Lenders continue to digest the long-term implications of distress in the banking industry precipitated by the recent failures of Silicon Valley Bank, Signature Bank and now First Republic Bank as the fallout focus shifts to potential trouble spots.

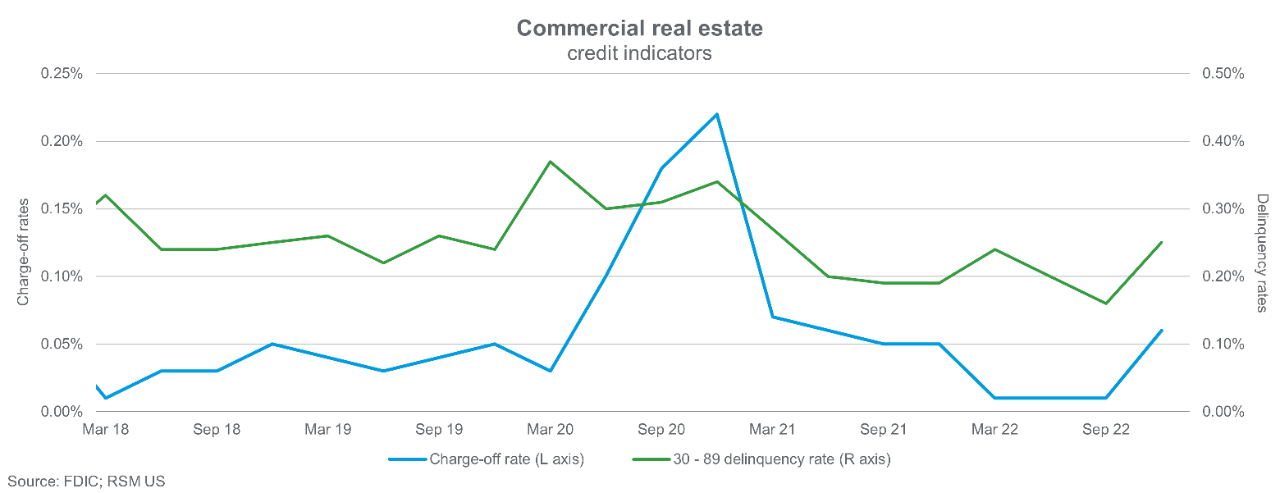

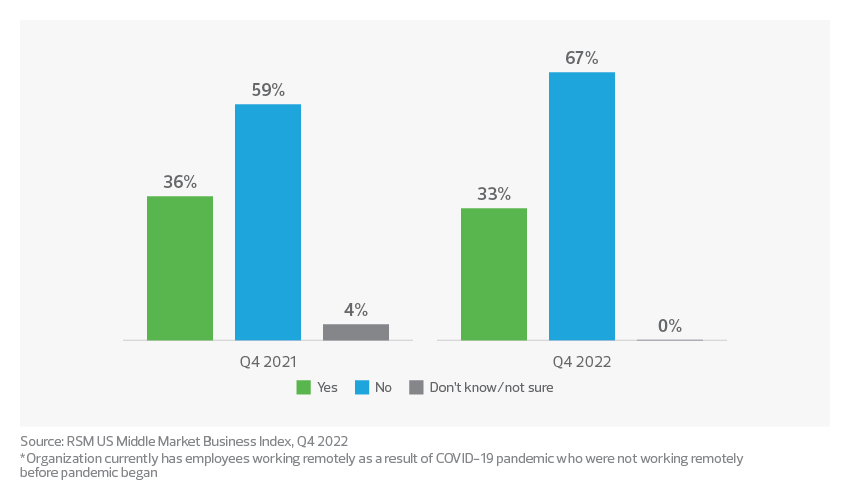

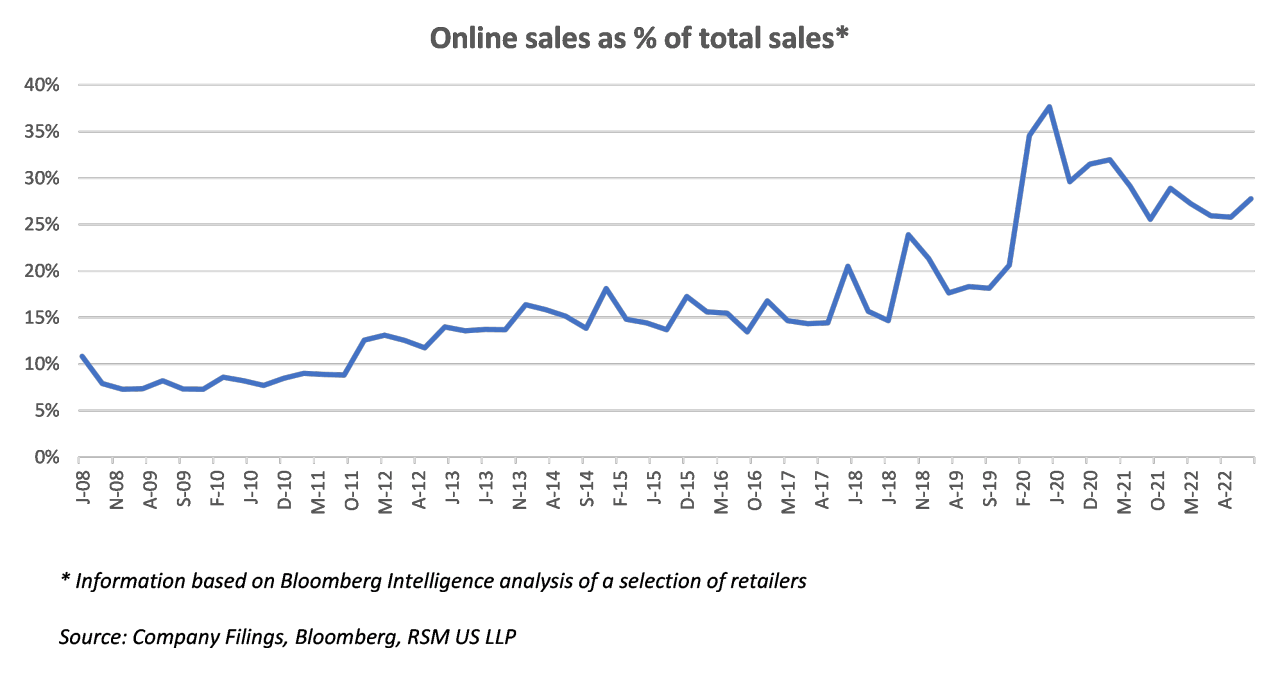

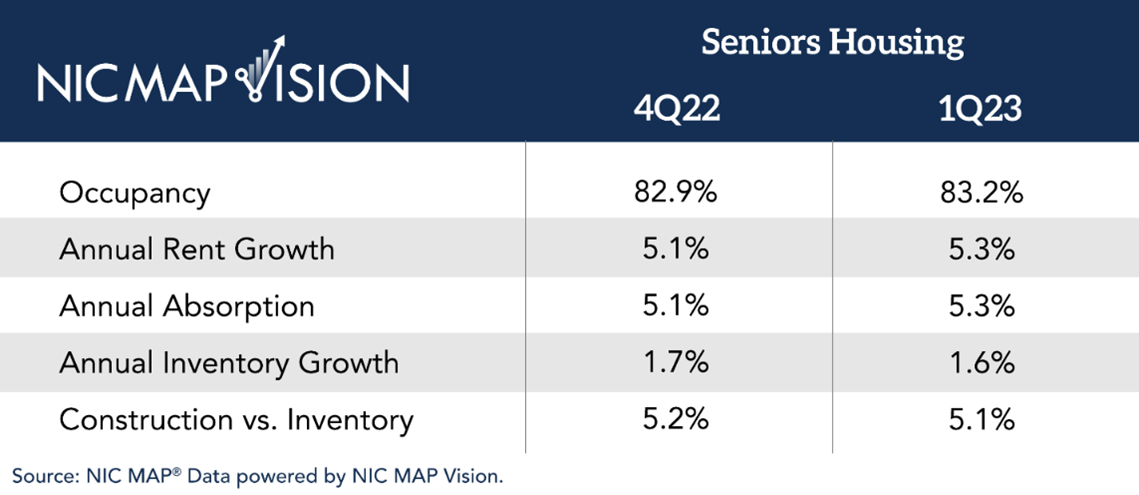

Signs point to increasing credit risk in commercial real estate loan portfolios, as recent skittishness around lending has compounded existing concerns. The CRE sector was already under pressure due to pandemic-induced trends such as the shift to remote and hybrid work that resulted in more unused commercial space, and Federal Reserve rate increases totaling 4.75% over the past year. Rate increases have made refinancing commercial property loans onerous, requiring a significant increase in debt or a capital contribution to support new loan-to-value ratios.

These trends mark a reversal from the positive environment for commercial real estate seen for most of the past decade. That environment was characterized by low interest rates and favorable market trends that fostered growth in CRE lending, especially at regional and community banks.