Whether preparing for a traditional IPO, a direct listing, a special purpose acquisition company (SPAC) merger or a spinoff, large to middle market companies need an operationally sound, in-the-trenches business advisor to help ensure they have the necessary frameworks in place to meet, and withstand, the scrutiny of public markets. In these cases, companies should look to begin the process of achieving their goals well in advance of the offering date.

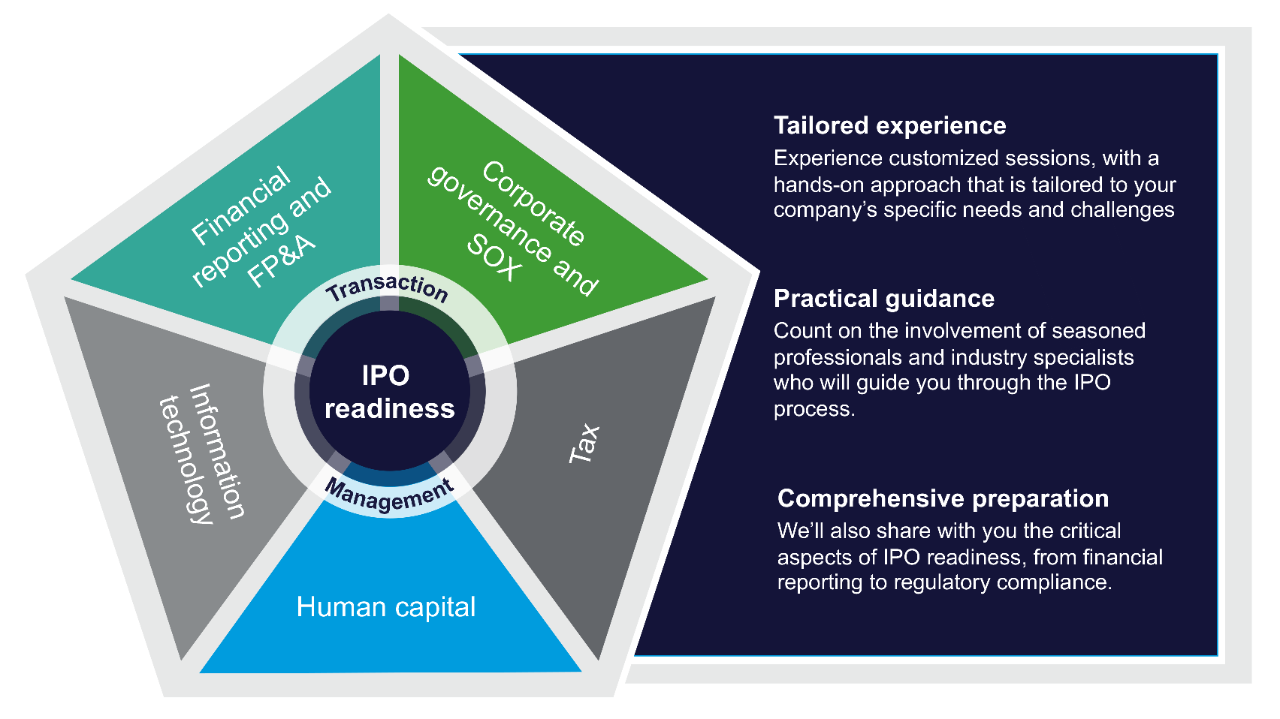

RSM has the immediate resources and brings a collaborative team across functional domains and industries to support any transaction that necessitates public company readiness. We work with U.S.-based filers and foreign registrants, offering specialized accounting and advisory services tailored to your regulatory requirements. Our priorities are to ensure we assist you in navigating the challenges of this process so that your public debut is successful.