Real estate businesses looking to move forward with their strategic plans during the downturn while preserving equity may just have another tool in their tool belt: Commercial Property Assessed Clean Energy programs, or C-PACE. C-PACE, a public-private financing option, allows commercial property owners to obtain low-cost, long-term financing for capital expenditures that affect energy and water performance of commercial and multifamily real estate. Because the financing comes in the form of an assessment on the property typically added to the property tax bill, the debt is tied to the property and not the property owner. This structure survives changes in ownership, which may be beneficial to investors.

Mortgage lenders may find C-PACE financing structures preferable to traditional options for a variety of reasons. C-PACE loans do not affect mortgage lenders’ foreclosure rights; assessments cannot be accelerated; and assessment payments can be put in escrow, similar to real estate tax payments. Furthermore, the qualified improvements tied to the financing likely positively affect debt service coverage ratio adherence by the owner for the mortgage lender. Lenders generally have no issues with this type of financing.

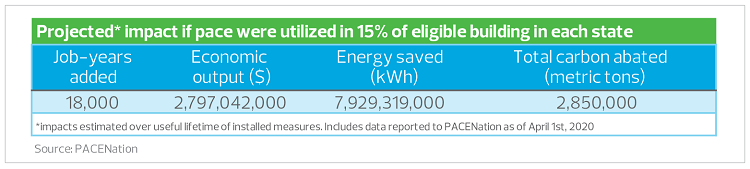

Public pressure is building for businesses across the board to adhere to environmental, social and governance standards known as ESG, and the commercial real estate industry is no exception.

Large real estate investment managers are taking note. Nuveen, a leading global investment manager, has recently agreed to acquire Greenworks Lending, a national leader in C-PACE financing. The acquisition gives Nuveen a foothold in the clean energy and energy efficiency lending market and will provide its clients access to an innovative and attractive clean energy investment.

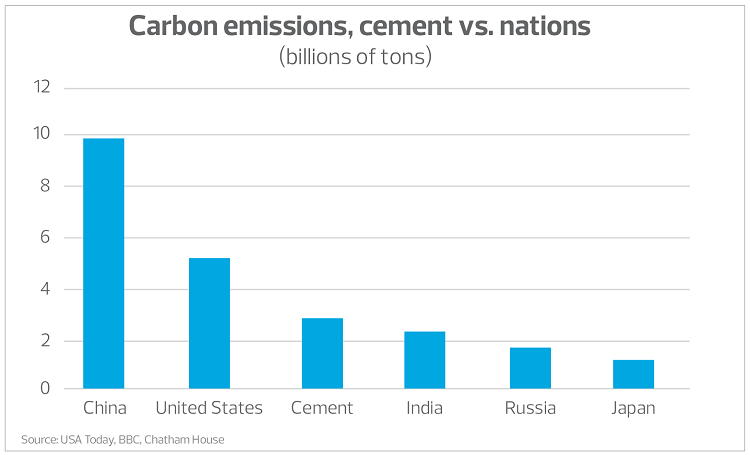

One of the largest environmental considerations for real estate investors is reducing their carbon footprint by achieving carbon net-neutrality. By recently rejoining the Paris Agreement, the United States is doubling down on its commitment to focus on decarbonizing buildings, mirroring similar efforts by the United Nations in its Sustainable Development Goals. ESG initiatives offer additional motivation for real estate investors to explore all available incentives, credits and financing options to achieve their sustainability goals.

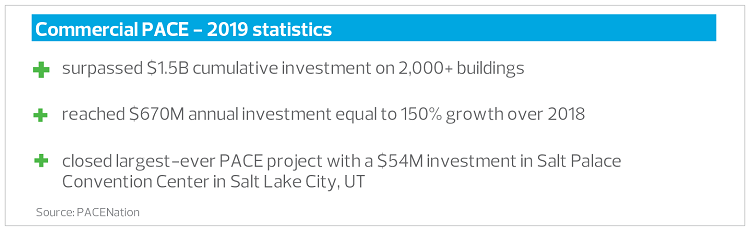

C-PACE is an attractive option to bolster extensive building retrofits when traditional underwriting for the investment isn’t appropriate, given the existing capital stack. C-PACE payback periods span 20 to 30 years, much longer than traditional financing’s seven-to-10-year terms; this flexibility may finally help these projects get across the finish line.

And in roughly a dozen markets, C-PACE financing may allow commercial properties that have already invested in energy-related retrofits a means to replenish their reserves through a retroactivity provision. This feature can augment other financing tools available to property owners still navigating the impacts of the COVID-19 pandemic.