The impact of price increases

While consumers had largely overlooked price increases throughout the recovery, that has changed in recent months, particularly among lower-tiered earners.

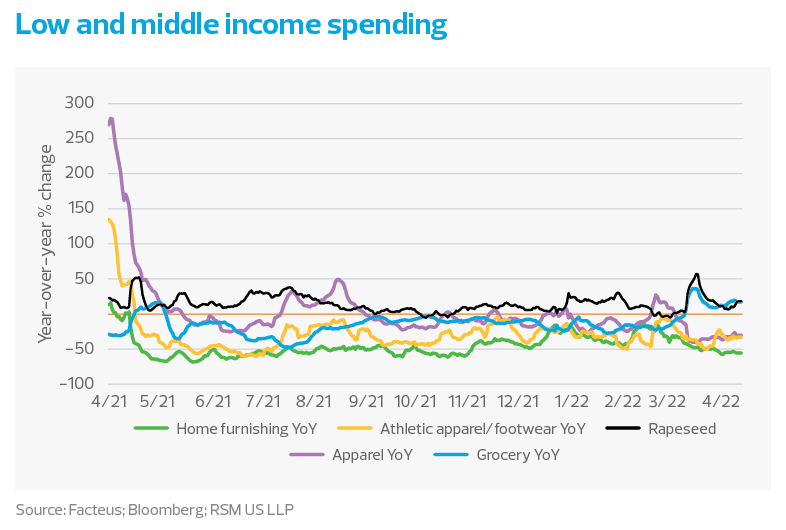

Since March, low- and middle-income wage earners increased their spending on essential items like groceries and gas by an average of 12% and 17%, respectively, on a year-over-year basis, according to Facteus, an alternative data research company. Over the same period, purchases of less essential items like apparel and home furnishings declined by more than 25% each. While a portion of this decline is attributed to government stimulus, the increase in grocery and gas is notable.

In April, consumers continued to pull back on many nonessential purchases, including the decline in demand for nearly all nonedible categories, according to recent spending data provided through the IRI CPG Demand Index. In the most recent University of Michigan consumer sentiment readings, consumers indicated that they are less confident in their ability to absorb additional price increases; 40% view this as a bad time to make large household durable purchases.

Even with disposable income dollars above pre-pandemic levels, real disposable income has declined as inflation has eaten into discretionary dollars. Retail sales excluding food service, gas, building materials and motor vehicles declined each of the last two months, the first time this occurred since April and May 2021, according to U. S. Census Bureau data.

As these pricing pressures continue, consumers will most likely shift some buying preferences to more necessary and shelf-stable items, like frozen foods, pasta and private-label goods, to operate within established home budgets rather than spending on desirable goods.

As a result, consumer goods companies will need to rethink sales strategies to ensure they are providing value consumers are willing to spend on as a decline in sales volumes pressures companies to protect margins.