Despite the name, Intentionally Defective Grantor Trusts (IDGTs) are not necessarily ‘defective’ when it comes to your estate plan. In fact, IDGTs can be an incredibly useful and valuable estate planning vehicle. By strategically gifting assets to an IDGT, you can potentially reduce your taxable estate and provide long-term benefits for your family.

What is an IDGT?

An IDGT is a type of trust that has unique tax benefits. This is because it is treated differently for gift and estate tax purposes than it is for income tax purposes. This treatment is caused by powers you retain (for example, the ability to swap assets in and out of the IDGT in exchange for other assets you own of equal value).

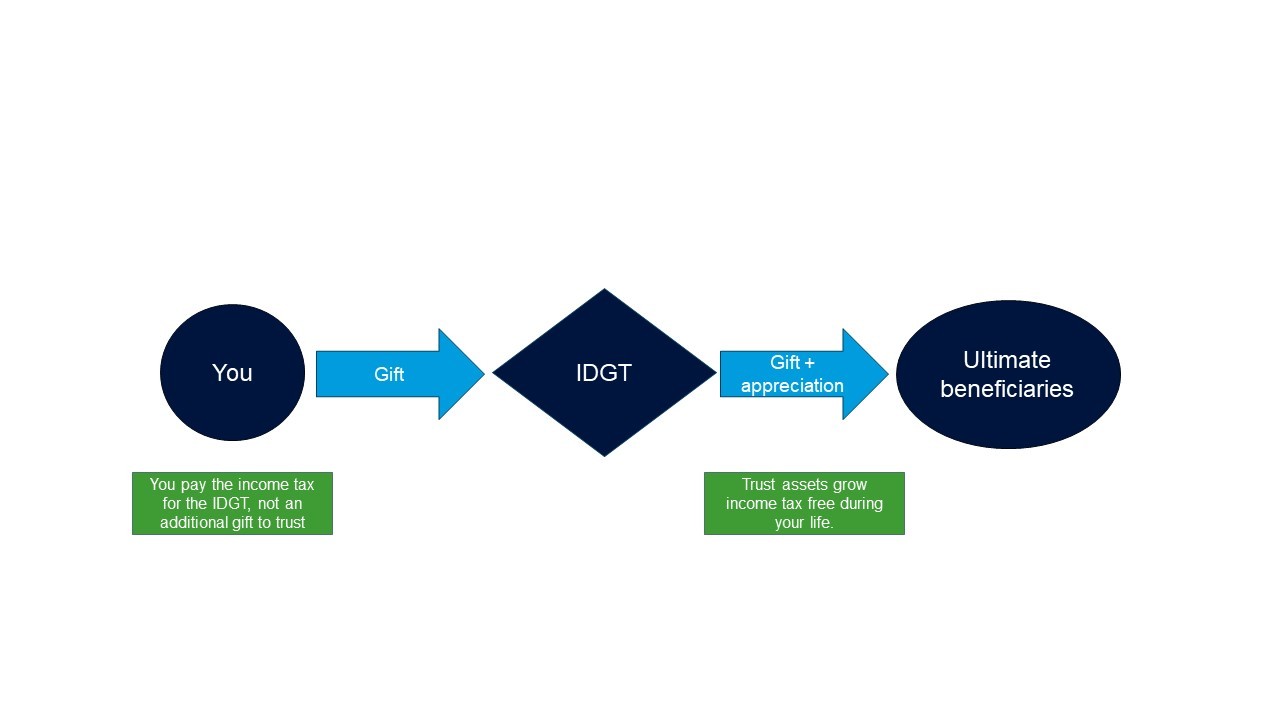

- Income tax purposes: You are responsible for paying the income taxes on any income the assets in the IDGT generate. This means the assets inside the IDGT can grow without diverting IDGT assets to pay income taxes.

- Estate and gift tax purposes: When you transfer assets to an IDGT, they're generally removed from your estate. You may use your gift tax exemption to avoid gift tax. Your payment of tax on the IDGT’s income is not an additional gift to the IDGT for gift tax purposes.