With attributes that help mitigate tax and reporting obligations for individual, tax-exempt and foreign investors, real estate investment trusts (REITs) have long remained an attractive alternative to pass-through structures for certain real estate funds. Due to the recent passing of the Tax Cuts and Jobs Act (TCJA), REITs have become an even more attractive investment vehicle for real estate. Starting in 2018, the TCJA allows for ordinary REIT dividends to qualify for the new 20 percent pass-through deduction regardless of the wage and qualified basis limitation rules. This benefit has captured the attention of many private real estate owners and investors looking to reduce the overall tax burden on their real estate holdings. While this is an appealing benefit, longstanding prohibitions on controlled ownership of REITs serve as a barrier to entry and remain a challenge for investors looking to incorporate as a REIT.

While there are several organizational and operational requirements that must be met to qualify as a REIT, this article will focus on two ownership tests that present issues for any investor considering a REIT for their real estate investments—the 100 Shareholder Test and the closely held prohibition test.

100 Shareholder Test

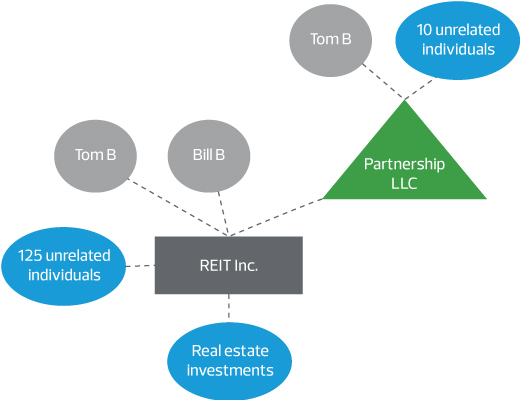

After the first taxable year, REITs must be held by 100 or more persons for at least 335 days in a 12-month taxable year or a prorated equivalent for a short tax year. The determination of ownership is based on the holder of the actual REIT shares (the person who gets the Form 1099-DIV). There is no consideration for attribution when testing for 100 shareholders. For example, assume a partnership with 150 partners owns 100 percent of the REIT’s stock. For purposes of the 100 Shareholder Test, the partnership, as the sole owner of the REIT shares, counts as the only shareholder and the REIT would fail the test. All classes of stock are considered as part of this test. If the REIT has one common shareholder and 125 preferred shareholders, for example, it would qualify for the 100 Shareholder Test. The 100 Shareholder Test is generally not a problem in the public REIT sector due to the number of public investors. However, it can be a challenge to secure 100+ investors in the private sector. Private REIT sponsors, who may not have access to a critical mass of investors necessary to meet this requirement, often hire shareholder accommodation firms to help bring in the necessary amount of investors.

Closely held prohibition test

After the first taxable year, REITs cannot be closely held. A REIT will be closely held if more than 50 percent of the value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals at any point during the last half of the taxable year. This is commonly referred to as the 5/50 Test. Unlike the 100 shareholder requirement, attribution rules under section 544 (modified to exclude partner attribution), must be applied to the 5/50 Test. These attribution rules require the REIT to look through corporations, partnerships, trusts or estates to the ultimate owners, shareholders, partners or beneficiaries. Each individual is assumed to own all shares owned by their brothers, sisters, spouse, ancestors and lineal descendants. Special care should be taken with respect to shares owned by certain trusts, tax-exempt and foreign entities as treatment varies (i.e., treated as an individual, look through to beneficiaries, or ignored altogether) for these purposes depending on facts and circumstances.

Example of 5/50 Test

Top 5 shareholders |

|||

Without attribution |

With attribution |

||

Tom B* |

14% (10% + (80%*5%)) |

Tom B and Bill B (treated as 1) |

24% (14% + 10%) |

Bill B* |

10% |

Individual 1 |

7.6% |

Individual 1* |

7.6% (80% * 9.5%) |

Individual 2 |

7.6% |

Individual 2* |

7.6% |

Individual 3 |

7.6% |

Individual 3* |

7.6% |

Individual 4 |

7.6% |

Total |

46.8% |

Total |

55.2% |

*Note: Assumes that Individuals 1, 2 and 3 are each a 10 percent partner (along with seven other unrelated individuals holding the same 10 percent interest each) in the upper-tier partnership (UTP) that holds the 95 percent interest in Partnership, LLC which in turn holds 80 percent of the common REIT stock. The remaining 5 percent of the UTP is held by Tom B. Further assumes that Tom B and Bill B, who are brothers, each own 10 percent of the common stock in the REIT. Finally, all preferred stock of the REIT (which has nominal value relative to the common shares) is held by 125 unrelated individuals.

Without the attribution rules, this REIT would pass the 5/50 Test as the total effective ownership of the top five shareholders would be 46.8 percent of the REIT. Due to the attribution rules, Tom B and Bill B, who are brothers, must combine their interests as if they were one person. Consequently, the top five shareholders then own 54.4 percent of the REIT and fail the 5/50 Test.

Maintaining compliance

There are certain strategies and mechanisms in place to monitor REIT ownership and ensure compliance with the aforementioned rules. REITs often times include certain ownership and transfer restrictions in their governing documents to preserve REIT status. For example, to help prevent an inadvertent violation of the closely held prohibition test, REITs will often times include an excess share provision in their governing documents that limits the amount by which a shareholder can increase his or her stock ownership (directly or indirectly via attribution). If a transfer is attempted that would violate the closely held prohibition test, the transfer to such an individual is voided, and the shares are instead transferred into a trust with charitable beneficiaries. Special care should be taken to make sure any such provisions do not infringe on another organizational requirement that REIT shares be freely transferable (beyond the scope of this article).

Another REIT requirement intended to help with the monitoring of these ownership tests is the shareholder demand letter. REITs are required to issue an annual shareholder demand letter to a certain number of shareholders on record to request confirmation on the actual owner of the REIT stock and the number of shares owned. REITs must distribute these letters within 30 days after the close of the REIT’s taxable year.

The 100 Shareholder Test and the closely held prohibition test present significant obstacles for private real estate owners considering a REIT for their investments. The 100 Shareholder Test requires that the REIT’s stock be held by more than 100 persons or entities. The closely held prohibition test requires that no more than 50 percent of the value of the REIT stock be held by five or fewer individuals (directly or indirectly via attribution). REITs can avoid violations of these tests through excess share provisions, thorough documentation with demand letters and continued monitoring of shareholder rosters. When considering the ownership rules, it is important for REITs to have the proper advisors in place to assist with these issues. A violation of these rules can result in significant penalties or worse, the disqualification of REIT status.