The American election produced no clear outcome in the race for the presidency on Tuesday night, and instead brought uncertainty, financial market volatility and political risk across the business world. Based on market action overnight, one observation is clear: Markets prefer neither Democrats nor Republicans, but rather stability. And for the next hours and days, it is the lack of stability and rising political risk that will drive pricing action as investors factor in the business implications of what appears to be an indeterminate result.

Because we are still early in the news cycle, there is more that is unknown than known, and right now pricing action across financial markets is the only real metric to ascertain how it may affect the economy heading into the end of the year. Middle market firms are far better off focusing on pricing action across equity, fixed income, and currency and commodity markets to derive business conditions going forward rather than following missives around likely legal interpretations and social reaction to the non-outcome of the vote.

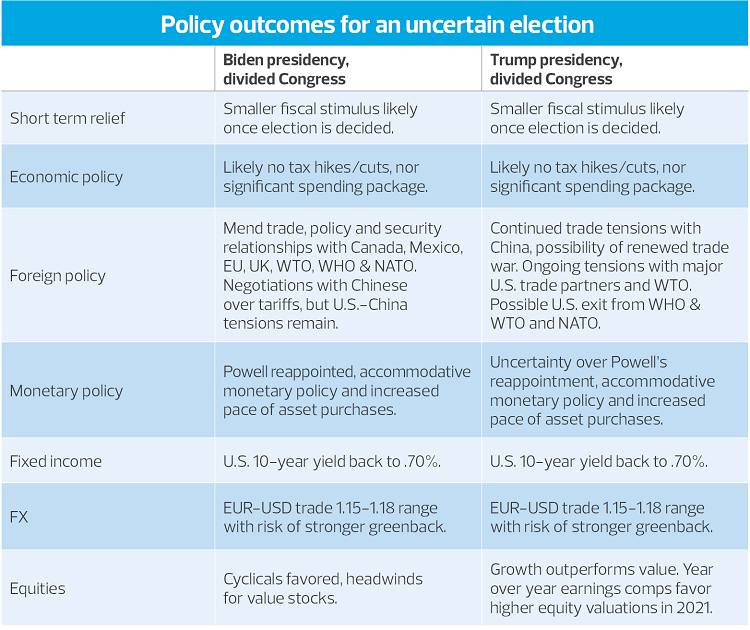

One conclusion that can be drawn from the election is that the Democrats will retain control of the House of Representatives. It appears that the Republicans will most likely retain control of the Senate—which would guarantee divided government regardless of who wins the presidency and favor the status quo.

Financial markets overnight engaged in a wild ride. The yield on the U.S. 10-year security ranged from .94 basis points to a low of .76, and at the time of this writing sits at .78 basis points. Currently there is no real bid under the U.S. dollar as investors adopt a bit of home bias under evolving political and policy risk in the United States. The dollar is trading higher against the yen, the franc and the euro. The greenback is trading down against the seven other major trading currencies. Oil is slightly higher and the price of gold is down $17.40 in the early-morning session.

During periods of crisis like that which occurred early in the pandemic or even during episodes like this, there is a certain order of operations, or logic if you will, to ascertain the near-term impact on the economy. We tend to look at the following to make such judgments:

- Financial channel: Equity markets, foreign exchange markets, Treasury yields, commodity prices. If the crisis is serious, then look at dollar-funding stress and credit stress.

- Confidence channel: Consumer, CEO, corporate.

- Spending channel: Consumer spending, with a lag.

It is clear that there is political risk around the uncertain outcome, which is difficult to measure and is the Achilles’ heel of financial markets. That risk will be organized around knowing which candidate will win the election, under what circumstances the victory is obtained, and how might the Supreme Court rule on any challenge to counts and ballots.

If that creates further policy uncertainty, one can expect to observe a period of asset volatility, which will create a modest negative wealth effect that will dampen spending in the current quarter and possibly in the first three months of 2021. The inconclusive outcome strongly implies that there will be no further round of fiscal aid coming before the outcome is certain, which will also dampen overall economic activity.