The economic outlook for biopharma in 2023 remains mixed.

Key takeaways

Many biopharmas have adequate cash on hand to continue weathering the storm and advancing their drugs through trials.

The demand for labor will remain strong, as will efforts to recruit data scientists and other specialists in competition with other tech sectors.

After two record years during the pandemic, 2022 was quiet, whether measured by IPOs, private capital raised, clinical trial starts or public sentiment toward the industry. Here we look at what we can expect in 2023—another quiet year in the doldrums, a return to record performance or something in between.

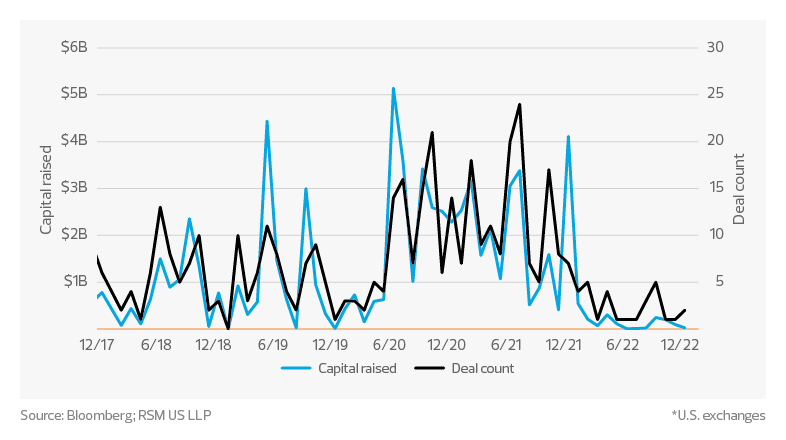

Life sciences IPO activity*

2022 was the slowest for IPOs in years. Although a small number of biotechs went public, it was a far cry from the two record years that came before, due to a number of reasons. Interest rates have risen quickly as the Federal Reserve attempts to beat back inflation, which makes risky assets like biotech stocks less appealing. Substantial volatility in the stock market also made the results of an offering less predictable. Finally, many companies are simply biding their time until the IPO market rebounds before attempting their own offering.

Unfortunately, at least the first half of 2023 will be much the same. With the Fed expected to raise interest rates through the first half of the year, substantial new offerings are unlikely during that period, and it is likely to be at least one to two quarters after the final hike before market performance picks up enough to lure companies looking to launch an IPO.

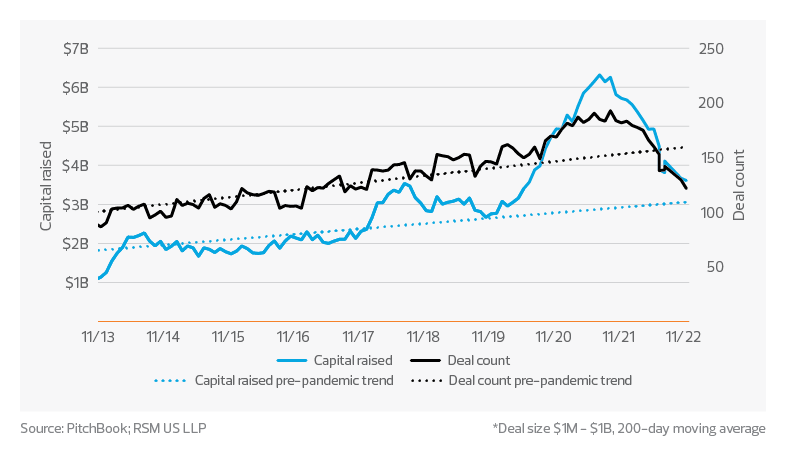

Life sciences private equity and venture capital investment*

The flow of private deals also slowed in 2022, for similar reasons. Although corporate balance sheets have ample cash to pay for acquisitions and private equity and venture capital funds are sitting on plenty of dry powder, deals have been hard to strike.

In 2020 and 2021, valuations for private biotechs increased due to both public enthusiasm for the space and the large number of deals struck. Now, companies and their investors are looking to ensure that their next raise is at a higher valuation than their last. However, funds and companies contemplating mergers and acquisitions are unwilling to pay the high multiples of prior years.

This impasse can’t last forever. Biotechs are watching their cash reserves burn down each month and will eventually have to raise capital again. VC and PE funds similarly don’t want their capital to sit idle. Finally, large biopharma companies are sitting on $93 billion in cash and will have substantial revenues from drugs coming off patent in the next two years. They will need M&As to refill their pipeline with drug candidates in late-stage trials.

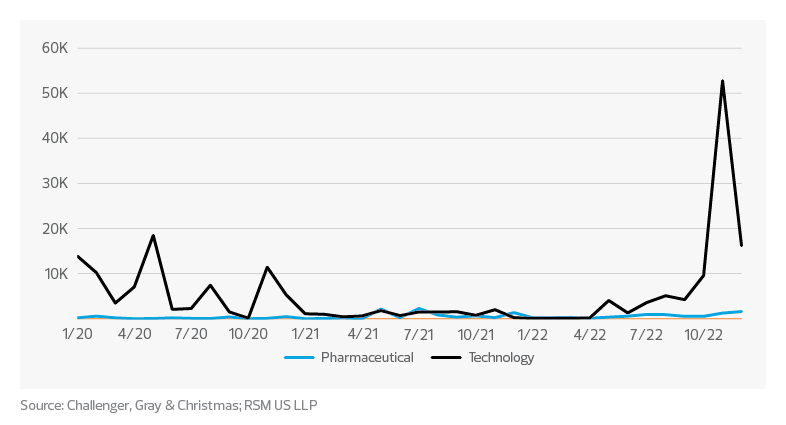

Layoffs in tech and pharma

One bright spot for the industry is the labor market. Despite substantial challenges in hiring and retaining top talent, the industry continues to expand its labor pool. This has been true throughout the pandemic, with employment levels dropping at the beginning of the pandemic but then rapidly recovering and returning to a strong pace of growth. Despite headlines about layoffs in specific biotechs, layoffs overall have not matched the sharp uptick seen in the broader technology industry.

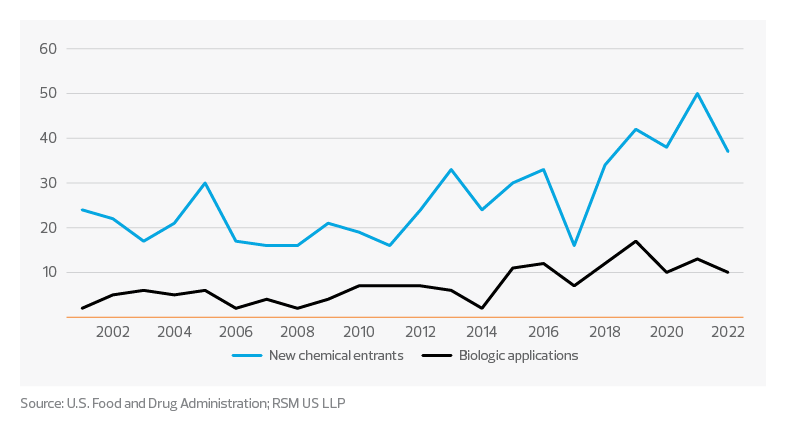

FDA new drug approvals

Drug approvals from the Food and Drug Administration were mixed in 2022. Biologics approvals matched totals of recent years, while small-molecule drugs showed a substantial decline. One driver of this decline is the FDA’s new expectation that a confirmatory trial must start and enroll patients before the agency will grant most accelerated approvals. This resulted in substantially fewer accelerated approvals in 2022, according to Evaluate Pharma.

The takeaway

Many companies have adequate cash on hand to continue weathering the storm and advancing their drugs through trials. We expect a continued strong demand for labor from biopharma companies, and with layoffs in other industries there will be opportunities to recruit data scientists and other specialists that would otherwise find work in tech. However, until the private and public markets become more accessible, new biotechs will struggle to form and companies running low on cash may find few good options.