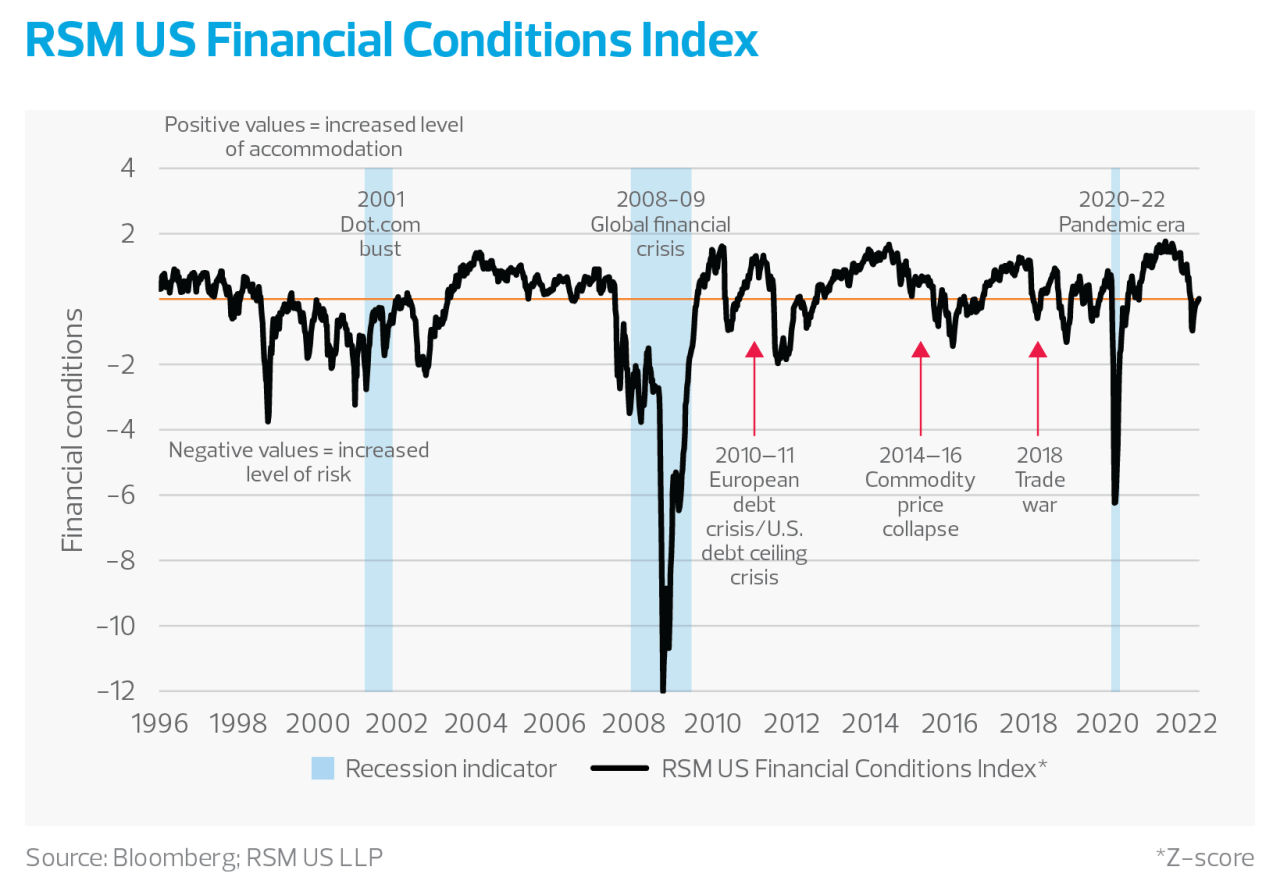

Financial conditions in the United States deteriorated again in May after a pause in late April. The recent selloff across equity markets is indicative of the policy shift at the Federal Reserve, which intends to tighten financial conditions to achieve price stability.

While we continue to make the case that a recession is not imminent—it is more likely a 2023 narrative—falling equity prices in the near term will dampen consumption among higher-income consumers. These consumers are the 40% of households that account for more than 60% of overall spending, which is critical to the sustainability of the current economic expansion.

And that spending is at the core of rising concerns about the durability of the expansion as the Fed hikes its policy rate and draws down its balance sheet while the American public contends with higher inflation.

The RSM US Financial Conditions Index is now more than 1.20 standard deviations below normal as losses in the equity markets pile up, volatility increases and credit spreads widen in the bond market.

All this signals a tightening of financial conditions and the slowing of the propensity to borrow and lend resulting in a drag on economic growth.