Promoting from within

As an alternative to tax cuts for the wealthy, which clearly provide short-term boosts to spending, we should consider investment in low-income earners that would have a longer-term impact on potential growth. It is critical that as the economy evolves in a digital age, pathways to prosperity should be built for those who have been left out because of the lack of education and infrastructure.

The military and corporations like McDonald’s are known for developing their workforce from within, providing employees the means to develop their skills and rise up through the ranks. General Colin Powell is a prime example, as were the Merrill Lynch chief executives who began their careers in the mailroom. A similar approach could be constructed to ensure that a large percentage of the population not be left behind as the digital economy rapidly accelerates.

MIDDLE MARKET INSIGHT Faced with a tight labor market, middle market companies should consider retraining existing employees with the skills needed to thrive in the digital economy.

According to a recent Brookings analysis, “Low-wage workers comprise a substantial share of the workforce. More than 53 million people, or 44% of all workers ages 18 to 64 in the United States, earn low hourly wages.”

This is due, in large part, to competition from a global supply of cheap labor and the off-shoring of basic manufacturing to low-wage centers. While this shift in labor supply is a fact of life, it does not mean we should simply walk away from society’s responsibility to provide the means for development.

From the Brookings report: “The well-educated and technically savvy find ample employment opportunities, while those with lower levels of education face a labor market that is decidedly less welcoming, with lower wages and less potential for career growth. Meanwhile, some regions dramatically outpace others in job growth, incomes and productivity, raising disquieting questions about how best to promote broad-based economic growth.”

Policy alternatives include expanding the earned income tax credit, wage subsidies and increasing the minimum wage to $15 an hour in an orderly fashion. This increase would partially shift the source of income for low-wage workers from government subsidies to corporations. A century ago, Henry Ford provided wages that were sufficient for his employees to purchase a Model-T; modern-day corporations are expected to simply outsource or automate their low-wage jobs in the name of maximizing shareholder earnings.

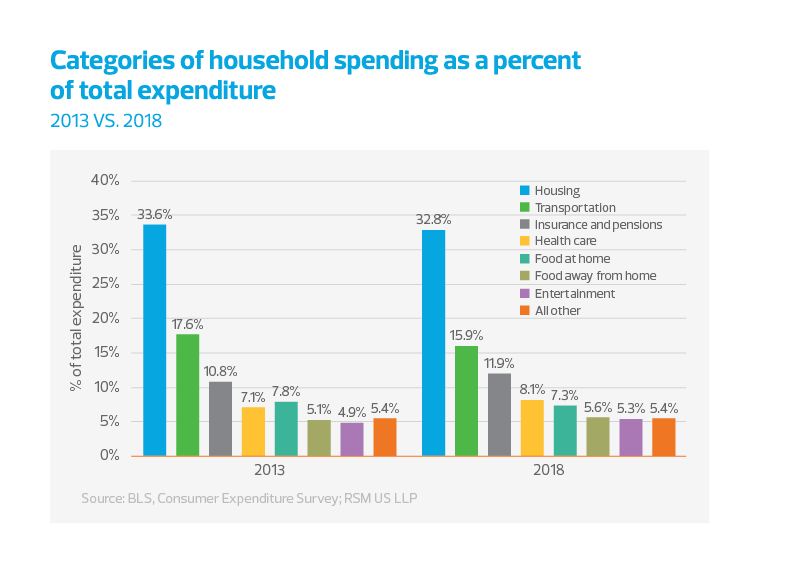

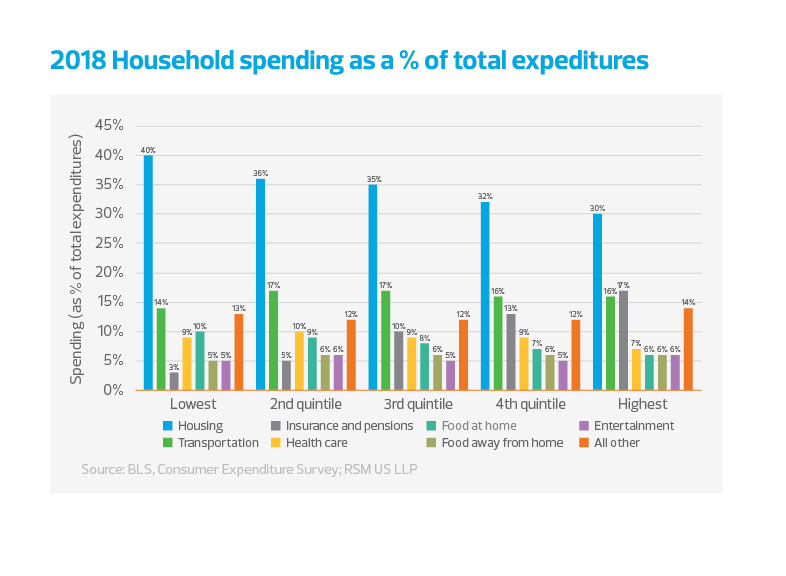

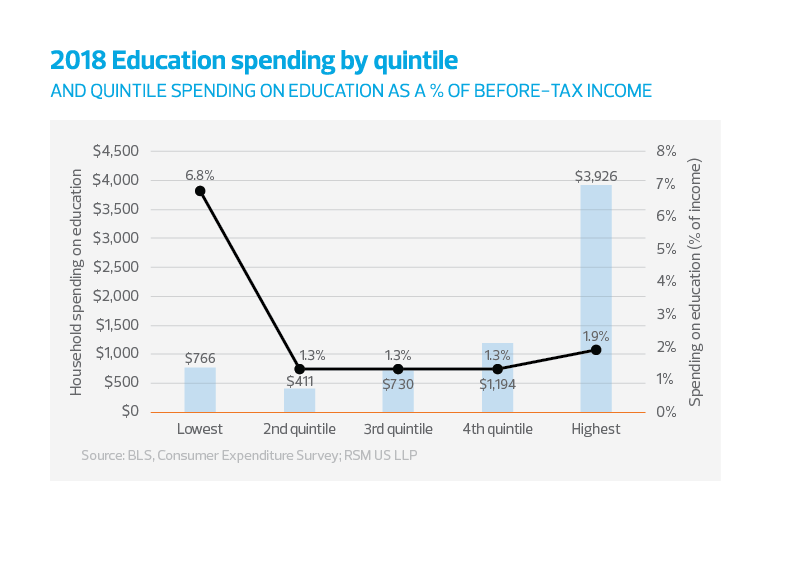

Household spending data appears to support the need for assistance. As the figure below indicates, the lowest quintile spends 6.8% of its before-tax income on education; all other quintiles spend 1.3% to 1.9% on education.