Equity compensation incentivizes employees with payments tied to the equity value of the employer. Stock options, in particular, give employees the right to purchase company stock at a specified price for a specific time period. Following the exercise of the option, the employee becomes a partial owner of the entity. Understanding how stock options work economically and are taxed will help you make informed decisions.

What is a stock option?

A stock option grants individuals (hereinafter referred to as “employees,” although certain options can be granted to non-employees) the right to purchase stock from a company at a stated price within a given timeframe. Employees acquire the optioned stock by paying the exercise price (also referred to as the “strike price”). Stock options allow employees to benefit from appreciation in the value of the company if the company’s value rises over the exercise price.

When an employee exercises a stock option, the employee becomes the legal owner of the stock on that date. The timing, type and amount of income inclusion depend on whether you receive an incentive stock option (ISO) or a nonqualified stock option (NSO).

What is an ISO?

An ISO is the right to purchase company stock according to a written plan designed to meet a number of requirements in section 422 of the Internal Revenue Code (Code). For economic and legal purposes, an ISO is essentially the same as a NSO (i.e., you are provided a right to purchase a certain number of shares at a stated price, and you will become the owner of those shares if you choose to exercise the options), but the tax consequences are different.

What are the tax consequences of ISOs to employees?

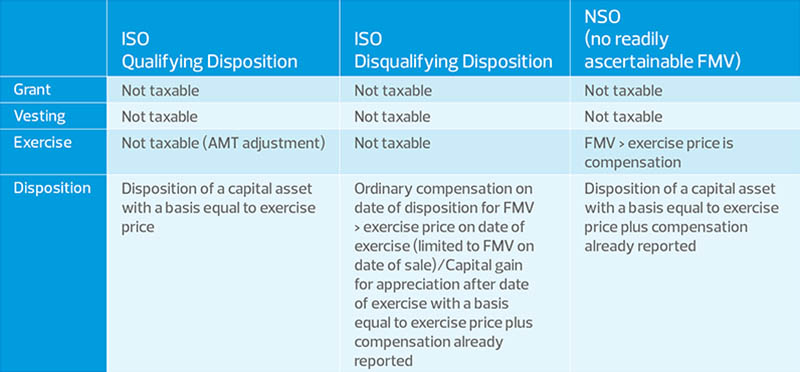

If the stock options are designed to meet all the ISO requirements, the following tax consequences should result:

- No income is reportable or includible at the time of the grant.

- No income is reportable or includible to the employee upon exercise of the option, except as noted below regarding the alternative minimum tax (AMT). Special rules apply upon a disqualifying disposition of the shares (see below), which may be concurrent with the exercise.

- The difference between the exercise price and the fair market value (FMV) of the stock at the time of exercise (i.e., the value spread) is an adjustment for AMT purposes and could cause the employee to become subject to the AMT.

- The employee’s basis in the ISO stock is equal to the amount paid upon exercise of the options. If the ISO stock is disposed of in a disqualifying disposition (see below), the basis of the stock is increased by the amount taxable as ordinary income due to such disposition.

- The holding period of the stock begins on the date of the exercise.

- If the stock received upon exercise of the ISO is held until a date that is 1) two years from the date the ISO was granted, and 2) one year from the date of exercise, any gain or loss upon disposition of the stock should result in capital gain or loss treatment, and there is no ordinary income.

- If the stock received upon exercise of the ISO is disposed of prior to the later of 1) more than two years after the ISO is granted, or 2) more than one year from the date of exercise, it is treated as a disqualifying disposition of the stock. In the case of a disqualifying disposition, the difference between the exercise price and the FMV of the stock on the date of exercise is considered ordinary income to the employee. However, if the value received by the employee upon disposition is less than the FMV on the date of exercise, the income recognized by the employee does not exceed the difference between the disposition price and the exercise price of the ISO stock. This income is taxable in the year of disposition of the stock. It should be noted that certain transfers of stock may not be considered dispositions for this purpose (e.g., the exchange of the ISO stock in a tax-free merger or reorganization transaction, a transfer incident to a divorce, a transfer from a decedent to his or her estate, or a transfer by bequest).