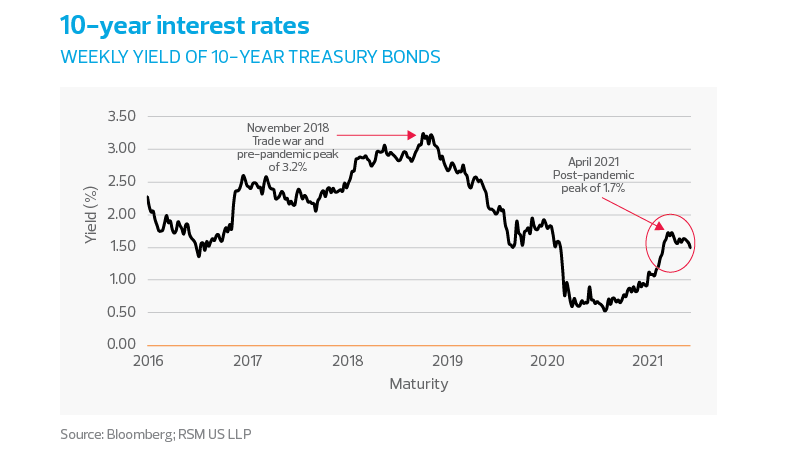

The yield on 10-year Treasury bonds has been on a roller coaster since reaching its recent peak of 1.74% on March 31, dropping below 1.50% in late June.

If the initial move up to that peak can be rationalized as a response to the risks around higher growth and inflation, then the move below 1.50% in the midst of an economic recovery involves a resetting of those concerns.

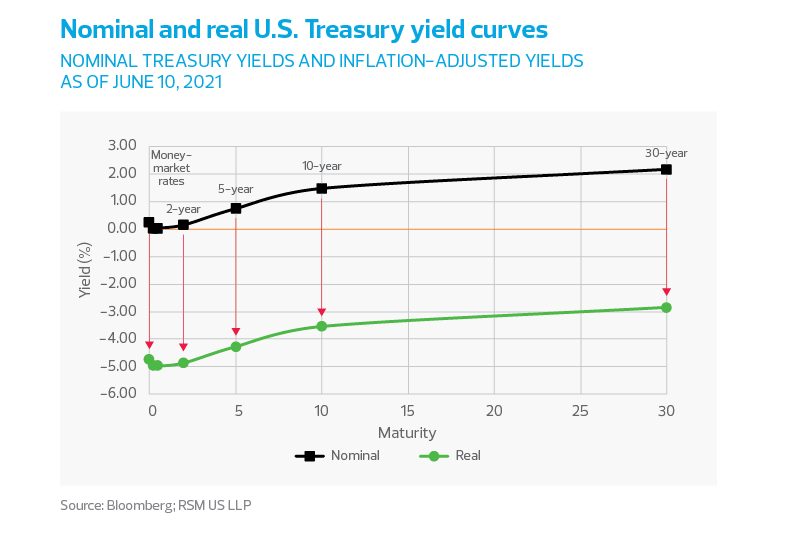

An infrastructure package that increases the productivity and competitiveness of the American economy will pay for itself when interest rates are this low.

The factors in this down cycle likely include:

- Politics: Passing an infrastructure package becomes more difficult every day, making a multitrillion-dollar package less likely.

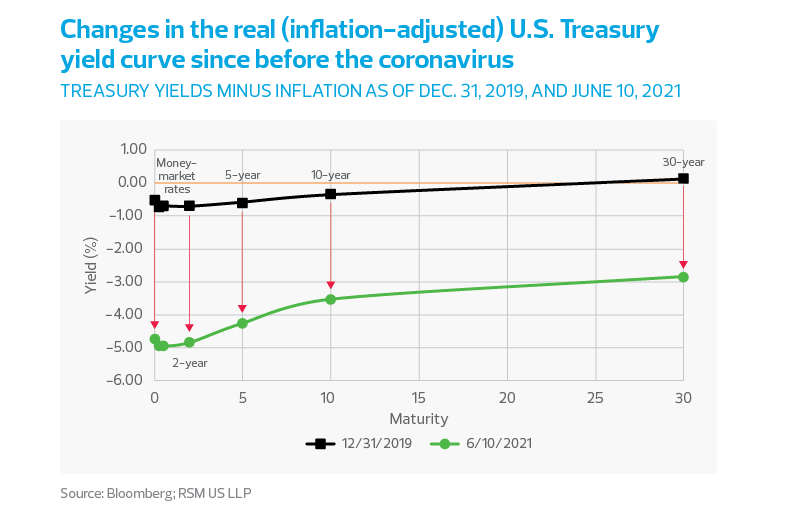

- Inflation expectations: Inflation is a feature of the initial post-pandemic recovery and not a significant risk, as professional investors appear to be backing away from the inflation trade and the possibility of a return to 1970’s-style inflation.

- Increased demand for bonds: There is a recognition that Treasury bonds provide a safe return in an increasingly risky economic and national security environment

- Productivity: Improvement in some of the sectors hit hardest by the pandemic, along with working from home, will most likely result in re-optimized working arrangements and a strong medium-term increase in productivity, lifting wages and living standards. (See “Why Working From Home Will Stick” from the National Bureau of Economic Research.)

Regardless, sub-2% interest rates are not what a healthy economy would support, and suggest the need for sustained support from the fiscal and monetary authorities. An infrastructure package that increases the productivity and competitiveness of the U.S. economy will pay for itself when interest rates are this low.