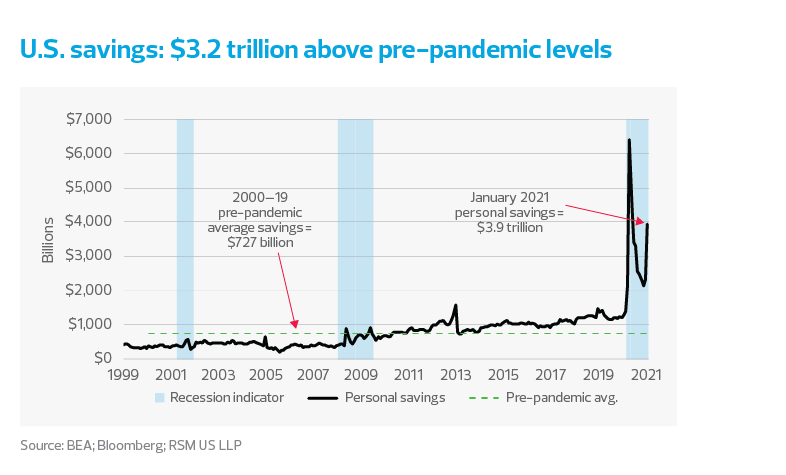

Government transfers from the end-of-year $908 billion fiscal aid package were the primary catalyst for the 10% increase in income and the 2.4% jump in spending, a robust kickoff to what is going to be one of the more memorable years in economic activity in decades. The personal savings rate increased to 20% in January from 13.7% in December. The amount of national savings now stands at $3.93 trillion, $3.2 trillion above the pre-pandemic average. This combination of excess savings built up over the past year as a result of business curtailment and fiscal aid/stimulus that is in the legislative pipeline is the kindling for what will likely be an economic boom later this year.

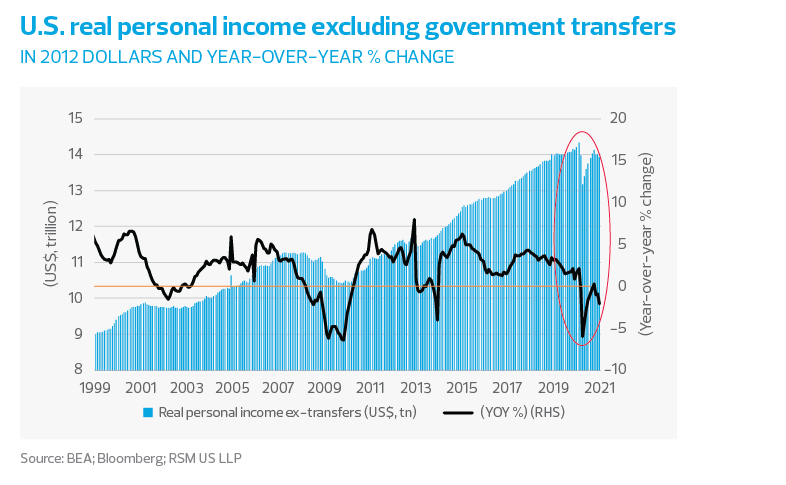

For those questioning the need for fiscal aid, here’s the rub: after excluding government transfers, income actually showed a third straight monthly decline. January personal income ex-transfers declined by -0.5% even after an 11% increase in disposable income. This reaffirms our view that another round of aid is in order even after the boom-like January retail sales, spending and income data. The decline in personal income ex-transfers will reaffirm the Federal Reserve’s policy path and its forecast of a modest transitory bump in inflation midyear that will then fall back toward its 2% target later this year and into 2022.

While financial markets are moving swiftly to price in better growth and pushing interest rates higher at the long end of the treasury curve, recent data won’t cause the Fed to alter its zero interest rate policy or the path of its $120 billion monthly asset purchase program.

The central bank wants to see the reflation of the economy, higher inflation (at least in the short term) and an eventual move back to full employment, which we define as an unemployment rate at or below 3.5%. In our estimation, they will achieve the former later this year, while full employment still remains a number of years away.

The response in fixed income market to this data is notable. Just prior to the data release the U.S 10-year Treasury was trading near 1.47%, well above the 0.91% level at which it started the year. In our view, this is a positive development, reflecting the reflation of the economy and not indicative of risks linked to inflation. In the immediate aftermath of this recent data, the 10-year eased to 1.45%, perhaps indicating a modest break in the recent bond selloff after several volatile days of trading, and certainly related to the third straight decline in personal income ex-government transfer noted.

Inside the details of the report, the policy-sensitive core personal consumption expenditure index (policy-sensitive because the Fed uses this metric to formulate monetary policy) advanced 0.3% on the month and 1.5% on the year. This is in line with our preferred forward-looking inflation metric, the Fed five-year and five-year forward, which points to a 2.2% rate of inflation over the next 10 years. This does not scream inflation, hyperinflation or dollar debasement. Rather, it implies long-term price stability.