The IRS recently issued long-awaited guidance on the section 45Q carbon sequestration credit, which was originally enacted by the Energy Improvement and Extension Act of 2008, amended by the American Recovery and Reinvestment Act of 2009 and substantially enhanced by the Bipartisan Budget Act of 2018. The carbon sequestration credit provides a very generous tax incentive to taxpayers that install equipment that captures carbon oxide. The carbon oxide is then disposed of in secure geological storage or utilized as a tertiary injectant in a qualified oil or natural gas recovery project. The guidance consisted of a notice and a revenue procedure.

Notice 2020-12

The notice provides guidance on the section 45Q requirement that the qualified facility used to capture the carbon oxide be under construction before Jan. 1, 2024.

Similar to the Production Tax Credit for wind facility, or the Investment Credit for solar energy property, a qualified f carbon capture facility is considered to have begun construction if it meets either the Physical Work Test, or the 5% Safe Harbor Test. Under either test, a taxpayer’s carbon capture facility is deemed to have begun construction on the date either test is met. Under the continuity requirement of the notice, once the taxpayer satisfies the requirements of either test, the taxpayer must make continuous progress toward completing the facility. The notice also provides a safe harbor for this requirement, discussed below.

Physical Work Test

The physical work test is satisfied based on the facts and circumstances surrounding a taxpayer’s construction activities. The test looks at whether a taxpayer began physical work of a significant nature, and takes into account both off-site and on-site work. The off-site work includes manufacturing of mounting equipment and support structures, as well as components to capture or dispose of the carbon oxide. The on-site physical work includes excavation for the installation of the facility’s foundations, installation of the system of gathering lines to connect the carbon capture equipment to the industrial facility generating the carbon, and installation of the components used for either carbon capture or disposal.

Activities that are more of a preliminary or planning nature are not physical work of a significant nature, and include activities such as securing financing, obtaining permits or conducting test drilling to test soil strength for the facility’s foundation.

5% Safe Harbor

The 5% safe harbor test is met when the taxpayer pays or incurs 5% or more of the total costs of the qualified facility or carbon capture equipment. The total costs include all property included in the depreciable basis of a qualified facility. Cost overruns incurred in a later period may cause the costs paid or incurred before Jan. 1, 2024 to drop below 5% of the ultimate cost of the project, thereby disqualifying the project. As such, applicable taxpayers should consider exceeding 5% of the original cost estimate by a reasonable margin to preserve the 5% safe harbor in the event of a cost overrun.

Importantly, a taxpayer is not considered to have paid or incurred the costs for the applicable tax year unless economic performance has occurred In the case of providing property to the taxpayer, economic performance occurs when the taxpayer takes delivery of the property or takes title to the property. In the case of providing services to the taxpayer, economic performance occurs when the services are performed. If payment is made by the close of a tax year, then economic performance is deemed to have occurred if the property is delivered or the services are provided within 3.5 months of the last day of the tax year.

Continuity Requirement

Under either test, there is a continuity requirement. A continuous program of construction is required for the physical work test. Similarly, the 5% safe harbor requires that the taxpayer make continuous efforts to advance toward completion of the facility or equipment by paying or incurring additional amounts included in the totally cost of the facility, enter into additional contracts for the manufacture or construction of the components or facility, obtain necessary permits and perform physical work of a necessary nature.

However, if a taxpayer fails the continuity requirement based on the starting date of one test, it can meet the continuity requirement as applied to the other test if it also met the other test’s requirements. Additionally, a project that consists of multiple qualified facilities may be treated as single project if it meets certain requirements, and therefore all of the facilities can meet either the physical work test or 5% safe harbor test and related continuity requirement. However, if the taxpayer fails the continuity requirement when multiple qualified facilities are treated as a single project, the taxpayer may disaggregate the multiple facilities to meet the requirement for some of the facilities.

Under either test, the notice allows for excusable disruptions to the construction, and provides a non-exclusive list for the construction disruptions. The IRS provided a safe harbor whereby the continuity requirement is met if the facility is completed by the end of the calendar year that is no more than six years from the date construction was deemed to have begun under either the physical work test or the 5% safe harbor.

Revenue Procedure 2020-12

Simultaneous with the issuance of the notice, the IRS issued Revenue Procedure 2020-12. That procedure provides a safe harbor in which the IRS will treat partnerships as properly allocating the credit in accordance with section 704(b) in order to facilitate a partial transfer of ownership to a ‘tax equity’ investor who can utilize the credit in the event the developer is unable to utilize the credit. Such structures are common in renewable energy credit projects and historic building rehabilitation credit projects.

Section 45Q provides a credit based on the metric ton of carbon captured and appropriately used or stored. The credit is available for the 12-year period beginning after the date the equipment is placed in service.

Section 704(b) provides that a partner’s distributive share of income, gain, loss, deduction or credit is determined in accordance with the partner’s interest in the partnership if the partnership agreement does not provide as to the partner’s distributive share of those items or the allocation to the partner under the partnership agreement of those items does not have economic effect. Regulations for 704(b) provide that allocations of tax credits do not have economic effect and must be allocated in accordance with the partners’ interest in the partnership.

The revenue procedure provides a safe harbor for allocation of the credit that meets the allocation requirements of section 704(b). Like a similar revenue procedure for the section 45 production tax credit, the section 45Q procedure allows for a flip point where the developer of the project and investor allocate the credit, cash and income or loss from the partnership based on a pre-determined after-tax rate internal rate of return.

Safe Harbor

A developer must own a minimum 1% partnership interest in each material item of partnership income, loss, deduction, and credit at all times during the existence of the partnership of a partnership eligible to claim the section 45Q credit.

An investor in partnership that may validly claim the section 45Q credit must, at all times, own at least a 5% interest in each material item of partnership income, gain, loss, deduction and credit. That partnership interest must be a bona fide equity investment with a reasonably anticipated value commensurate with the investor’s overall percentage interest in the partnership. Such an interest is a bona fide investment if the reasonably anticipated value is contingent upon the partnership’s net income, gain and is not substantially fixed in amount. On the date the partner acquires a partnership interest, the minimum investment amount must be equal to at least 20% of the sum of the fixed capital investment, and more than 50% of the sum of the fixed investment must be fixed and determinable.

The value of an investor’s partnership interest cannot be reduced through unreasonable fees or other arrangements. None of the parties are permitted to have a call option or other contractual arrangement to purchase the carbon capture equipment, any component thereof, or partnership interest, other than an agreement for a present sale. Further, the investor cannot have an agreement for any other person involved in the carbon capture to purchase the partnership interest for an amount more than the fair market value of the interest. No person involved in the partnership may guarantee the investor’s ability to claim the section 45Q credit, the cash equivalents of the credit or the repayment of any portion of the investor’s contribution due to an inability to claim the credit.

Revenue Procedure Example

The revenue procedure provides an example of an agreement of the distribution and allocation provision of a developer and investor. The developer formed a partnership that will own and manage a carbon capture project. The partnership has an agreement with a carbon emitter, and will sell the captured carbon to an offtaker that will use the carbon. The developer contributed the carbon capture equipment to the partnership and the investor contributes the first investment of cash, which is at least 20% of the investors total agreed upon investment.

The allocation agreement between the developer and investor provides that all allocations must satisfy section 704(b).

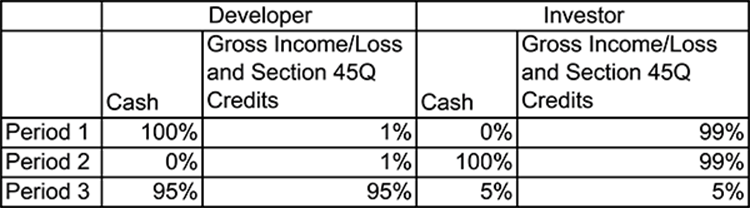

The example provided a chart showing the allocations between the developer and investor over the period of the project permitted by section 704(b).