Amortization of 2022 R&D expenditures over 5 years combined with the 30% of EBIT deduction for business interest will result in large increases to taxable income

Key takeaways

Due to high cost and length, the prevalence of traditional Chapter 11 reorganizations is expected to continue to decrease

Distressed debtors should consult professional advisors to maximize their options in navigating these difficult issues

The following content is republished with permission. Originally published in ARIA Journal, Vol. 35, No. 4.

A fundamental goal of the federal bankruptcy laws enacted by Congress is to give debtors a financial "fresh start" from burdensome debts. The Supreme Court made this point about the purpose of the bankruptcy law in a 1934 decision.

It gives to the honest but unfortunate debtor...a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of preexisting debt.

It gives to the honest but unfortunate debtor...a new opportunity in life and a clear field for future effort, unhampered by the pressure and discouragement of preexisting debt.

The Internal Revenue Code (IRC) similarly allows corporate taxpayers special tax benefits to facilitate a “fresh start” upon emergence from Chapter 11 bankruptcy. This is accomplished through specific provisions in the IRC that are designed to preserve tax attributes of the debtor, as well as to ameliorate cancellation of debt income from creating taxable income once the Chapter 11 Plan of Reorganization is confirmed (refer to IRC sections 382(l)(5) and (l)(6) as well as IRC section 108(a)(1)(A) for more information).

Current efforts by the Federal Reserve to aggressively combat inflation may usher in a new wave of corporate bankruptcies. If present trends continue, it is expected that relatively fewer “conventional” reorganizing Chapter 11 cases will be filed. Rather, more “pre-packaged” and/or Bankruptcy Code 363 asset sales (363 asset sales) may occur due to the benefits they offer corporate bankruptcy filers.

Tax attributes such as net operating losses (NOLs) can be a valuable attribute of a distressed or bankrupt corporation. The form in which a corporation discharges its liabilities, through bankruptcy or out of court negotiations, can have a large impact on the amount of tax attributes that survive, and whether cancellation of debt income is recognized.

This article describes the current economic outlook and the expected increase in debt workouts and bankruptcies. In addition, this article discusses how the tax consequences may differ between out of court workouts, traditional “reorganizing” Chapter 11 bankruptcies, “pre-packaged” bankruptcies and 363 asset sales.

Economic outlook

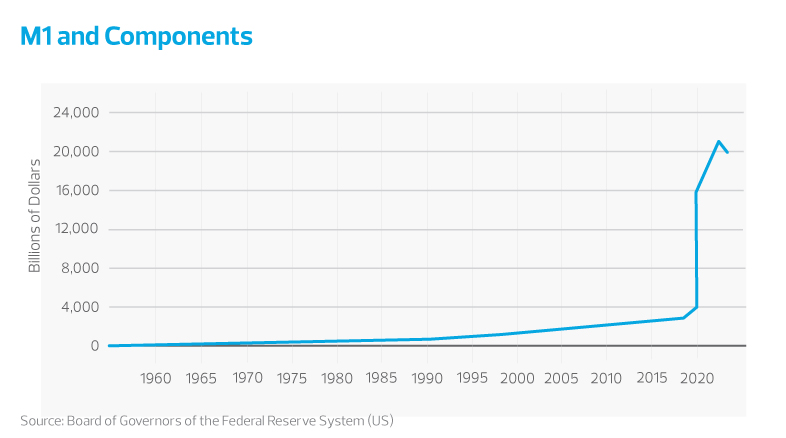

In response to the Covid-19 pandemic, an unprecedented amount of countercyclical fiscal and monetary stimulus was introduced to support the U.S. economy. As the graph below indicates, the M1 (broadly, the available U.S. money supply) dramatically increased from a then historic high of $4 trillion in January of 2020 to $20.8 trillion in March of 2022.

Beginning May 2020, M1 is defined as:

- currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions;

- demand deposits at commercial banks (excluding those amounts held by depository institutions, the U.S. government, and foreign banks and official institutions) less cash items in the process of collection and Federal Reserve float; and

- other liquid deposits, consisting of OCDs and savings deposits (including money market deposit accounts). Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.

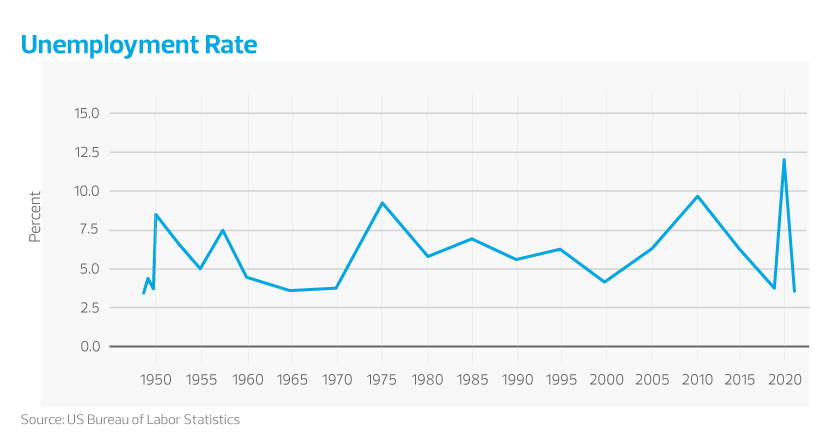

While the deleterious effects of this stimulus are being experienced currently, it should be noted that that the government was addressing a very different situation at the onset of the Covid 19 pandemic that led to such profligacy of liquidity. For example, from February 2020 to March 2020 – unemployment alarmingly increased from 3.5% to 14.7%.

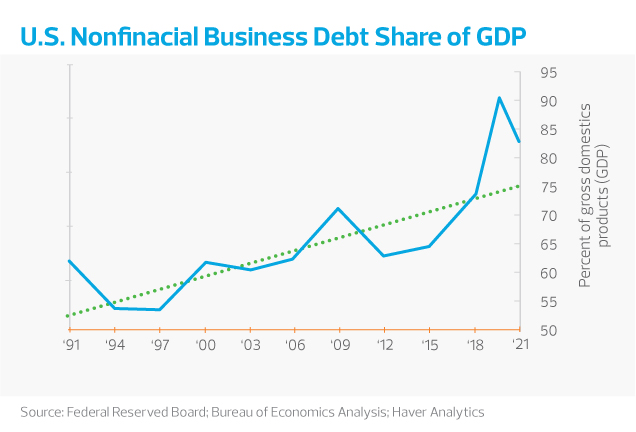

Corporate debt

Non-financial business debt (i.e., debt issued by non-financial institutions) has increased steadily for past few decades, surging to record levels during the pandemic. For example, in 2020. outstanding non-financial business debt increased at an 18 percent average annual rate as compared to 2019.

The increase in corporate debt is partially attributable to the issuance of Paycheck Protection Program (PPP) loans. Despite most PPP loans later being forgiven, about $28 billion of PPP debt still remains. The majority of the $28 billion unforgiven debt relates to loans that are below $25,000 and primarily affect small businesses. Small business advocates claim these loans are often denied forgiveness because the business owner does not understand or is unable to comply with confusing loan terms and conditions.

PPP loans, which were largely expected to be tax-free, gave businesses more liquidity to seek additional debt. In total, the confluence of such economic stimulus and unprecedented debt, combined with the current downturn, is expected to result in an increase in debt workouts and bankruptcy filings.

See the Office of the Comptroller of the Currency chart below:

Despite the increase in corporate debt, low interest rates increased corporate liquidity as interest payments on expanding debt loads were not then a material draw on cash. However, low interest rates potentially encouraged many businesses to borrow beyond their means. There has been a significant increase in BBB rated bonds and junk-rated bonds. BBB bonds made up 40% of the investment-grade market during the 2008 recession but currently make up around 57% of the market.

The junk bond market rallied in late summer of 2022 but has since started to decline. The decline in the junk bond market can be attributed to the persistent efforts by the Federal Reserve to quash inflation by raising interest rates. A weakened junk bond market will make it difficult for companies to issue more debt or refinance, in particular as cash flow difficulties increase during the current economic downturn. Junk bond issuers with an average credit rating of B3 or B- rating could see an 80% reduction in free cash flow as a result of the interest rate increase according to Alliance Bernstein Holding L.P.

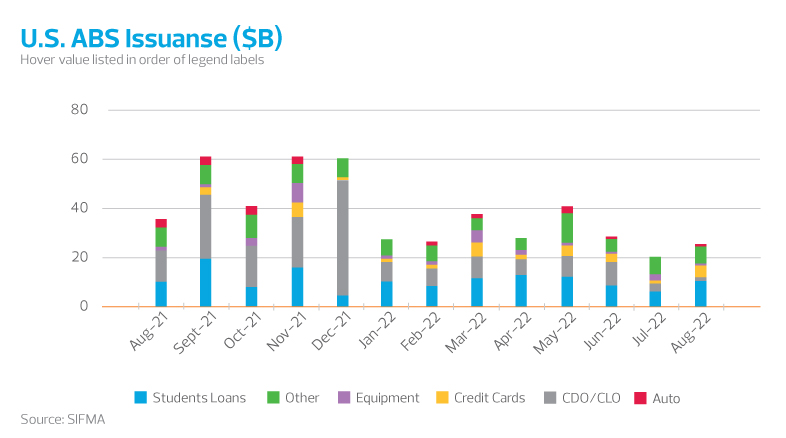

Moreover, total asset-backed security issuances as of August 2022 were down by 33.9% as compared to the prior year. As reflected in the graph below, the market for collateralized debt obligations (mostly mortgages) and collateralized loan obligations (mostly corporate debt) has dramatically contracted. This suggests that the perceived riskiness of the underlying mortgages and corporate loans has substantially increased - as the market to securitize such obligations has essentially disappeared. The inability to “offload” these obligations may disproportionately burden companies holding lower or junk-rated assets and reflects the overall increased riskiness of these obligations in the current economic environment.

We thus appear to be entering a “perfect storm” of high debt levels, monetary tightening and uncertain economic conditions. It is anticipated that any resulting bankruptcy filings will reflect an increase in quicker “pre-packaged” bankruptcies and section 363 sales, as compared to traditional reorganizing Chapter 11 bankruptcies as further explained below.

Internal Revenue Code provisions relating to corporations in a Chapter 11

Cancellation of debt provisions

IRC Section 61(a)(11) provides that taxable income includes income from the cancellation of indebtedness (COD). For example, if a corporation owed $100 of debt to its creditors – but satisfies the debt for $60, the corporation would generally have $40 of taxable income (and the creditors would have a correlative $40 bad debt deduction).

To the extent a debtor is insolvent, IRC section 108(a)(1)(B) generally provides that COD is excluded from taxable income. In the example above, if the debtor was insolvent by $10 – then $30 of COD would taxable and $10 would be excluded from income. However, to the extent COD is not taxable under IRC section 108(a), attribute reduction is required under IRC section 108(b). In this example, the $10 of COD that is excluded from taxable income might decrease, for example, the corporations net operating losses by $10. Under this “fresh approach,” excluded COD does not result in immediate taxation - but might reduce tax attributes that could have otherwise reduced federal income taxes in the future.

One issue relating to reliance on IRC section 108(a)(1)(B) is that the taxpayer must prove to the IRS that they were insolvent. The taxpayer may, for example, argue they were insolvent to the extent the debt was forgiven, as the debtor would not have otherwise discharged the debt by that amount. This argument becomes less persuasive when the original debt has been sold. For example, if the debt were sold at a discount to a “vulture fund” – the acquiror of the debt may accept a quick payoff that would result in a gain to them – even if the borrower was not insolvent by the entire amount of the debt that is forgiven.

Another issue arises when various debts are forgiven over time, it is possible that at some point the taxpayer may become solvent, or the amount of insolvency may differ from the COD income recognized.

To avoid this factual issue, one advantage of a chapter 11 filing is that IRC section 108(a)(1)(A) provides that all debt discharged in a “title 11 case” is excluded from gross income. However, despite the legal and tax advantages available in bankruptcy; it is often taken as a last resort and a choice that should be carefully considered.

Section 382 provisions

When more than 50% of the ownership of a company changes hands (generally over a 3-year rolling period) IRC sections 382 and 383 limit the utilization of NOLs and other tax attributes, respectively (section 382 limits NOLs and 163(j) carryforwards; and section 383 similarly limits general business credits and other tax attributes). The “base” section 382 limitation is based on the equity value of the company immediately before the 50% change in ownership, times a prescribed rate. Every month, the IRS publishes a Revenue Ruling that include the applicable federal rate (or “AFR”) or section 382 ownership changes. The AFR for October of 2022 is 2.6% (see Rev. Rul. 2022-18, Table 3). For example, if the equity value of a loss corporation is $1 million and experienced an ownership change in October of 2022, subject to certain adjustments, the “base” limitation would be $26 thousand per year relating to that ownership change. As such, the loss corporation could use $26 thousand of pre-change NOLs on an annualized basis relating solely to the “base” limitation. For more information, review “A Primer in Section 382 Built-in Gains and Losses”, AIRA Journal Volume 34, No. 4, page 22, that discusses how recognized-built gains, if any, can increase the “base” section 382 limitation.

As such, if an insolvent corporation is sold in exchange for debt, the pre-change value of the company would be $0 and thus the “base” section 382 limitation would be $0, which could result in the effective elimination of the corporation’s NOLs (and potentially other tax attributes).

IRC section 382 provides two bankruptcy exceptions to the general section 382 rules.

Under IRC section 382(l)(5), if certain conditions are met, there is no section 382 ownership change upon emergence from a title 11 or similar case, but certain interest deductions paid to creditors who become shareholders are eliminated from the post-emergence NOL.

Under IRC section 382(l)(6), an ownership change occurs, but the limitation is based on the value of the corporation after taking into account any surrender or cancellation of creditors’ claims in a title 11 or similar case.

These special bankruptcy provision generally allow taxpayers to preserve a far greater amount of their net operating losses, IRC section 163(j) carryforwards and general business credits than under the general IRC section 382 and 383 rules (but only to the extent such attributes are not otherwise reduced under IRC section 108(b) upon emergence from Chapter 11). Although section 108 does not require certain taxpayers to include discharge of indebtedness income in gross income, it does require the reduction of tax attributes. Section 108(b)(1) provides that if a taxpayer excludes an amount from gross income under section 108(a)(1)(A), (B), or (C), the taxpayer must reduce its tax attributes by the amount excluded. Such attribution reduction occurs to the extent of all debt forgiven in a chapter 11 bankruptcy, or to the extent the taxpayer is insolvent, if the debt is reduced outside of a chapter 11 bankruptcy.

For tax years beginning after Dec. 31, 2017, the deferral of excess interest expense under “new” IRC section 163(j) disproportionally affects distressed debtors. While these deferred interest carryforwards can be carried forward indefinitely, they are subject to the same section 382 limitations as net operating loss carryforwards (refer to IRC section 382(d)(3)).

Chapter 11 reorganizations and section 363 asset sales

In a traditional chapter 11 bankruptcy, the debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains “in possession,” has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money. A plan of reorganization is proposed, creditors whose rights are affected may vote on the plan, and the plan may be confirmed by the court if it gets the required votes and satisfies certain legal requirements.

These “reorganizing” chapter 11 filings historically can be quite lengthy and expensive for all parties involved. For example, the Sears bankruptcy that was filed in October of 2018 and the J.C. Penney bankruptcy that was filed in May of 2020 – collectively generated more than $150 million in combined legal fees.

In order to prevent the time and expense of these extended chapter 11 reorganizations, an increasing number of recent bankruptcies were “pre-packaged” and/or involved Bankruptcy Code section 363 asset sales, as described below.

Pre-packaged bankruptcies

A pre-packaged bankruptcy is a Chapter 11 bankruptcy proceeding that has been pre-negotiated with creditors prior to the Bankruptcy Court filings. Through the use of a pre-packaged bankruptcy, a debtor can simplify and accelerate the bankruptcy proceedings. Pre-packaged bankruptcies come with substantial cost savings over a traditional chapter 11 proceeding. Further, pre-packaged bankruptcies are often used by companies to renegotiate specific classes of debt while preserving the structure of the debtor’s business operations.

Despite the benefits of pre-packaged bankruptcies, they are not without critics. The Justice Department has raised concerns over pre-packaged bankruptcies’ lack of transparency and fairness to creditors. In some cases, pre-packaged bankruptcies can be approved within days and may not give adequate notice to creditors or shareholders. However, advocates of pre-packaged bankruptcies note that these proceedings enable the United States to better compete with insolvency proceedings in foreign countries. Advocates also note that the more efficient proceedings help preserve money for shareholders and creditors.

Section 363 asset sales

A section 363 asset sale occurs when a court grants a corporation the power to satisfy its credit obligations through the sale of a corporation’s assets, rather than pursuant to a Plan of Reorganization. Thus, unlike a traditional Chapter 11 filing, a 363 sale gives a company (or trustee, as applicable) more control over the sale process. Additionally, the purchaser of assets sold through a 363 sale generally takes title free and clear of any encumbrances.

In general, 363 sales are treated as taxable transactions. As such, any debtor tax attributes would generally not transfer to the acquiror. If the debtor liquidates after the 363 asset sale, all of the tax attributes would thus be lost after the debtor’s final tax return is filed.

The consideration for a section 363 asset sale may in the form of a “credit bid”. “In the bankruptcy context, a credit bid is where a secured creditor in connection with a Section 363 sale uses (or “bids”) all or a portion of its secured debt as full or partial consideration for the debtor’s assets.” If structured properly, such a transaction may qualify as a tax-free “G” reorganization. Section 368(a)(1)(G) provides that a “G” reorganization requires “a transfer by a corporation of all or part of its assets to another corporation in a title 11 or similar case; but only if, in pursuance of the plan, stock or securities of the corporation to which the assets are transferred are distributed in a transaction which qualifies under section 354, 355, or 356.” In such case, the debtor’s tax attributes would transfer to the acquiring corporation.

Summary

Rising interest rates and tightening credit conditions are expected to result in an increase in distressed debt, debt workouts and bankruptcy filings.

Due to their high cost and length, the prevalence of traditional Chapter 11 reorganizations is expected to continue to decrease relative to the filings of pre-packaged bankruptcies and section 363 asset sales.

The form of the debt workout or reorganization can result in dramatically different tax results, as well as non-tax consequences, to the parties involved. The earlier a debtor can identify potential cash flow and insolvency issues, the more control the company may have over the ensuing process. Distressed debtors should thus consult tax and bankruptcy counsel as soon as practicable to maximize their options in navigating these difficult issues.

Pre-packaged bankruptcies and section 363 asset sales may offer advantages over traditional reorganizing Chapter 11 bankruptcies, based on a debtor’s specific facts and circumstances, though all of these options are generally preferable to waiting too late and “falling” into a liquidating Chapter 7 bankruptcy.