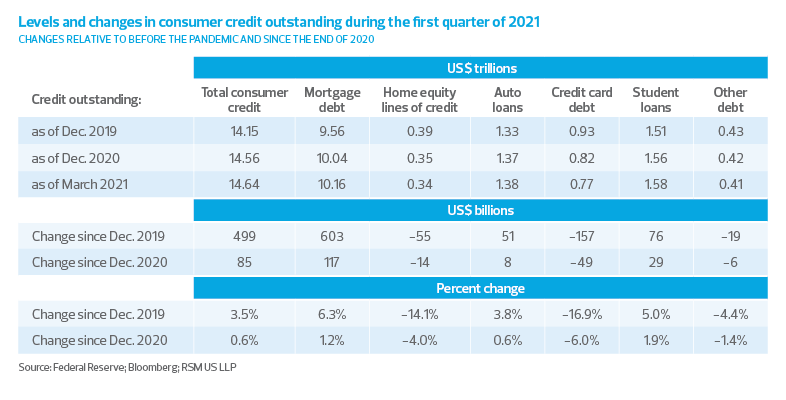

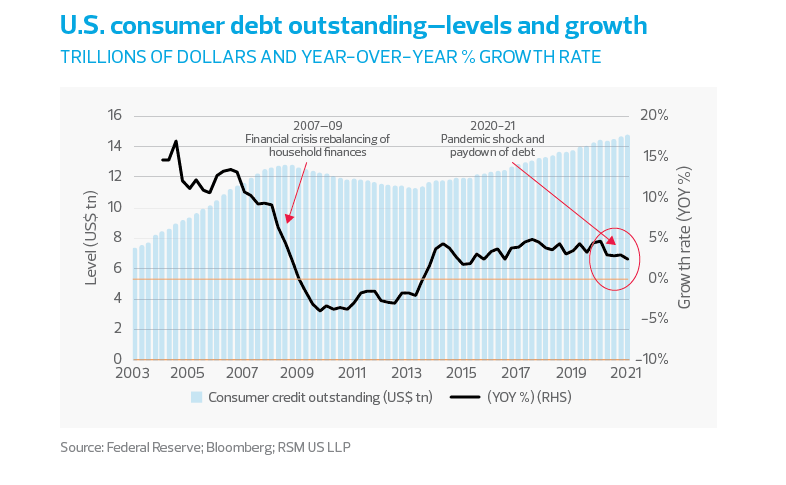

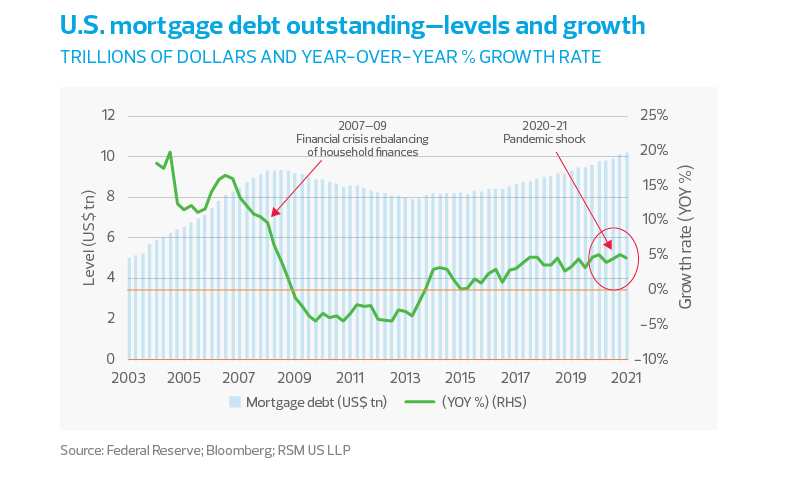

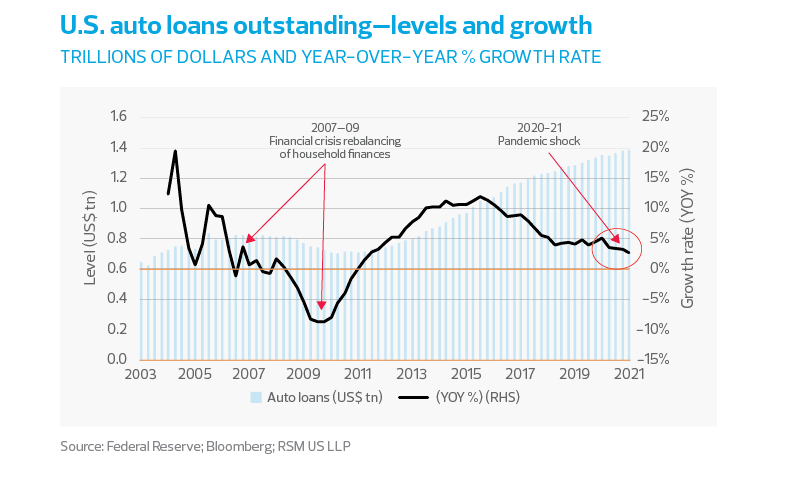

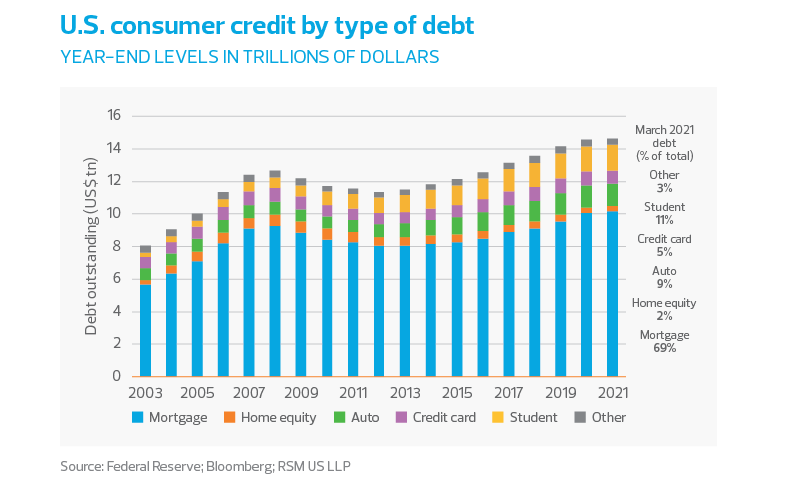

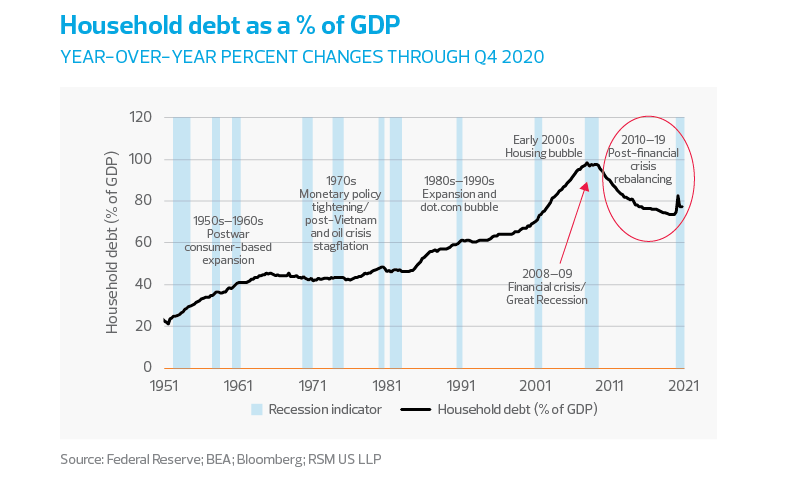

Consumers continued their pandemic-era rebalancing of household finances in the first quarter, shedding credit card debt and home equity lines of credit. These adjustments to household balance sheets appear consistent with increases in government transfers and changes in buying habits during the pandemic.

This underscores the powerful release of pent-up demand that will be the foundation of this year’s economic boom and will provide the overarching narrative for the first phase of the recovery and expansion.

Government efforts to maintain income streams and spending during the pandemic have been successful, as evidenced by the recoveries in retail sales and in personal consumption expenditures since the depths of the pandemic.

In one sense, those government transfers to households have in a modest way helped millions of Americans rehabilitate their balance sheets. Over a decade ago, the government took a not too dissimilar approach, but with major banks, when it sponsored a de facto bailout of those large and systemically important institutions.

But not all of those fiscal transfers have gone into spending. Instead, a significant portion is being retained as outright savings or through the paying down of debt. Our estimation is that households will largely save 30% of those government transfers, use 30% to pare down debt and spend 40% of them over this year and next.

We categorize paying down debt as a form of precautionary savings, in which households give themselves more room to maneuver should expenses once more overwhelm available income during the inevitable economic shakeout of the post-pandemic recovery.

This reduction of debt should also reinforce the improvements in household balance sheets and the overall economy as Americans gain confidence in their own financial conditions.

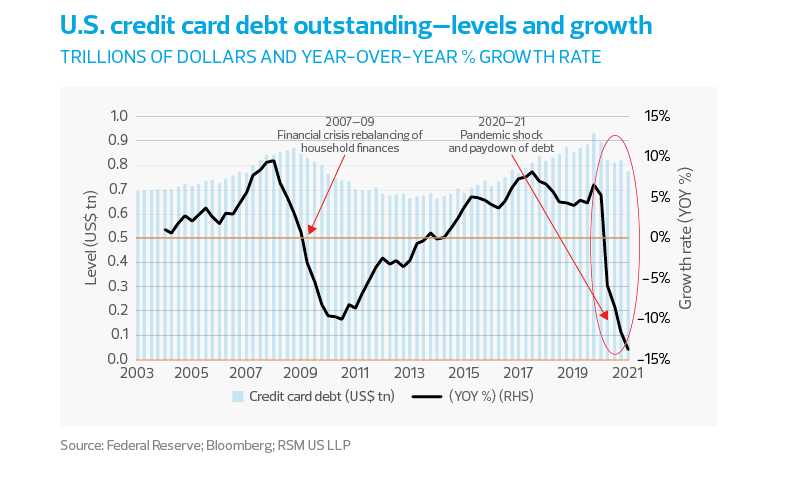

Credit card debt was reduced by $157 billion in the five quarters of the pandemic (from the end of 2019 through the first quarter of 2021), including a $49 billion drop in the first quarter. Credit card debt was growing at a five-year average rate of 5.4% per year before the pandemic, but grew by only 2.6% on a year-over-year basis in the first quarter of 2021.

Home equity lines of credit were reduced by $55 billion during the five quarters of the pandemic, including a drop of $14 billion in the first quarter of 2021. Home equity financing has been in general decline since the early 2000s, with negative growth since 2012.

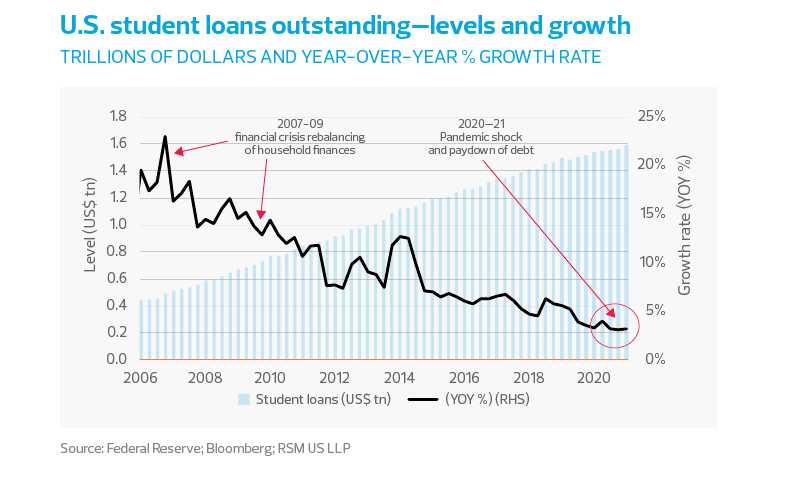

According to an analysis by the Federal Reserve Bank of New York, in total, “non-housing balances declined by $18 billion, with increases in auto and student loans offset by the declining credit card balance.”