Analysis

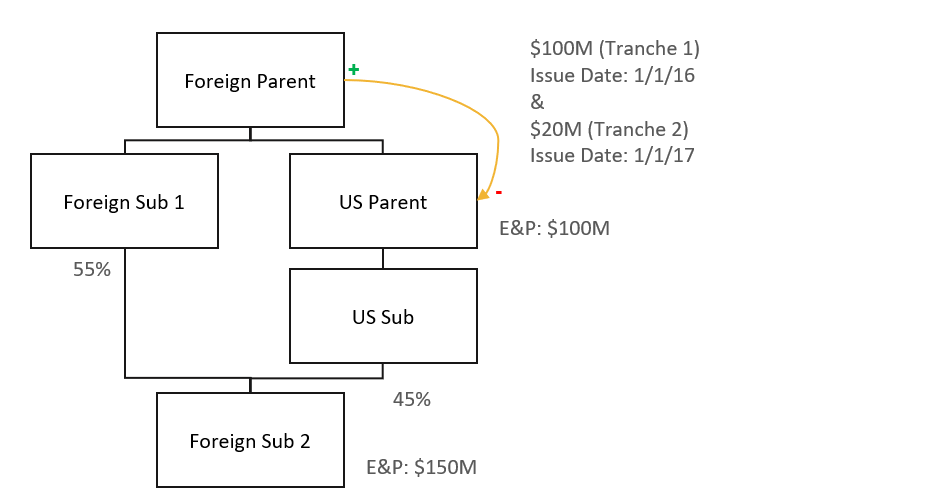

Original Structure

As of Dec. 31, 2017, prior to the Redemption Transaction, the Group had $20 million of “covered debt instruments” as Tranche 2 was issued after April 4, 2016. At this point, there is no reclassification of any debt into stock.

Based on the ownership, US Parent is a “covered member” and the Group is an “expanded group” with each entity being a member. Interest payments are made by US Parent to Foreign Parent, which are deductible in the U.S. and included as income in the foreign country.

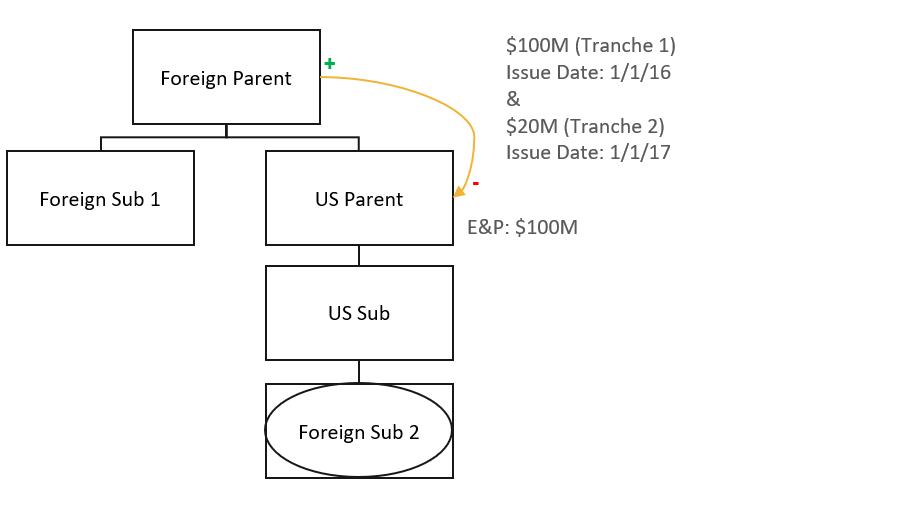

Redemption Transaction

The wide net of the Per Se Funding Rule likely treats the distribution of $150 million in redemption of Foreign Sub 2’s stock, as having been funded by US Parent with the covered debt instrument.

Mechanically, the Per Se Funding Rule applies because the covered debt instrument was issued within 36 months of the distribution, and Foreign Sub 2 made the distribution within 36 months of US Parent becoming the successor. Therefore, US Parent is treated as having funded the distribution in part, by the $20 million Tranche 2.

The $100 million Tranche 1, even though issued within 36 months, is not a covered debt instrument because it was issued prior to April 4, 2016.

Through the application of the Per Se Funding Rule, Tranche 2 is potentially subject to the application of the recharacterization rules under Reg. Sec. 1.368-3. However, as discussed above, the first $50 million is not subject to recharacterization and as such Tranche 2 will not be treated as stock by way of 385.

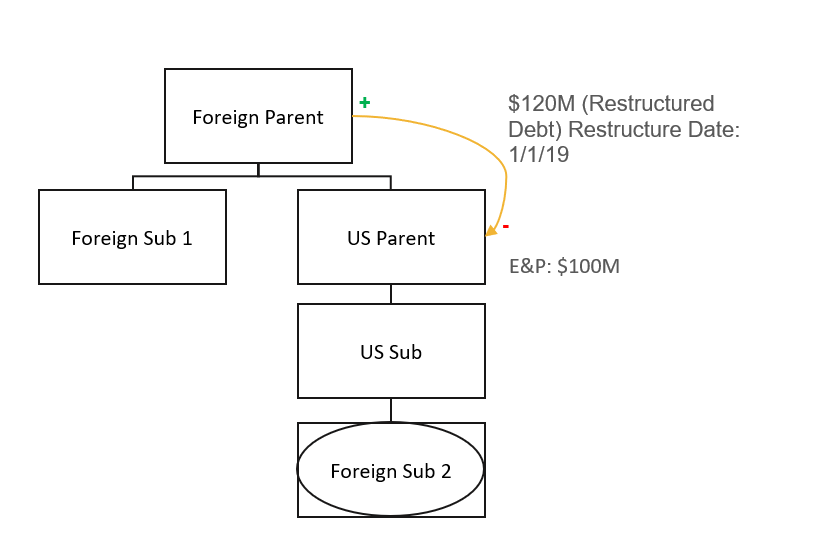

Debt Restructuring

Assuming the two tranches were combined, and the term extended via modifications of the original debt instruments, this would likely represent a significant modification for purposes of Reg. Sec. 1.1001-3. The extended term would constitute a “material deferral” in that the term is extended beyond the safe harbor period discussed above.18 Since there was a “material deferral”, Reg. sec. 1.385-3(b)(3)(iii)(E)(2) treats the Restructured Debt as having been reissued on the date of the modification (i.e., Jan. 1, 2019).

Therefore, the Restructured Debt is treated as having been issued within 36 months of the Redemption Transaction and is now subject to reclassification under the Per Se Funding Rule.

The aggregate adjusted issue price of the covered debt instruments held by all the members of the expanded group is $120M. However, under Reg. sec. 1.385-3(c)(4), the first $50 million is excluded from recharacterization. Therefore, as a result of the deemed reissuance, $70 million of the Restructured Debt is treated as stock for U.S. federal tax purposes.

As mentioned above, utilizing the E&P Reduction, the aggregate amount of any distributions or acquisitions made by a covered member is generally reduced by the covered member's expanded group earnings account. In this instance, US Parent has $100 million in its expanded group earnings account. However, since the distribution was made prior to Foreign Sub 2’s joining of the U.S. consolidated group, that amount is unavailable to offset any amount of the distribution.

Conclusion

As a result of the Redemption Transaction and the Debt Restructuring, $70 million of the outstanding Restructured Debt amount is treated as stock for U.S. federal tax purposes. One result is that interest payments that relate to the reclassified $70 million are no longer deductible as interest expense for U.S. federal tax purposes.

Additionally, since payments made under the reclassified amount are treated as distributions on stock (and potentially dividends) for U.S. federal tax purposes, there may be withholding tax consequences that were not present prior to recharacterization. Moreover, since the recharacterization is solely for U.S. federal tax purposes, Foreign Parent will continue to have interest income in its home country without any offsetting interest expense in the U.S.

In terms of alleviating the disconformity between interest income and interest expense, the simplest solution, from a U.S. federal tax perspective, is likely a capitalization of the reclassified debt obligation into the US Parent. For U.S. federal tax purposes, this capitalization would potentially be a tax-deferred recapitalization transaction. However, for foreign purposes the contribution would be treated as a contribution of the note receivable into the US Parent, thus tying out the interest disconformity.

As demonstrated in the case study, practitioners need to be cautious when restructuring debt, particularly in the international context as a seemingly simple modification of an intercompany debt instrument could have major tax consequences.