ViDA modernizes EU VAT with e-invoicing, platform rules and single registration.

Key takeaways

E-invoicing and digital reporting will be mandatory across the EU by July 2030.

Businesses must align systems and teams now to meet ViDA’s phased compliance demands.

Value-added tax (VAT) makes up a significant portion of tax revenue for European Union (EU) member states; however, according to the European Commission’s 2022 Value-Added Tax Gap report, it’s also the basis of an estimated 89.3 billion euros in uncollected tax revenue due to noncompliance, fraud, evasion and miscalculations. The rise in digital transactions and e-commerce also contributes to this gap.

As such, the EU in April 2025 implemented its VAT in the Digital Age, or ViDA, package, a little more than two years after introducing and proposing it. It stands as a significant reform aimed at modernizing and adapting the VAT system to the digital economy, reducing fraud, and simplifying compliance for cross-border trade.

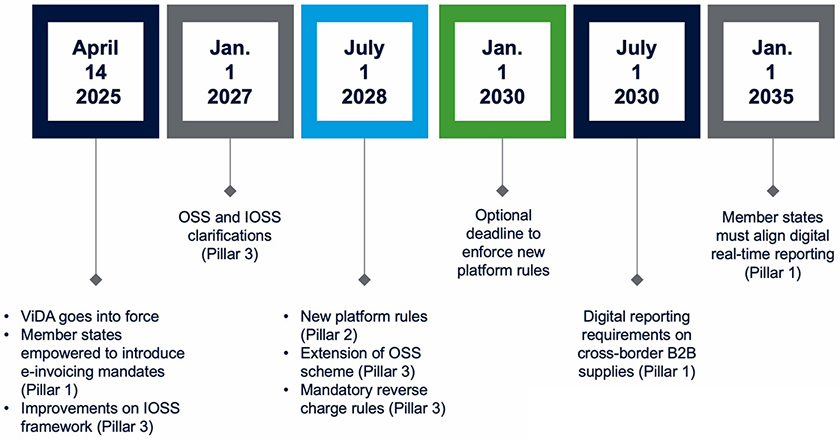

Various amendments will be rolled out progressively between now through 2035; however, significant advancements in this space have been well underway, with an even faster rate of change anticipated in the coming months.

ViDA pillars

ViDA covers three main areas, also known as pillars:

Pilar 1

E-invoicing and digital reporting requirements: One of the cornerstone changes under ViDA is mandating and harmonizing e-invoicing and digital reporting across EU member states for cross-border transactions. By July 1, 2030, businesses will be required to issue electronic invoices in a structured format that complies with the European e-invoicing standard (EN16931). This shift aims to enhance transparency, reduce fraud and streamline VAT reporting processes.

Pilar 2

Platform economy rules: New “deemed supplier” rules will be introduced for the platform economy in the short-term accommodation rentals and passenger transport space, essentially holding these businesses responsible for VAT collection and remittance, particularly when the underlying service provider is not VAT-registered. This simplifies tax collection for authorities and attempts to further equalize the playing field between online and traditional providers.

Pilar 3

Single VAT registration: This pillar aims to reduce the complexity and administrative burden associated with multiple VAT registrations by expanding the scope of supplies under current simplified regimes known as the one-stop shop (OSS) and import one-stop shop (IOSS) and mandating reverse charge for nonidentified suppliers. This will simplify VAT compliance for businesses operating across the EU as they would be able to fulfil most, if not all, their EU VAT obligations via a single online platform, registration and member state.

Timeline of key changes

Below is the planned timeline for the implementation of these amendments. Note the following are effective immediately:

- Individual member states may now introduce mandatory e-invoicing rules without needing prior approval from the European Commission.

- Additionally, they may also remove the domestic requirement that the use of electronic invoicing is subject to the recipient’s approval.

Businesses affected by ViDA and where to start

The effects of ViDA will permeate across all industries with the consistent link being businesses with activities in the EU. This includes businesses:

- Engaged in cross-border transactions within the EU

- Operating across multiple EU member states

- Operating digital marketplace platforms, particularly for short-term accommodations rentals and passenger transportation

- Conducting e-commerce and selling directly to consumers in the EU

To prepare, businesses should assess their current systems, data governance and processes against the expectations and requirements of ViDA. Businesses can then identify gaps within their processes and determine how they can be addressed, be it through automation, technological upgrades, systems consolidations or even an overhaul of how indirect taxes are currently being managed.

Gearing up for ViDA will require representation from teams beyond the tax function such as information technology, finance, operations and procurement. Particularly with the requirement for e-invoicing and near real-time reporting, accurate and reliable data will be crucial, requiring business departments to be cohesively aligned and operationally integrated.

Need help?

VAT advisors can support your business—from ViDA readiness assessments to implementations of technology or integration of processes required to support the ViDA requirements. Contact us to learn more.

RSM contributors

-

-

Yen LeeManager

Yen LeeManager

Related insights

Tax resources

Timely updates and analysis of changing federal, state and international tax policy and regulation.

Subscribe now

Stay updated on tax planning and regulatory topics that affect you and your business.

Washington National Tax

Experienced tax professionals track regulations, policies and legislation to help translate changes.