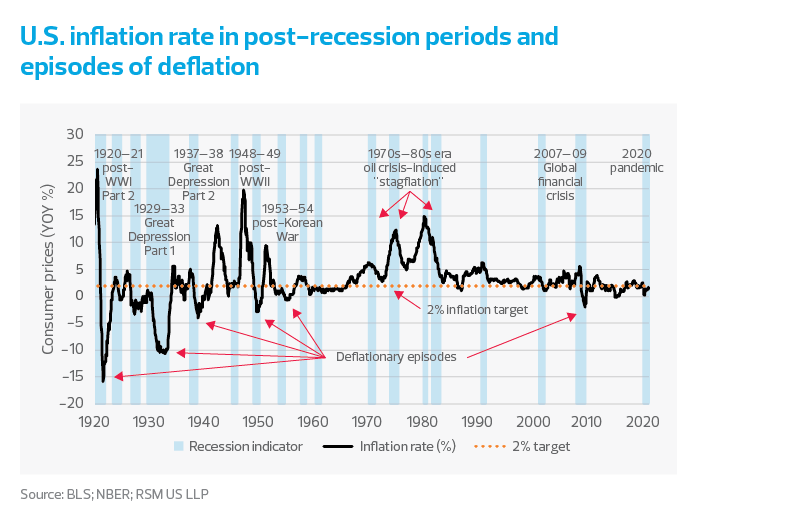

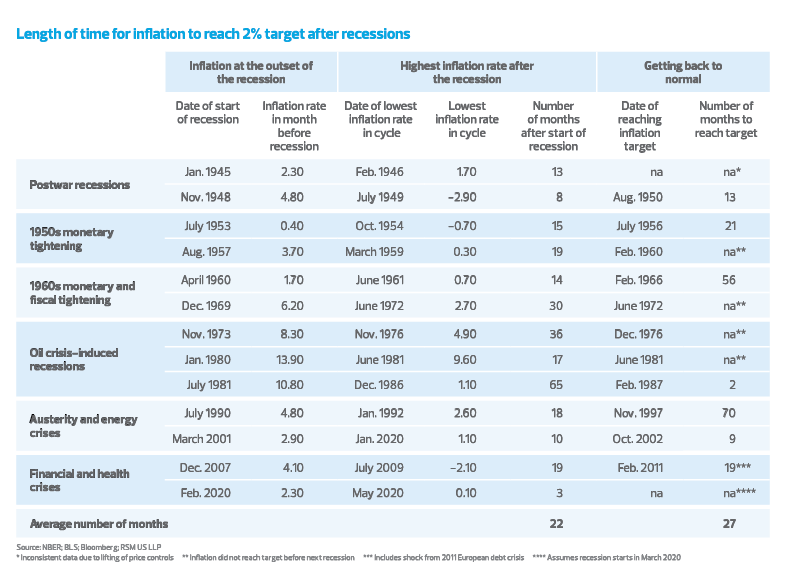

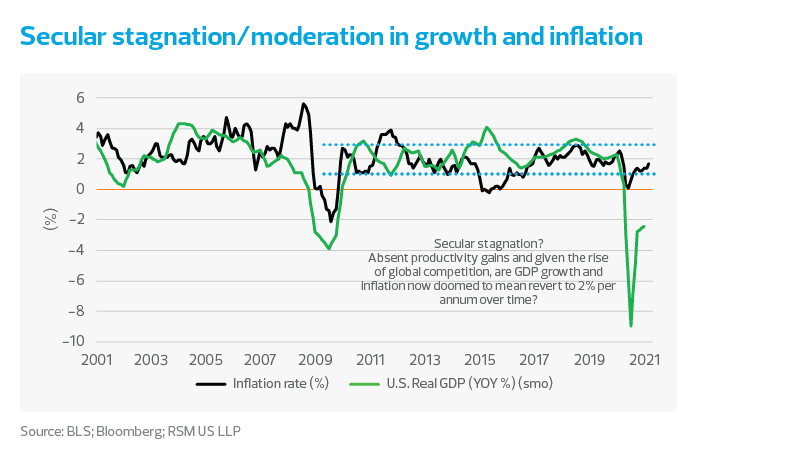

This has held up in our analysis of the postwar business cycles, which shows that inflation does indeed drop when demand falls during an economic downturn. The lowest rate during the cycle normally occurs 22 months after the start of the recession.

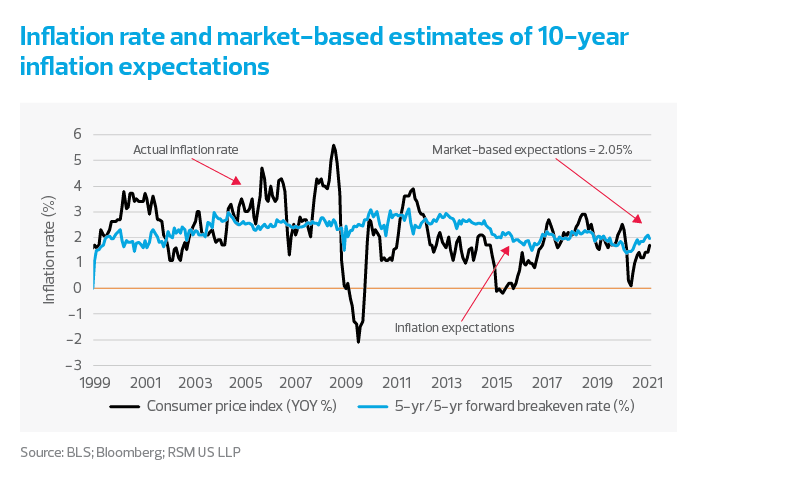

It can then take an average of 27 months for inflation to return to normal as sustained economic growth is attained and inflation reaches its assumed 2% target. This implies that some of the recent concerns around inflation are premature and that risks around the outlook linked to higher pricing are overblown.

We are now more than 12 months into a unique pandemic-induced recession. Because of the demand shock caused by the pullback of households and government-mandated economic shutdowns, it took only three months to reach the low point in inflation for this cycle. Does that mean that, because of the large amount of fiscal aid already applied and the accompanying debt, inflation will skyrocket?