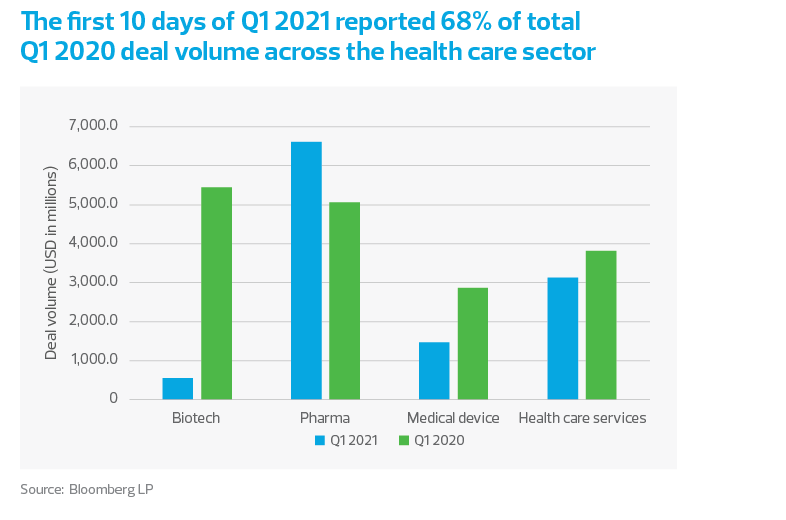

In years past, the JP Morgan Healthcare Conference, held in mid-January, has heralded sector announcements of large partnerships, joint ventures, and mergers and acquisitions. This year, the health care sector could not even wait until the second full week of the year to kick off an acquisition announcement spree. While we may see investors pull back after last quarter’s investment spree to focus on integrations and operations, or to focus on other industries as they rebalance portfolios, the quick start is an early sign of what promises to be an active year for funding and mergers and acquisitions activity.

Through mid-January, we have seen more than $3.1 billion of announced deals in the health care services sector, largely driven by Centene’s $2.9 billion acquisition of the behavioral health provider Magellan on Jan. 4. Already, this deal represents 82% of last year’s first-quarter deal volume ($3.8 billion). It’s safe to say that year over year, we will see more health care services deal volume in the first quarter than we did last year.