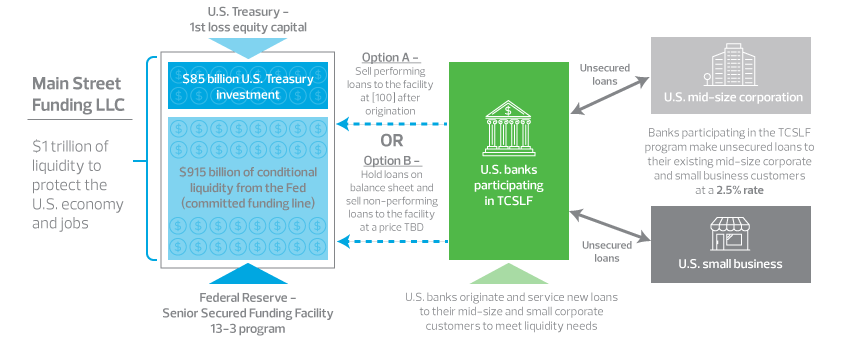

From our vantage point, the most important and historical development was the construction of the Main Street Lending Program that will permit small and medium-size businesses to obtain bridge financing through eligible lenders. The loan facility is backstopped by $75 billion in equity investments that will support up to $600 billion in liquidity commitments by the Federal Reserve. Under the Main Street Expanded Loan Facility, the central bank has committed to lend to a single common purpose vehicle on a recourse basis.

In our estimation, this a robust first step toward providing a lending facility that will stem what was a likely solvency crisis inside the critical small and medium-size commercial community. Like the Paycheck Protection Program, we anticipate that the Main Street program will experience greater-than-expected demand and will very likely be oversubscribed.

Based on our interaction with RSM’s core client base of small and medium-size businesses, Congress will likely move to increase the size of the its equity investment and the Fed will need to boost its liquidity commitments. We think that once all is said and done that this facility will likely see demand for bridge financing at greater than a $1 trillion pace.

The special purpose vehicle will commit to purchasing 95% of loans made by eligible lenders — U.S. insured depository institutions, U.S. bank holding companies and U.S. savings and loan holding companies — that will hold 5% of each eligible loan.

Eligibility is based on firms with revenues of less than $2.5 billion in 2019, or firms with up to 10,000 employees. Each firm must be a business that is created or organized in the United States with significant operations and a majority of its employees in the U.S.

Loan terms are a four-year maturity at an adjustable rate of SOFR plus 250-400 basis points with the minimum size of $1 million. Amortization of principal and interest will be deferred for one year. The maximum size will be the lesser of $25 million or an amount that, when added to the borrower’s existing and committed but undrawn debt, does not exceed four times the borrower’s 2019 EBITDA. Prepayment will be permitted without penalty.

The facility does contain some loose conditionality around efforts to maintain payroll and retain its employees during the term of the loan, as well as not cancel or reduce any existing lines of credit to the eligible lender or any other lender. In addition, loans obtained through the facility will not be used to repay or refinance pre-existing loan balances.