On Aug. 25, 2022, the Securities and Exchange Commission adopted amendments to its rules to require registrants to disclose information reflecting the relationship between executive compensation actually paid by a registrant and the registrant’s financial performance. The rules implement a requirement mandated by the Dodd-Frank Act.

The new pay-versus-performance rules expand existing rules by requiring registrants to disclose how the compensation actually paid to principal executive officers (PEOs) and named executive officers (NEOs) over the previous five fiscal years relates to the financial performance of the registrant and its peers over that period.

Who is affected?

Disclosure rules apply to all reporting companies other than foreign private issuers, registered investment companies and emerging growth companies. Smaller reporting companies will be subject to scaled-back disclosure requirements.

When is this effective?

The new rules will apply to any proxy and information statement where shareholders are voting on directors or executive compensation that is filed in respect of a fiscal year ending on or after Dec. 16, 2022. Most registrants that are subject to the new rules will be required to include the new disclosure in their 2023 proxy statements.

What is required to be disclosed?

There are three new elements of disclosure:

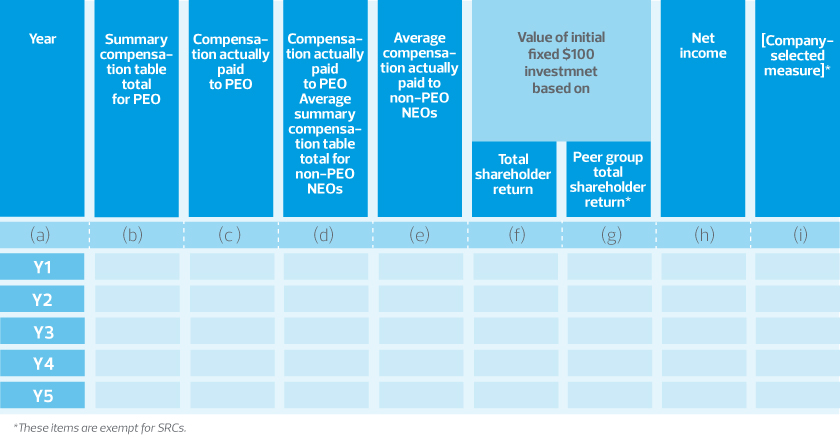

1. Prescribed tabular disclosure: Tabular disclosure of total compensation for the PEO and the average for the other NEOs for the five most recently completed fiscal years.

In the first year of disclosure, only three fiscal years will be required in the table, with an additional fiscal year added in each of the following two annual proxy filings (i.e., year one includes three years of disclosure, year two would include four years of disclosure, and year three and subsequent years would require five years of disclosure). For small reporting companies (SRCs), the initial disclosure will include two fiscal years with an additional fiscal year added in the subsequent annual proxy filings.

The rules require the following tabular disclosure: