Kimberly Bartok, Enterprise Public Relations Leader, kim.bartok@rsmus.com, 212.372.1239

for media use only

RSM US Middle Market Business Index Highlights Solid Business Conditions and Optimistic Outlook

Firms continue productivity-boosting investments amidst hiring slowdown

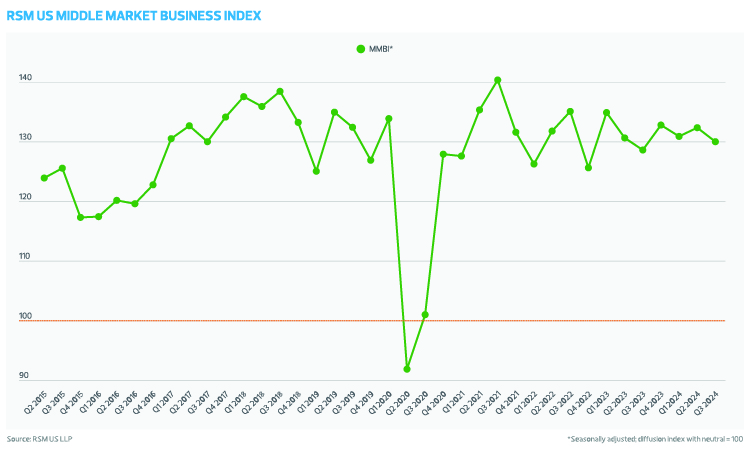

CHICAGO – (September 12, 2024) – The RSM US Middle Market Business Index (MMBI), presented by RSM US LLP (“RSM”) in partnership with the U.S. Chamber of Commerce, eased slightly to 130.0 in the third quarter from 132.3 in the prior period on a seasonally adjusted basis. The MMBI survey results reflect solid economic and business conditions in the middle market, with large majorities of respondents expressing optimism about improvements in the economy, revenues and earnings for the remainder of 2024.

“Despite noise around a potential end to the current business cycle as growth, hiring and inflation cool, the third-quarter survey of middle market firms implies a sustained period of solid growth within what appears to be a quickly evolving and dynamic portion of the American economy,” said Joe Brusuelas, chief economist with RSM US LLP. “We are optimistic that as interest rates and financial costs ease, we’ll see the release of pent-up demand in business investment and improved revenues and net earnings. Executives that remain stuck in the doom-and-gloom crew are likely to miss a golden opportunity to expand the prospects of their firms.”

Optimistic Outlook Despite Discontentment with Pricing Levels

The MMBI survey results captured a strong sense of forward-looking optimism among middle market executives, but displeasure with the permanent increase in price levels presents an ongoing source of tension for firms. Only 38% of executives said the economy improved during the third quarter and 34% said it remained unchanged. In contrast, 57% of participants said they expect the economy to improve during the final months of 2024 and into the first quarter of 2025.

Middle market executives continued to report strong financial performance in the third quarter, with 45% noting improvement in revenues and 40% indicating net earnings increased. Looking ahead over the next six months, 65% of participants said they expect further revenue gains and 64% expect continued net earnings growth.

Unsurprisingly, 65% of survey participants noted an increase in prices paid in the current quarter, and 67% said they expect to pay more going forward. Similarly, 49% said they had passed along some of those price increases downstream, while 63% said they will over the next six months.

“American businesses are bullish on the economy and the future. Now, we need our elected officials to match that optimism with policies that will support and accelerate economic growth,” said Neil Bradley, executive vice president and chief policy officer at the U.S. Chamber of Commerce. “Through the November elections and beyond, the U.S. Chamber is outlining policies that would ensure at least 3% annual real economic growth over the next decade.”

Capital Expenditures Remain Strong as Hiring Cools

Supported by sustained improvement in revenues and earnings, the survey found that 44% of middle market firms increased capital outlays in the third quarter and 55% of participants said they intend to over the next six months. As the Federal Reserve begins its policy pivot toward lower interest rates, RSM will monitor the release of pent-up demand among firms looking to purchase a greater quantity of equipment, software and intellectual property.

Interestingly, the third-quarter survey also recorded a notable slowdown in hiring. Only 36% of respondents stated they increased their hiring pace. Fifty-four percent of executives said they expect to hire more individuals going forward, but RSM estimates this increase may not materialize because firms are hoarding labor at higher costs and are likely reaping the rewards of a three-year period of fixed business investment in technology that is bolstering productivity.

Underscoring labor costs, 46% of survey participants indicated they increased compensation to attract labor and 62% said they anticipate doing so going forward. The MMBI report notes that as past capital expenditures bear yields, the result should be slower wage growth and profit margin expansion.

The survey data that informs this index reading was gathered from 404 respondents between July 8 and July 26, 2024.

About the RSM US Middle Market Business Index

RSM US LLP and the U.S. Chamber of Commerce have partnered to present the RSM US Middle Market Business Index (MMBI). It is based on research of middle market firms conducted by Harris Poll, which began in the first quarter of 2015. The survey is conducted four times a year, in the first month of each quarter: January, April, July and October. The survey panel consists of approximately 1,600 middle market executives and is designed to accurately reflect conditions in the middle market.

Built in collaboration with Moody’s Analytics, the MMBI is borne out of the subset of questions in the survey that asks respondents to report the change in a variety of indicators. Respondents are asked a total of 20 questions patterned after those in other qualitative business surveys, such as those from the Institute of Supply Management and National Federation of Independent Businesses.

The 20 questions relate to changes in various measures of their business, such as revenues, profits, capital expenditures, hiring, employee compensation, prices paid, prices received and inventories. There are also questions that pertain to the economy and outlook, as well as to credit availability and borrowing. For 10 of the questions, respondents are asked to report the change from the previous quarter; for the other 10 they are asked to state the likely direction of these same indicators six months ahead.

The responses to each question are reported as diffusion indexes. The MMBI is a composite index computed as an equal weighted sum of the diffusion indexes for 10 survey questions plus 100 to keep the MMBI from becoming negative. A reading above 100 for the MMBI indicates that the middle market is generally expanding; below 100 indicates that it is generally contracting. The distance from 100 is indicative of the strength of the expansion or contraction.

About The U.S. Chamber of Commerce

The U.S. Chamber of Commerce is the world’s largest business organization representing companies of all sizes across every sector of the economy. Members range from the small businesses and local chambers of commerce that line the Main Streets of America to leading industry associations and large corporations.

They all share one thing: They count on the U.S. Chamber to be their voice in Washington, across the country, and around the world. For more than 100 years, we have advocated for pro-business policies that help businesses create jobs and grow our economy.

About RSM US LLP

RSM empowers middle market companies worldwide to take charge of change. The clients we serve are the engine of global commerce and economic growth. Our unique middle market perspective makes RSM the natural choice for growth-oriented, internationally active organizations seeking relevant insights and tailored, innovative solutions for a complex and changing world. With a global reach spanning more than 120 countries, we instill confidence in a world of change by bringing the full power of RSM to make a lasting impact on our clients, colleagues and communities. For more information, visit rsmus.com, like us on Facebook and/or connect with us on LinkedIn.