Public defense contractors are making strategic investments via their venture investing arms.

Key takeaways

Artificial intelligence and machine learning are changing the environment for contractors.

Protecting intellectual property is a top priority for both contractors and the government.

Technology and innovation are foundational for the U.S. federal government to serve and protect its citizens. To do this well, the government must work with contractors to develop cutting-edge solutions, educate its acquisition workforce to guide the procurement process effectively, and put safeguards in place to ensure its achievements are protected. This is a challenging but worthy pursuit that government contractors are ready to tackle in partnership with their government customer.

Strategics moving into venture capital

Public defense contractors have frequently played the part of strategic acquirer in a robust and resilient merger and acquisition market. Now those same companies are taking on the role of investor, making strategic minority investments in pioneering businesses via their venture investing arms. This was a common topic of conversation during third-quarter earnings season, with multiple executives announcing injections of cash into their venture funds and/or the deployment of those funds via strategic investment.

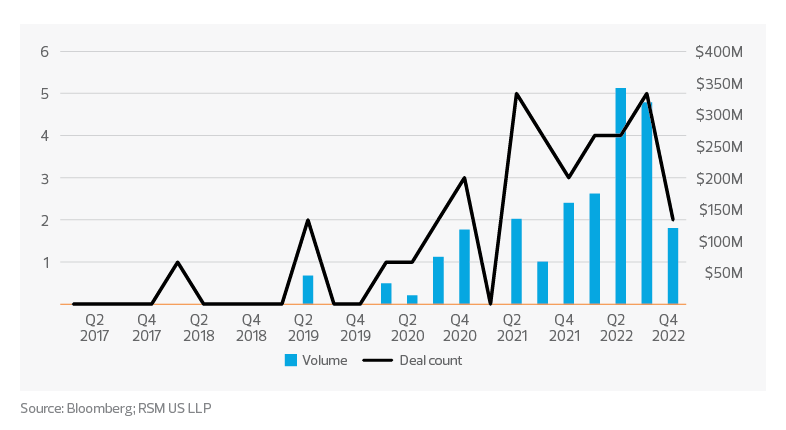

Venture investment volume and deal count have increased in a meaningful way for 20 of the biggest publicly traded defense contractors over the last three years. That trend has not only continued but accelerated in calendar year 2022, according to data from Bloomberg.

Prime contractor venture investment

When asked about acquisition targets, strategic buyers in the ecosystem have historically noted success in acquiring familiar targets—those with which they have established relationships via subcontracting, small business mentor-protégé assignments, joint ventures or, more recently, minority investment. In a consolidating ecosystem this has been common.

While investments and partnerships may end in a change-of-control transaction, there are far more optionality and near-term benefits to consider. Large prime contractors need access to the cutting-edge technologies developed by growing startups to deliver complete, innovative solutions to their government customer. The agile, growing startups need help selling to the federal government and traversing the Department of Defense “Valley of Death”—the multiyear period between successful prototype and official DOD program of record.

We expect this trend to continue, particularly as the battlefield continues its transition from land to sea to sky and now, to space. The partnership of large prime contractors with trailblazing space and satellite businesses will help to accelerate innovation and affect the current race to protect and defend from orbit via massive amounts of data, geospatial analysis and secure communications.

Getting smarter about artificial intelligence

The federal government appreciates and acknowledges that artificial intelligence and machine learning will be key tools for protection, advancement and operational efficiency in the future for defense and civilian applications alike. Like many other technologies, AI and ML will help the government enable the labor it has and replace the labor it is unable to maintain in a shrinking labor market.

However, that is often easier said than done when a revolutionary technology enters the scene. Such a scenario is a prime opportunity for the government to partner with contractors with relevant skills and expertise. To do that well, the government must assess contractors’ true capabilities and performance to ensure it chooses the best partner and develops tools devoid of data biases or discriminatory outcomes.

The Artificial Intelligence Training for the Acquisition Workforce Act became law on Oct. 17. This law requires the Office of Management and Budget to provide AI training to the federal government acquisition workforce annually for the next 10 years. This signals the federal government’s esteemed view of AI as it relates to federal procurement. It also suggests that contractors should be prepared to be pressed on any broad or unsupported claims around their AI and ML capabilities and solutions.

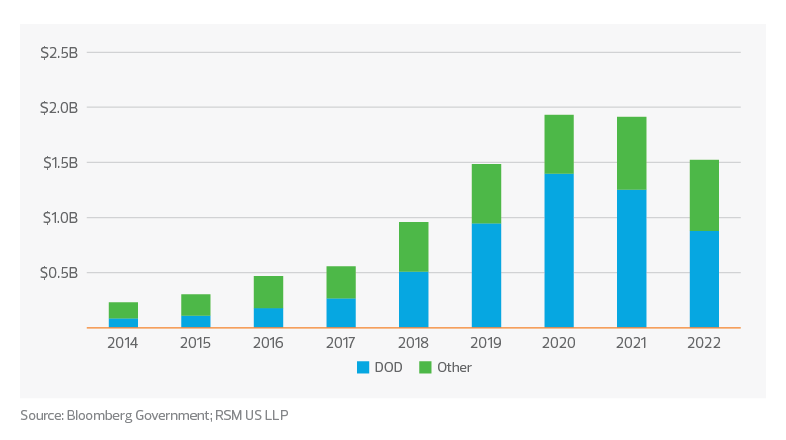

Federal spending on AI and ML has grown steadily over the last decade, with particularly steep acceleration beginning in fiscal year 2018. Spending plateaued in 2020 and 2021 at approximately $1.9 billion. Fiscal 2022 obligations total $1.5 billion so far but are likely understated due to the 90-day DOD data lag.

Some of this could be due to the government’s focus on the pandemic response. Some could be due to agencies pausing to learn about, equip themselves for, and make better procurement decisions around AI- and ML-based solutions. This may also be a driver of the growing share of spending coming from the DOD, the agency with the most experience and expertise with such innovative technologies.

According to data from Bloomberg, total federal spending on AI and ML in fiscal 2021 ($1.9 billion) was only 0.3% of total contract obligations ($650.8 billion) despite innumerable applications for AI and ML throughout the federal government. We expect an aggressive growth trajectory in this area as AI and ML continue to develop and as the federal acquisition workforce becomes more comfortable assessing and procuring it effectively.

Federal AI/ML contract dollars

Protecting intellectual property

Developing innovative technology is crucial to remaining competitive on the global stage, and the protection of those achievements is paramount. The DOD released its 2022 National Defense Strategy in late October. The unclassified version of this document held few surprises, identifying China’s threat to the homeland as one of the top-level defense priorities. With the battlefield continuing to evolve into space and digital realms, national security concerns are focused on the protection of intellectual property, cybersecurity and supply chains for electronic components.

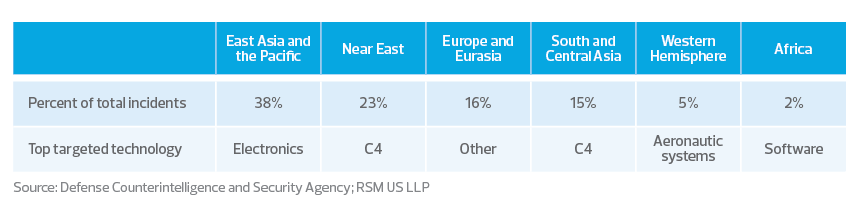

The Defense Counterintelligence and Security Agency provides security support services to the military, federal agencies and cleared contractor facilities. The DCSA’s 2022 edition of Targeting U.S. Technologies: A Report on Threats to Cleared Industry summarizes the efforts of global adversaries to exploit cleared personnel and target the cleared contractor community in the prior fiscal year.

According to that report, 38% of reported incidents originated in East Asia and the Pacific regions. C4 (i.e., command, control, communications and computers) continues to be a focus of threats. Specific targets include dual-use microelectronics, aeronautic turbine engines, AI software, satellite communication systems, telecommunications equipment and sensors.

The top results from the East Asia and Pacific data set present a common threat vignette of a commercial entity attempting to exploit an electronic component supply chain via email attempts. This isn’t difficult to imagine in a post-pandemic world, where supply chains proved vulnerable, and communications and solutions shifted to be more digital. Contractors should continue to be vigilant and aware of the wide array of methods and entry points bad actors are using to gain access to U.S. intellectual property.

In an effort to confront foreign national security concerns from every angle, in September the Biden administration issued Executive Order 14083—Ensuring Robust Consideration of Evolving National Security Risks by the Committee on Foreign Investment in the United States; and in 2021 issued Executive Order 14034—Protecting Americans’ Sensitive Data from Foreign Adversaries, along with Executive Order 14017—America’s Supply Chains. These orders illustrate the administration’s comprehensive view of the threat landscape and how cyber and supply chain vulnerabilities can pose significant national security threats to the defense industrial base and beyond.

We expect regulatory requirements attempting to mitigate these risks to continue to grow in scope and depth. A recent example includes the SBIR and STTR Extension Act of 2022, which includes disclosure requirements for affiliations with foreign countries of concern related to talent recruitment programs, joint ventures, subsidiaries, current or pending transactions, venture capital investment, tech licensing or intellectual property sales. The small, agile technology startups that may be best positioned to develop cutting-edge technology solutions, like those in the SBIR and STTR programs, should be prepared for such requirements if they desire the federal government as a partner or customer.

Looking ahead for government contractors

For technology enhancements and innovation efforts to maintain their impact, people and processes must develop in lockstep. Contractors must be prepared to compete in a fast-moving ecosystem, and be equipped with the skills needed to navigate a world of embedded AI and ML. They must also be careful to remain compliant with security and disclosure requirements to ensure our achievements aren’t stolen. While this requires a balance of exploration and discipline, it is a line government contractors have successfully walked for decades.