Being mindful of your exit strategy from the beginning will ensure you’re ready to sell.

Key takeaways

Sell-side due diligence can head off potential issues that could diminish the sale price.

Envisioning your ideal buyer will help you evaluate offers when the time comes.

For most business owners, the process of exiting the business involves a formal transaction—whether selling to a third party or to a family member. Third-party transactions, specifically, have some distinct variables, including less control around the timing.

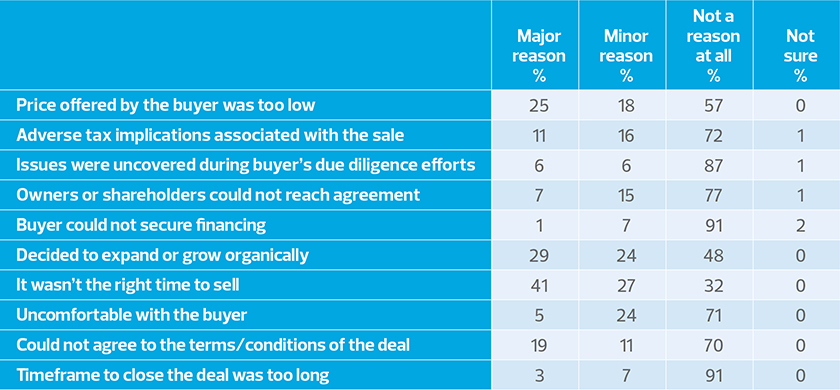

That timing variable can be particularly problematic. An RSM Middle Market Leadership Council survey identified a cohort of respondents who had received offers to sell their business but did not complete a sale. The most popular reason given for not selling? “It wasn’t the right time to sell,” according to 68% of the cohort.

So how do you recognize the right time? Or how do you make sure you’re ready anytime? And once you’ve decided to sell, how can you manage the process to receive the best benefit?

Confirm your plan to sell

Before deciding to sell your business to a third party, confirm you truly are operationally, emotionally and financially ready to sell—both as a business owner and as an individual.

This confirmation process will be easier for you and your family if you have addressed some key questions repeatedly over the life of your business, including:

- What strategic steps are necessary to prepare your business for sale and earn maximum return on your investment? Sell-side due diligence is a possible strategy to help with this.

- What role, if any, would you like to play in the business after the sale? If family members are involved in the business, it is equally important to determine their role in the sale and after the liquidity event.

- What after-tax proceeds do you need on the sale to meet your goals for estate planning, lifestyle, philanthropy, health care and other priorities? A realistic understanding of the business value and your desired personal lifestyle is key to the business sale and transition process.

These questions help you identify the right time to sell and evaluate potential buyers or offers. However, answering them requires planning. By being mindful of these considerations and planning steps throughout the life of your business, you can guard against the unpredictable, problematic timing of an exit scenario.

For example, if you receive an attractive offer before sufficiently planning, you may not be positioned to take advantage of it. Or perhaps an economic, personal or other life event could force you to consider a sale on short notice. Having a plan in place prepares you for any scenario.

Unlock business value through due diligence

It is possible to be so close to the day-to-day operations of your company that you miss warning signs or other concerns that could discourage a prospective buyer of your business.

Reductions in the purchase price or deal failures are common when irregularities are discovered or issues are inadequately addressed. In the RSM survey, 12% of respondents cited issues uncovered during buyer’s due diligence efforts as a reason they did not sell their business after receiving an offer for it.

Before a prospective buyer even initiates a transaction, sell-side due diligence helps to anticipate buyer concerns and satisfy expectations. It is also valuable for helping to ensure the transaction is advantageous for both the buyer and seller.

Pre-transactional due diligence can produce accurate financial information for your potential buyer. It also can help you address operational, technology and human resources issues that might make the difference between a successful sale and a long, contentious transaction process.

When a buyer identifies issues, it can place you in a defensive negotiating position on price and transaction terms. Potential benefits of sell-side due diligence include:

- Identifying risks early

- Accelerating the closing date

- Improving the accuracy of the historical and projected financial information

- Providing the buyer with a transparent, objective and credible view of the business

- Identifying adjustments that positively affect earnings before interest, taxes, depreciation and amortization (EBITDA)

- Increasing competition between buyers and minimizing buyer negotiations after the letter of intent

- Maximizing after-tax proceeds by addressing risks and optimizing the deal structure

Consider potential buyers

Ideally, you would have multiple buyers on your doorstep, when you want them, with competitive offers. More likely, you will need to seek out potential buyers or evaluate an unsolicited offer.

It helps to think ahead and identify the attributes of an ideal buyer. Categorize these attributes as absolute or negotiable to create a measure for future offers. Some areas to consider include:

- Hard dollars: What is the difference between your ideal and your absolute minimum?

- Leadership style: What is the value of keeping in place the current management team?

- Location: What are the pros and cons of the new owner managing on-site or from afar?

- Purpose: How do you value someone continuing your legacy versus rewarding you for your hard work?

- Industry experience: What unique factors of your business could be difficult for an outsider to successfully manage?

There are no right or wrong answers—only your preferences and beliefs. You may be surprised to learn where your true bottom line lies.

Know your options

Other important questions when preparing for the sale of your business include:

- What are the state tax and capital gains ramifications of the sale, and how might they affect you given where you plan to live after the transaction?

- Rather than preparing for a sale now, how might a “hold and grow” strategy increase the value of your business for an improved future sales price?

- How does the current market’s demand for your products and services affect the potential sale of your business?

- What are the pros and cons of divesting a portion of the business to gain more immediate liquidity?

Indeed, considerations for selling your business are varied and complex. Overall, your needs, goals, alternatives and tax ramifications are all important pieces to designing your exit strategy.

Equally important is the time you’ll need to get things right. Rushing may not produce the results you want. Allowing enough time will get you the transaction you hope for and need.