Numerous economic headwinds will continue well into the year for biopharmas.

Key takeaways

A sufficient cash runway is needed to survive until capital markets become more receptive to deals.

Hiring continues to be a challenge for biopharmas and biotechs.

Biopharma and biotech companies continue to struggle with cash management, given that capital markets remain slow. This is the case for both private financing and initial public offerings. Additionally, companies are still hard pressed to find quality talent. Despite layoffs, however, unemployment in the industry remains at historic lows.

Deal flow, both public and private, has slowed to a trickle

One of the key measures of health in the biopharma sector is the availability of private equity and venture capital funding. With the U.S. Federal Reserve continuing to raise interest rates, disruption in regional banks that serve biopharmas, biotechs and venture capitalists, and a hangover caused by high valuations in prior years, it should come as no surprise that 2023 has had a sluggish start when measured by deal count or capital raised.

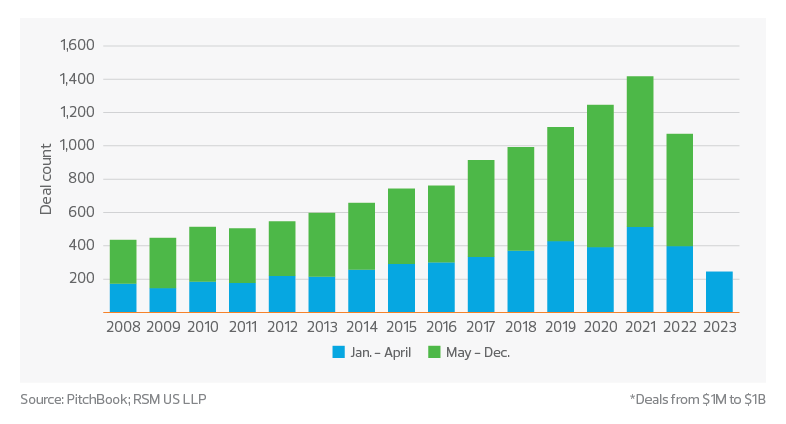

Private equity and venture capital investment in biopharma*

The first four months of 2023 had the lowest volume (246) of deals since 2013 (213) and a 38% decline from the same period last year. Over the past 15 years, on average, the first four months of the year accounted for 36% of the deals for the full year. If that trend continues, we expect approximately 675 total deals this year, which would be the lowest volume since 2014.

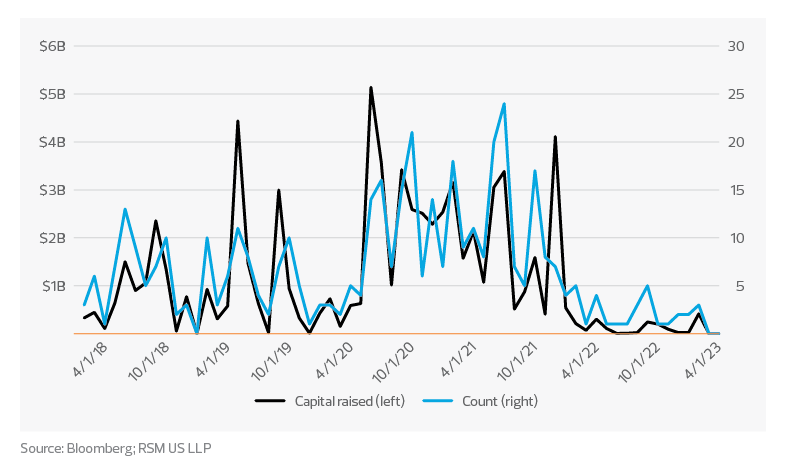

Life sciences IPO activity–U.S. exchanges

Public markets are faring even worse than private markets, with only five IPOs so far in 2023 and with no companies going public in either March or April. The prior two years started off at a much higher pace, with 14 offerings in 2022 and a staggering 45 in the same period of 2021. The beginning of 2023 continues the steep drop-off seen throughout 2022, with few signs of that changing as the year progresses.

TAX TREND: Mergers and acquisitions

The new required tax treatment of R&D expenses is also affecting M&A by worsening the tax posture of targets. Transaction planning that includes R&D cost analyses may help deals proceed by reducing the cash tax rate. However, the utilization of favorable tax attributes, such as net operating losses, may be limited by a change in ownership, and that must be factored.

For a sector so dependent on raising capital, this presents a challenging start to the year. For this outlook to change, we would need to see interest rates stabilize, new banking partners to replace the troubled or failing banks that served the sector, and a drop in the valuations that founders and existing investors are expecting based on prior-year fundraising.

TAX TREND: Cash management and liquidity

Many biopharma companies are facing increased cash and compliance costs resulting from the unfavorable change to the required tax treatment of R&D expenses. The inability to immediately deduct these expenses from taxable income may mitigate the value of certain tax attributes that were previously thought to be favorable. Companies expanding into new jurisdictions or entering into third-party collaboration deals can minimize unexpected costs by understanding how this new requirement affects their tax obligations.

Companies might minimize this burden by analyzing their R&D expenses to ensure proper treatment and carve out those that may not require capitalization under the new law. And once a company identifies and quantifies its R&D expenses, it may find it is eligible for an R&D tax credit or other incentives

Labor markets remain tighter for biopharmas than the economy overall

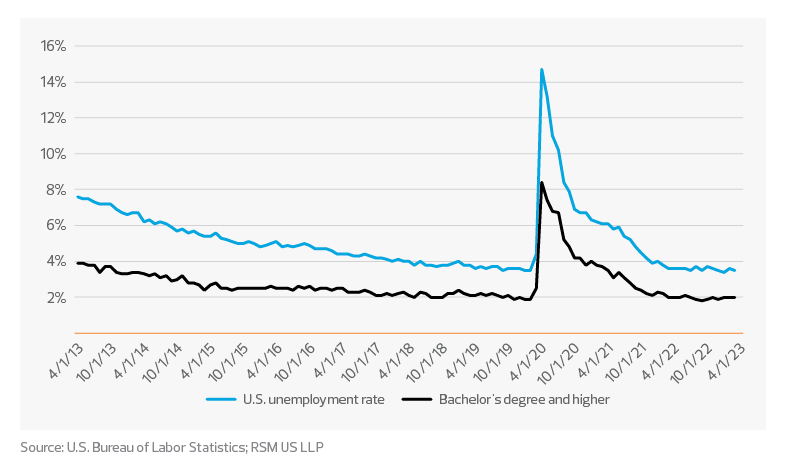

U.S. unemployment remains extremely low, despite rising interest rates and a slowing economy. Low unemployment rates are good for workers, ensuring they are able to change jobs when desired and creating upward pressure on wages. This is true for the overall job market but is especially true for job seekers with a bachelor’s degree or higher, like those employed in the biopharma sector. The unemployment rate for the U.S. overall in March was 3.5%, but for people with bachelor’s or advanced degrees it was only 2%.

Unemployment remains near record lows

Unfortunately, for the biopharma sector, this means hiring continues to be a challenge. Despite layoffs in other sectors and challenges in raising capital, the tight labor market means executives are still struggling to make strategic hires. This is compounded by the pressure on valuations from the stalled capital markets. In-demand hires often expect to receive valuable stock options as part of their compensation, but the risk of a down round for a biopharma company makes these options less desirable.

TAX TREND: Workforce

For biopharma companies pushing to make strategic hires, developing a compensation philosophy centered on total rewards instead of just cash salary may help balance costs with offerings that match workers’ preferences. It is important for employers to understand the tax implications of compensation plans so the company can implement ones that are advantageous to both the employees and the employer. Retirement programs, equity compensation, education opportunities or assistance and subsidized transportation benefits are just a few of many common offerings.

The takeaway

The biopharma sector has faced numerous headwinds so far in 2023, and unfortunately, it looks like these challenges will continue well into the year. For biopharma executives, cash management has become a critical concern to ensure they maintain a sufficient cash runway to survive until the capital markets become more receptive to deals. Unfortunately, running counter to this need is the continued tight labor market for biopharmas and the wage pressures that accompany it.