Kimberly Bartok, Enterprise Public Relations Leader, kim.bartok@rsmus.com, 212.372.1239

for media use only

RSM US Middle Market Business Index Improves on Rising Revenues and Earnings

Firms report improving fundamentals, though views on the economy remain cautious

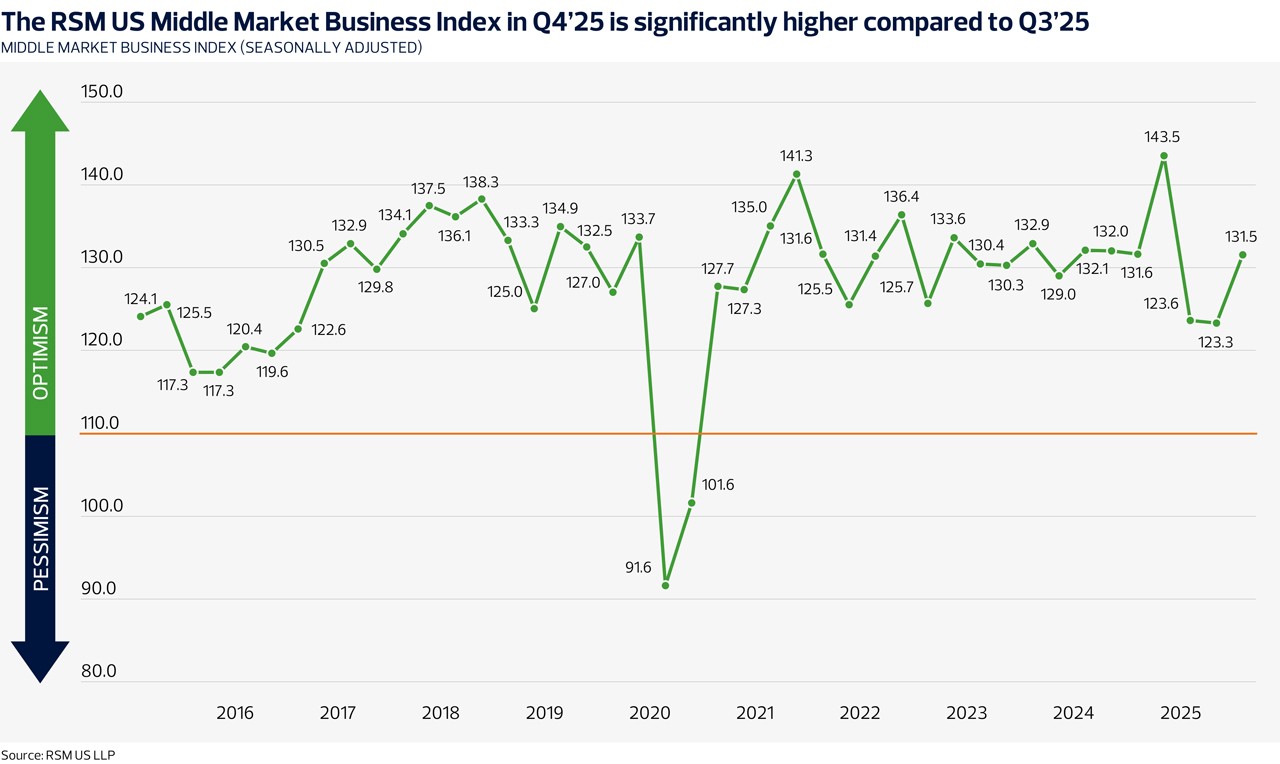

CHICAGO – (Dec. 16, 2025) – The RSM US Middle Market Business Index (MMBI), presented by RSM US LLP (“RSM”) in partnership with the U.S. Chamber of Commerce, rose to 131.5 in the fourth quarter from 123.3 in the prior period on a seasonally adjusted basis. The survey results are supported by rising revenues and earnings and reflect growing optimism among middle market firms, even as attitudes on the general economy remain sour.

The MMBI survey data indicates that the economy has experienced a moderate acceleration as middle market firms prepare for an environment of eased regulations, tax cuts, the retroactive full expensing of capital expenditures and lower interest rates. In the fourth quarter, 52% of respondents reported an increase in general revenues and 58% said they expect revenues to rise further over the next six months. Half of all respondents reported higher net earnings, while 56% expect that trend to continue in the first half of next year.

“This year has been characterized by twin policy shocks related to trade and immigration, yet the pop in the topline index points to a slight reacceleration as we close out 2025,” said Joe Brusuelas, chief economist with RSM US LLP. “Growth continues even as inflation persists, and retroactive full expensing should support further investment in the middle market. The first half of next year will show whether that momentum builds as firms benefit from expensing their capital outlays and other policy changes.”

Pricing Pressures Persist, Tempering Views on Current Economic Backdrop and Outlook

Despite optimism around revenues and earnings, executives’ views on the economy remained subdued. Only 38% of survey respondents said the economy improved in the current quarter, and 36% stated it had deteriorated. Looking ahead over the next six months, 46% of executives expect the economy to improve, while 32% anticipate it will weaken.

This general unease is reflected in executives’ responses to questions about pricing, which are indicative of inflation conditions. Middle market firms continue to grapple with pricing pressures, and with inflation hovering around 3.6% on a three-month annualized basis, it’s unsurprising that 71% of respondents reported a rise in prices paid. Seventy-two percent of survey participants said they expect to pay higher prices through the middle of next year. Similarly, 61% said they were able to pass costs along and 64% said they intend to raise prices over the next two quarters.

“Tax relief, eased regulations and new AI efficiencies are giving the economy a solid boost, which is critical in helping offset higher costs from tariffs," said Neil Bradley, executive vice president, chief policy officer and head of strategic advocacy at the U.S. Chamber of Commerce. "Profit margins are lifting as companies pass these costs on to customers, but so is inflationary pressure. Slower demand for labor will be something to watch amid a tight labor market that could stifle growth.”

Labor Demand Cools while Firms Increase CapEx

The slowing demand for labor in the middle market is evident in this quarter’s survey results. Only 40% of respondents reported they increased hiring in the current period, while 50% signaled an intent to do so through the middle of next year. Regarding compensation, 50% said they increased wages, and 55% stated they would lift compensation to attract labor in the coming months. A set of special questions in this quarter’s MMBI further explores workforce dynamics in the middle market, and RSM will publish that special report in January.

The survey data also showed that capital expenditures have rebounded slightly, driven by improved revenues and earnings expectations, in addition to the retroactive full expensing. Forty-eight percent of respondents stated they increased outlays in the current quarter and 53% said they anticipate doing so over the next six months.

The survey data that informs this index reading was gathered from 405 respondents at middle market firms in the United States from Oct. 1 to Oct. 22, 2025.

About the RSM US Middle Market Business Index

RSM US LLP and the U.S. Chamber of Commerce have partnered to present the RSM US Middle Market Business Index (MMBI). It is based on research of middle market firms conducted by Harris Poll, which began in the first quarter of 2015. The survey is conducted four times a year, in the first month of each quarter: January, April, July and October. The survey panel consists of approximately 1,600 middle market executives and is designed to accurately reflect conditions in the middle market.

Built in collaboration with Moody’s Analytics, the MMBI is borne out of the subset of questions in the survey that asks respondents to report the change in a variety of indicators. Respondents are asked a total of 20 questions patterned after those in other qualitative business surveys, such as those from the Institute of Supply Management and National Federation of Independent Businesses.

The 20 questions relate to changes in various measures of their business, such as revenues, profits, capital expenditures, hiring, employee compensation, prices paid, prices received and inventories. There are also questions that pertain to the economy and outlook, as well as to credit availability and borrowing. For 10 of the questions, respondents are asked to report the change from the previous quarter; for the other 10 they are asked to state the likely direction of these same indicators six months ahead.

The responses to each question are reported as diffusion indexes. The MMBI is a composite index computed as an equal weighted sum of the diffusion indexes for 10 survey questions plus 100 to keep the MMBI from becoming negative. A reading above 100 for the MMBI indicates that the middle market is generally expanding; below 100 indicates that it is generally contracting. The distance from 100 is indicative of the strength of the expansion or contraction.

About The U.S. Chamber of Commerce

The U.S. Chamber of Commerce is the world’s largest business organization representing companies of all sizes across every sector of the economy. Members range from the small businesses and local chambers of commerce that line the Main Streets of America to leading industry associations and large corporations.

They all share one thing: They count on the U.S. Chamber to be their voice in Washington, across the country, and around the world. For more than 100 years, we have advocated for pro-business policies that help businesses create jobs and grow our economy.

About RSM US LLP

RSM empowers middle market companies worldwide to take charge of change. The clients we serve are the engine of global commerce and economic growth. Our unique middle market perspective makes RSM the natural choice for growth-oriented, internationally active organizations seeking relevant insights and tailored, innovative solutions for a complex and changing world. With a global reach spanning more than 120 countries, we instill confidence in a world of change by bringing the full power of RSM to make a lasting impact on our clients, colleagues and communities. For more information, visit rsmus.com, like us on Facebook and/or connect with us on LinkedIn.