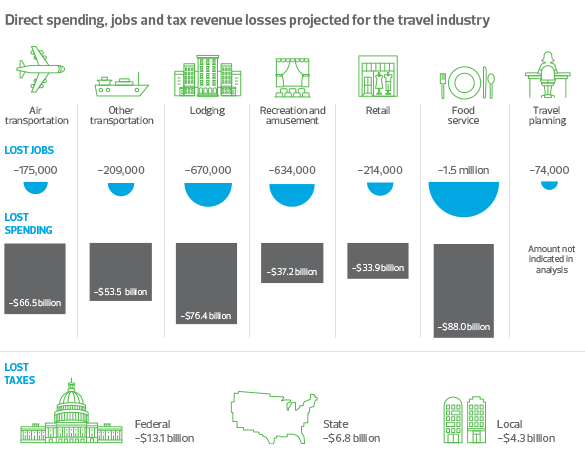

Travel restrictions, social distancing guidelines and lockdowns across the country have created a perfect storm for the travel sector as conventions and other events get canceled, more hotel rooms sit empty and spending plummets at restaurants—many of which are closed—due to the coronavirus pandemic.

Conferences and meetings make up a substantial portion of revenue for hotels in the United States. Large chains and boutique properties alike are expected to take a significant hit as the result of recent cancellations and delays in the domestic market. In early March, the city of Austin, Texas, canceled programming for its annual South by Southwest music and film festival. The Boston Marathon was rescheduled from April to September; the Indianapolis 500 was postponed from May to August and scores of other arts and sporting events around the country have been canceled as organizations make efforts to slow the spread of the new coronavirus disease, COVID-19.