That’s because diesel is used to plant and harvest crops and move the food to market. And diesel transports products from Shanghai to Los Angeles to warehouses and shops. So, as long as our reliance on fossil fuels continues, consumers can expect to be stuck with the indirect costs of diesel.

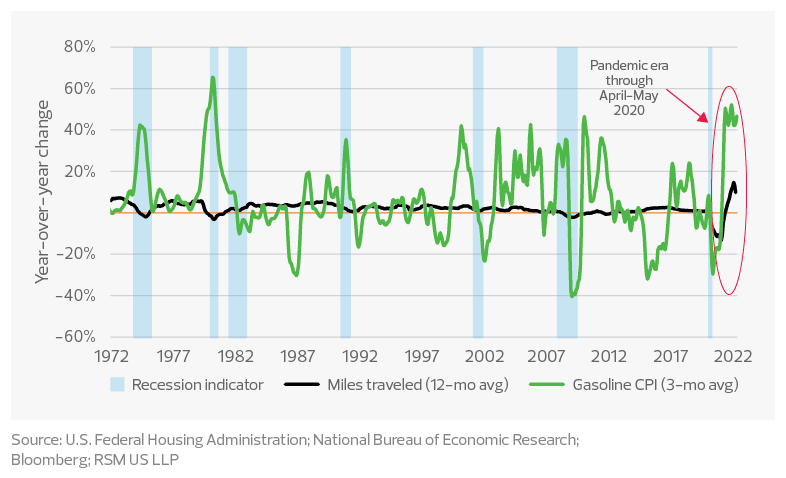

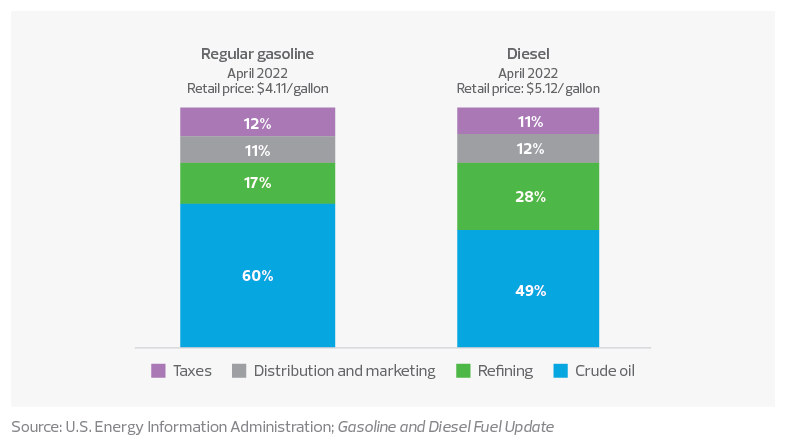

Retail gasoline prices increased by 62% over three years, from $2.79 per gallon in June 2019 to $4.52 in mid-June.

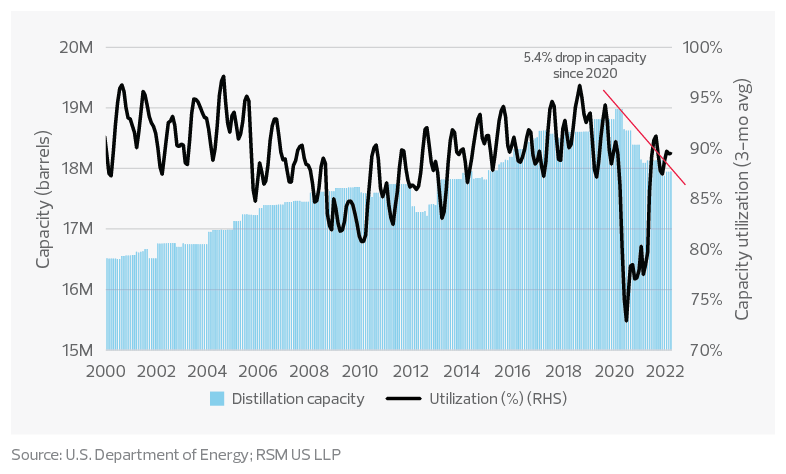

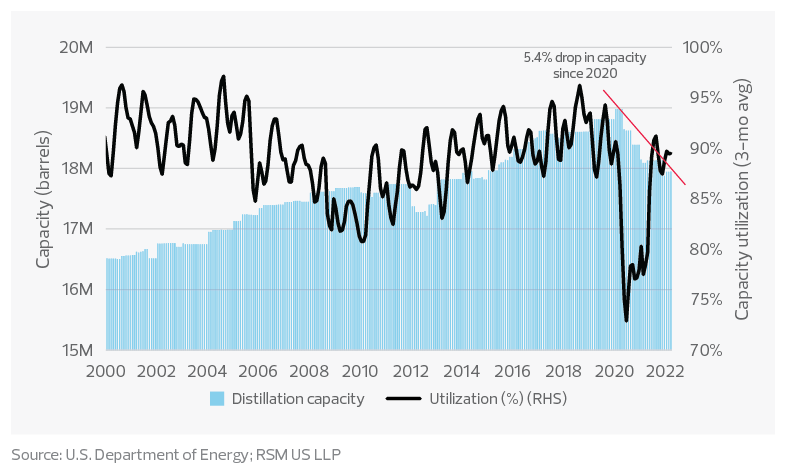

Over that same timespan, the retail diesel price increased by 75%, from $3.13 to $5.47. Much of the diesel price increase is because of the 113% jump in refining costs, from $0.75 to $1.59 a gallon.

The takeaway

Fossil fuels will be part of the energy mix into the foreseeable future despite efforts to decarbonize the domestic and global economies. If there is a lesson to be learned from the unwillingness of investors to finance the reopening of wells, it is that there is a role for government, in partnership with the private sector, to finance the expansion of production and refining capacity.

In terms of inflation, demand for energy is relatively inelastic in the short term and we think that fuel prices have reached a tipping point with respect to reallocating consumer choice and dampening overall consumption.

While consumers can change buying habits in the long term—to alternatives like electric vehicles, for example—in the short term, they will have little choice but to spend more on necessities like gasoline, all of which raises the likelihood of a recession.