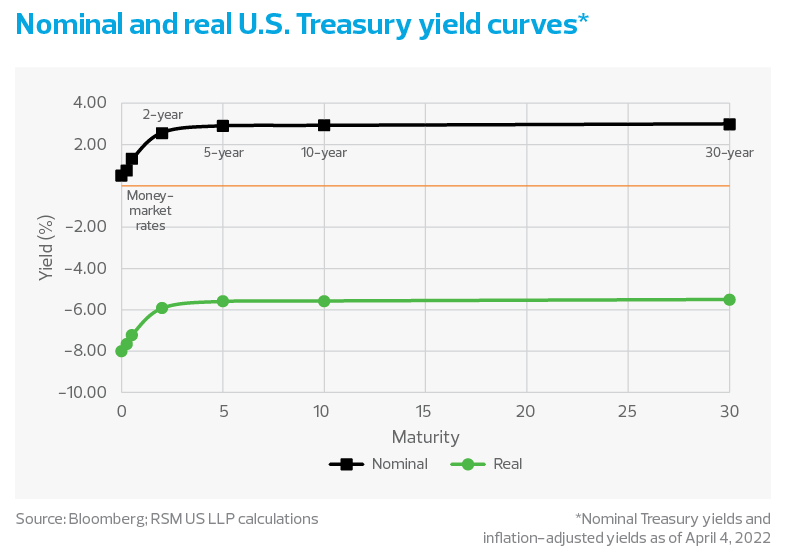

While the yield curve is no longer inverted, it remains too flat in our estimation, signaling uncertainty about the ability of the economy to support higher rates of return and to continue growing.

We expect growth to arrive at or below 1% in the first quarter, rebound strongly in the second and third quarters, and then be subdued as higher rates of interest and inflation affect the consumer sector’s propensity to spend.

Thirty-year and five-year Treasury yields

You would expect 30-year bond yields to reflect the greater risk of holding a security over that length of time, with the prospect of event risk disrupting economic growth at some point. Instead, we find five-year Treasury yields rising above 30-year yields, and the yield spread becoming negative.

We attribute the increase in the five-year yield to the larger impact of monetary policy on short-term securities. And while we expect a more subdued impact of monetary policy on bonds 30 years out, there is also concern that the economy has yet to make significant improvements in its potential growth.

We attribute that to the absence of infrastructure spending, which was delayed until after the midterm election to get bipartisan support. As such, it may take at least another year for the bond market to assess the prospect of an economy more advanced than the stagnant, low-growth economy of the years before the pandemic.

Mortgage rates have responded

The average mortgage rate calculated by Freddie Mac shows that new homeowners are facing a 5% cost of carry, substantially higher than the less-than 3% rates of the pre-pandemic era. We expect those rates to put a crimp in the demand for housing, which, because of its weight in determining the consumer price index, will have a large impact on the inflation rate.