As COVID-19 concerns dissipate across the United States, hospitality and leisure-focused businesses must now contend with a new risk—stubborn, elevated inflation that could further curb recovery in the travel industry.

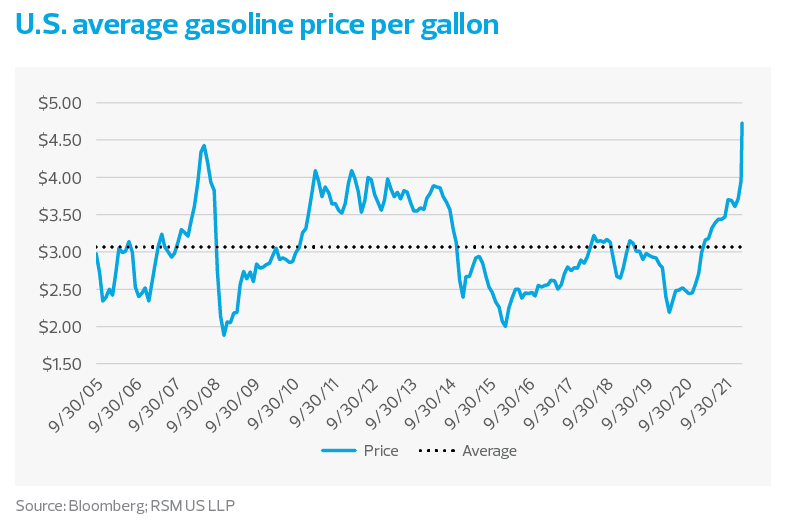

The war in Ukraine has driven up global oil prices, pressuring already high U.S. energy costs, including jet fuel and gasoline. Consumer discretionary spending on nonessentials, including flights and accommodations, is closely monitored. In short, what was supposed to be the summer of “revenge” travel may end up disappointing expectations.

Leaving on a jet plane

Bloomberg reports that jet-fuel prices have surged 50% year to date and are up 74% from 2019 levels. This escalation has not yet been pushed through to consumers in the form of higher fares, as airlines are in a battle over shares of the resurging leisure travel market. This competition, along with the lagged recovery in the business travel sector, has muted the pricing power of airlines.