Sustained levels of low U.S. unemployment have made finding and hiring qualified job applicants a struggle for companies of all sizes. Middle market companies are competing with their peers, as well as large-cap counterparts that sometimes can offer higher compensation and an arsenal of enticements. Recent RSM data shows, however, that there may be a clear opportunity for midsize businesses to close the gap for hard-to-fill roles with outsourcing.

Middle market organizations looking to hire face significant obstacles. Among those companies indicating a moderate or significant hiring need, roughly half in RSM’s second quarter Middle Market Business Index survey characterized staffing open positions as very or extremely challenging. One-third of survey respondents also indicated employee turnover as very or extremely challenging.

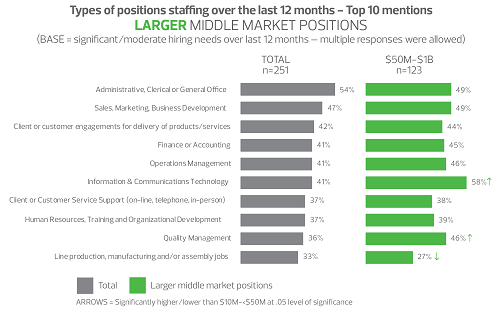

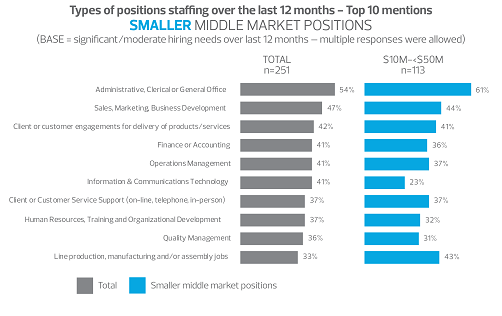

Despite these and other challenges, middle market companies exhibit a relatively low incidence of outsourcing, the MMBI data shows. Among respondents who found staffing open positions as extremely, very or somewhat challenging in the last 12 months, only 38% listed outsourcing as an action taken to address staffing issues—41% of larger middle market respondents ($50 million-$1 billion in revenue) and 36% of smaller midsize organizations ($10 million-$50 million in revenue).

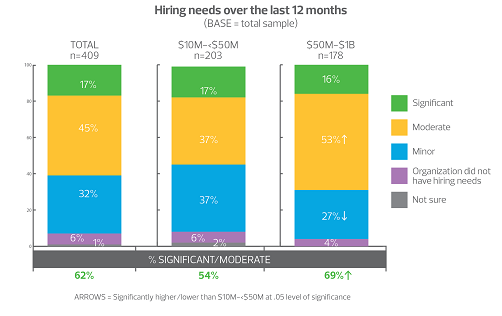

Unfortunately, the shortage of qualified workers to fill open posts will likely continue. In fact, nearly two-thirds of middle market organizations (62%) claimed moderate or significant hiring needs over the last 12 months. While hiring has slowed in the sector, 47% of survey participants still say they added jobs in the second quarter, and 54% indicated they would consider doing so through the remainder of the year.

Companies exhibit a reluctance to engage in aggressive hiring, partially due to a reduced supply of willing and available workers—79% of survey respondents noted the shortage is a challenge. In addition, approximately 74% of middle market executives polled identified labor competition among employers as an additional issue. Competition is responsible, in part, for driving compensation higher.

Ultimately, the expanded use of outsourcing is a means to help overcome these hiring barriers, matching sought-after skills with demand, and providing more stability—and affordability—in hard-to-fill roles.