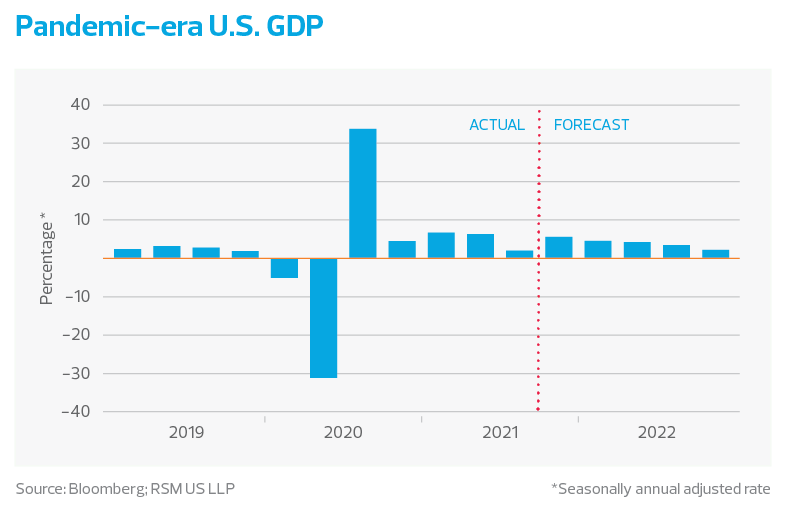

Nearly two years into the pandemic, there are signs that the worst of a once-in-a-century shock to the global economy is beginning to fade.

As the economy approaches a full reopening, we expect that growth in 2022 will exceed 4%, the unemployment rate will fall to 3.5% and job growth will average roughly 230,000 per month.

All of this will happen as inflation slowly recedes from what we think will be a peak near 7% in 2021 to roughly 3% at the end of 2022, setting the stage for tighter monetary policy and a path back toward 2.5% growth in 2023.

While there is likely a wide range of possible outcomes linked to the omicron variant, we do not see a need to alter our growth forecast of 7.2% in the fourth quarter nor the rate for 2022.

The current risk matrix related to growth, employment, interest rates and monetary policy will not alter our expectation that the Federal Reserve will increase the pace of its tapering operations to $30 billion per month, from $15 billion, at its December meeting.

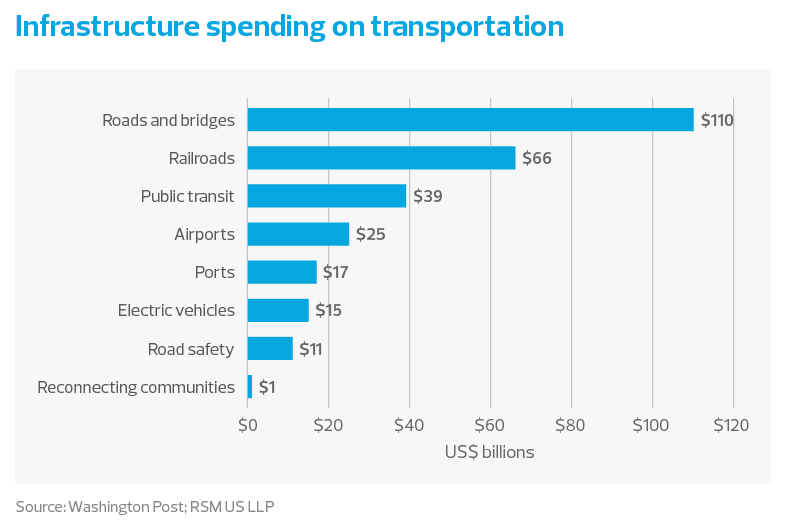

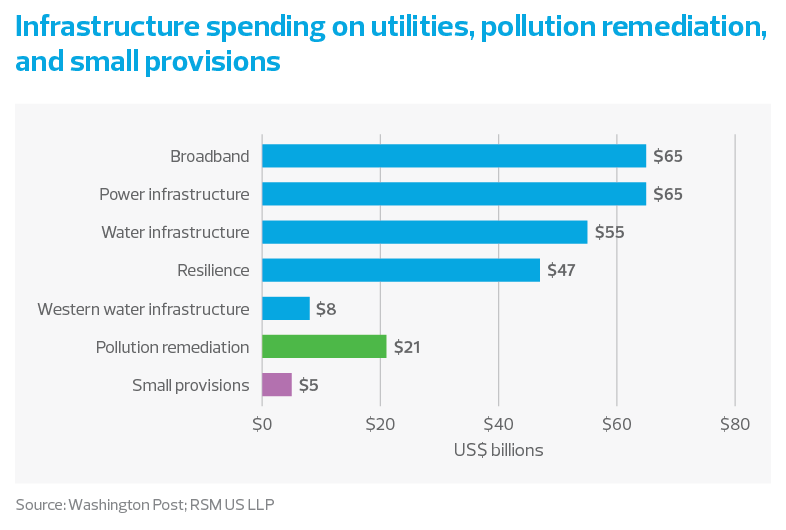

Other major wildcards in the forecast remain the direction of fiscal policy and the fate of the Biden administration’s proposed Build Back Better social spending program, which was still being negotiated in November.

Accommodative monetary policy and robust fiscal support, which blunted the downturn and continue to bolster growth, are likely to fade in 2022.

The current bout of inflation around the world poses another major risk to growth, and central banks are setting the stage to end their support in 2022. We expect that the nexus around growth, employment, inflation and policy will revolve around central bank policy actions in 2022.

Let us be clear: We do not think this is a time to become complacent about the pandemic, vaccinations, boosters and public health risks linked to COVID-19. Rather, we think the economy is transitioning from being at the mercy of a pandemic to one that is learning to live with an endemic—a disease that remains but can be managed. This next phase does not represent an outsized risk to overall economic activity. Should we be wrong on the evolution of the virus, it would result in a slower and more uneven pace of growth next year.

We think next year will be one of transition toward a hypercompetitive economy that features tighter monetary policy and improving capital expenditures that will support rising productivity and a transformation of the American workforce to one characterized by higher wages, flexibility and the rise of millennials into management.

Base case and the U.S. economy

Our fundamental base case is that the American economy will expand near 4.2% on the year with risks of a slower pace of growth if shocks to the global supply chain persist and inflation proves stickier with rising rents pushing up costs.

These risks to what is an otherwise optimistic outlook could be compounded if the Federal Reserve misses the mark on the pace of its tapering operations and the start of the inevitable rate-hike campaign that we anticipate will take place December 2022.