Midway through 2019’s third quarter and less than six weeks from the first official estimate of the period’s growth on Oct. 30, it’s never too soon for middle market businesses to begin planning. A continual flow of economic data releases and revisions can provide the means to assess what might be coming down the pike.

The initial estimate from the Bureau of Economic Analysis shows growth in the second quarter slowed to a 2.1% annualized pace (2.2% on a year-over-year basis), following an inventory buildup that powered surprise growth of 3.1% in the first quarter.

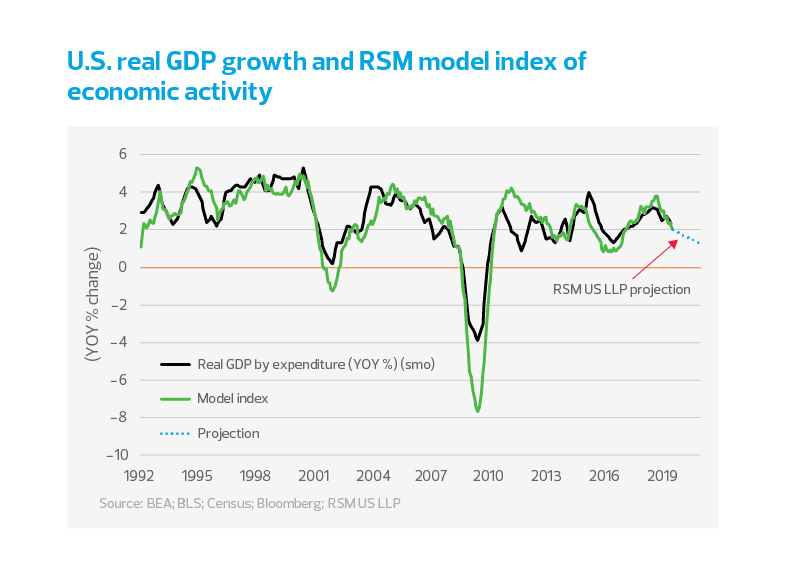

RSM has developed a monthly measure of gross domestic product, which indicates that GDP growth has been decelerating since November 2018, pacing at 3% in the early months of 2019 before dropping to 2.2% by June (see chart below). The RSM US Real GDP Index confirms that growth would have been worse if not for the injection of buoyancy from the stockpiling of inventory, likely the result of business uncertainty stemming from threats to the global supply chain such as tariffs. With July’s industrial production dropping to less than 0.5%, and signs of deterioration in the labor market, the third quarter has begun with a whimper.