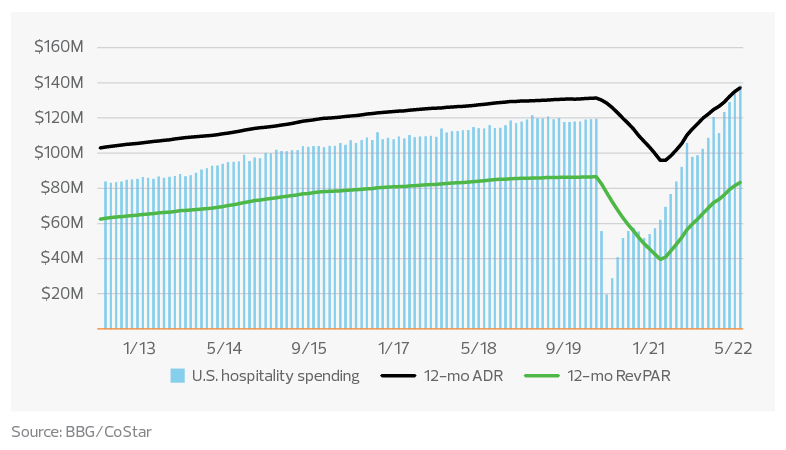

This summer was supposed to be the season of revenge travel. With COVID-19 caseloads easing and consumers flush with savings built up during the pandemic, the travel industry was anticipating a robust season. Consumers were so eager to get out of the house that little could deter them, the thinking went.

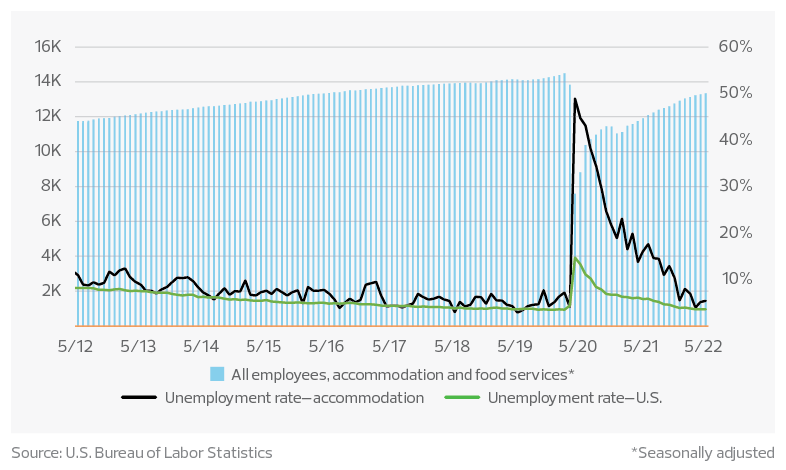

But that was before a new risk emerged: stubborn, elevated inflation. Even as overall inflation in the United States has surged above 8%, the components of the consumer price index that directly affect travel have risen even more. These include airfares, which are up by 33.3% year over year; gasoline, which has surged by 43.6%; and even food away from home, which has increased by 7.2%. For hoteliers, labor challenges continue to stress the summer travel experience.

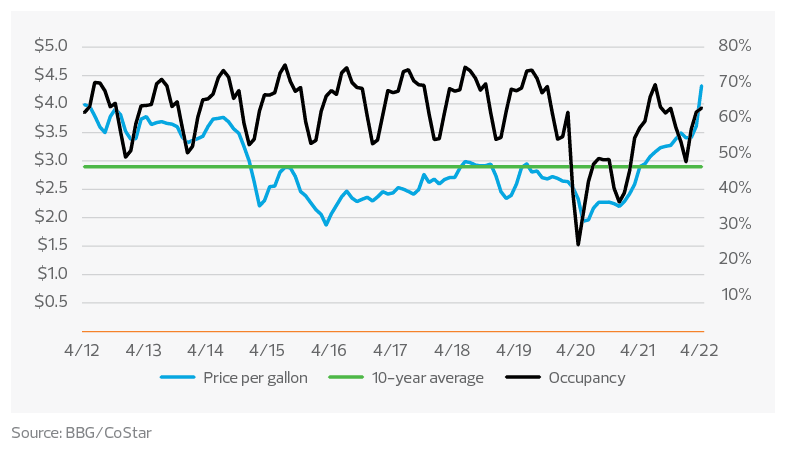

Rising gas prices

It all has left travel industry executives wary, even as they say they still expect a busy season.

"Even with rising inflation in gas prices, we continue to expect strong consumer demand, especially as we enter the busy summer leisure travel season,” Patrick Pacious, president and chief executive of Choice Hotels International, said on his first-quarter earnings call.

He added: "It is worth noting that gas prices historically have had little to no impact on travel. Rather, consumers indicate that rising fuel costs could mean adjusting how they spend their money, such as traveling shorter distances, choosing destinations closer to home or not dining out as often, but they are going to travel."

Indeed, surveys have supported the notion that Americans are determined to get on the road this summer. Approximately eight in 10 Americans are scheduling travel plans, according to a recent survey from The Vacationer.

But consumers are aware of rising costs. According to a March poll by Bank of America, 62% of respondents expected to travel more than usual in the next 12 months, but more than 40% of the respondents said higher gas prices would cause them to travel less, while 28% said they could take shorter trips to offset higher costs. Another survey from Bankrate in March found that 70% said they are changing their summer travel plans because of inflation.

History has shown that there is little correlation between gas prices and performance in hospitality. For instance, the 10-year average for gas prices is just under $3 per gallon, but prices have been volatile from year to year, given the constant changes in the energy sector. Apart from the global COVID-19 pandemic shutdown, hotel occupancy has been stable with its seasonal peaks and valleys.