Enterprise governance helps steward a family legacy across transitions and generations.

Key takeaways

Three branches of governance coexist to fuel a virtuous cycle of capital, confidence and loyalty

Establishing governance requires a clear set of rules for participation and communication.

Entrepreneurs and wealth creators work tirelessly to build something enduring, whether that’s a successful business, meaningful societal impact or personal fulfillment. Over time, these pursuits often converge into a shared family legacy. But sustaining that legacy across generations is a different challenge, one that comes sharply into focus during moments of transition, such as shifts in ownership and control, changes in leadership responsibilities, evolving family roles, or adjustments to the family’s capital structure.

How can families navigate these inflection points while staying true to what matters most to them? Effective governance is the key.

Family enterprise governance provides a framework to steward what families have built—their assets, as well as their shared vision, values, identity and unity—during transitions and across generations. While governance is often assumed to consist only of a set of documents, meetings or rules, it is actually a living, breathing system that, when properly designed, keeps families strategically aligned and emotionally and culturally connected. This ensures family priorities are honored and protections are maintained as the family and the enterprise evolve.

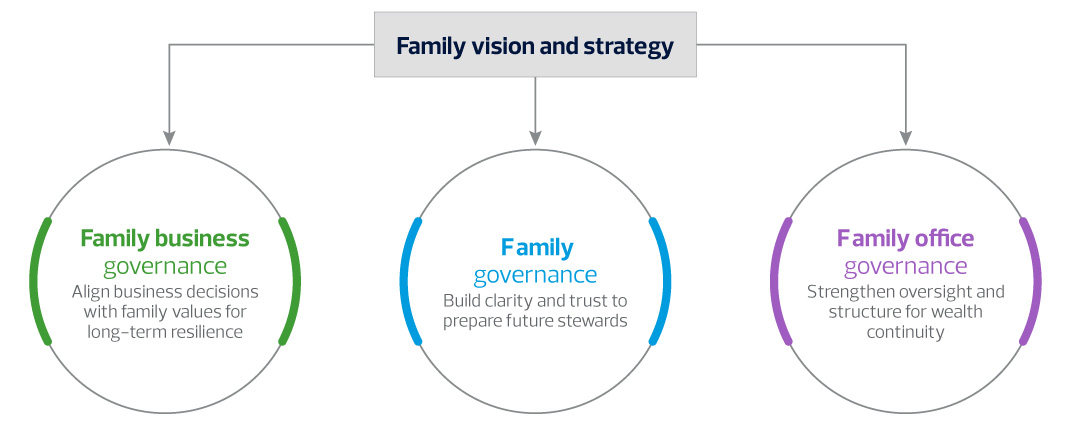

3 branches of governance ensure unity around vision, operations and wealth

Family enterprise governance is made up of three distinct but connected branches that provide a unified framework for meaningful oversight:

- Family governance is always at the center of the family enterprise and determines how the family organizes, communicates and makes collective decisions. It anchors the enterprise in a shared mission, vision and values; provides “patient capital,” or support that prioritizes long-term success over quick returns; and establishes a platform for family development and affinity/engagement with the family office.

- Family business governance enables oversight of the family’s operating business(es), ensuring they are well managed, strategy-focused and positioned to thrive into the future. It delivers operational confidence, fosters alignment between ownership and management, and provides a framework for sustained value creation.

- Family office governance establishes the framework for managing the family’s wealth and affairs to ensure long-term prosperity and alignment with family values. It encompasses investment management; financial, tax and estate planning; and philanthropic and family lifestyle endeavors—aligning pooled resources with shared goals and values to deliver greater impact, efficiency and cohesion.

Effective governance supports ongoing investment, confidence and engagement

The three branches of governance create a virtuous cycle: patient capital invested in the business; operational confidence for effective management of both the business and the family office; and cohesion through a shared connection, vision and purpose that keeps family members invested emotionally as well as financially.

Of course, achieving this harmony is no small feat. Effective governance across the family enterprise requires a significant commitment of time, resources and discipline, and maintaining it is an ongoing effort.

Governance works best when families invest the effort to establish and maintain a strong foundation based on the following seven criteria:

- Authentic engagement and empowerment. Family members should participate in governance because they’re genuinely invested in the success of the business—not out of obligation. Personal connections among family members, family pride and a genuine desire to preserve the legacy are key. Individuals also need to feel that their contributions have a positive impact. Develop engagement opportunities beyond formal meetings, like shared philanthropy or learning initiatives that connect values to action and reinforce belonging.

- Clear roles and lines of authority for family, family office and business responsibilities. Ambiguity undermines trust. Families need clarity on who holds decision-making power versus advisory influence, especially when individuals wear multiple hats. Decision rights should be distributed fairly across generations and other dimensions to reflect the diverse perspectives of all family members, not just the opinions of the current leaders. Create visual maps of roles and clearly defined mandates for councils or committees to help ensure transparency and meaningful participation.

- Effective communication. No one wants to be inundated with meetings and reports, but positive engagement demands timely, accurate information. Effective communication requires the right distribution cadence, ground rules and format tailored to the preferences of each generation and stakeholder group. Pair written briefings with interactive sessions or forums to enhance understanding. Share information regularly and reliably to build trust and reduce rumors and confusion; avoid hoarding information, and ensure it is disseminated quickly and clearly.

- Structured conflict resolution. Disagreements are inevitable. What matters is having a consistent, agreed-upon process to address them, whether through facilitated dialogue, escalation protocols or the involvement of a trusted elder. Embed these mechanisms into the governance framework to help depersonalize tough conversations and prevent long-term damage to relationships, trust and family unity.

- Clear entry and exit paths. Rising leaders need clear paths to contribute and grow, while current leaders need support to gradually and purposefully transition from decision making to mentorship with grace and dignity. Establish tenure expectations and mentoring plans early to ensure smooth succession and mutual respect across generations. Understanding each other’s paths facilitates governance and strengthens family unity.

- Periodic reviews. Every generation will redefine governance to some degree as the family and the enterprise evolve. However, establishing a framework and mechanisms for when and how to make updates can help preserve the foundational vision. Plan regular (at least annual) reviews of the enterprise mission, strategy and operations to ensure alignment with both family values and external realities. Schedule regular governance health checks, ideally led by a neutral third party, to help keep governance relevant and forward-looking.

- Independent perspectives. Independent, nonfamily voices can bring valuable outside perspectives and expertise, helping families see issues through different lenses and consider new approaches and information. Independent directors or external advisors can offer input that enriches decision making without replacing family judgment. Reassign independent roles periodically, assessing fit to maintain trust and value.

Protecting what matters starts with defining what matters

Because family enterprise governance is ultimately about stewarding a family’s legacy, the family must define that legacy’s foundation and align all generations around a mutual understanding of it. Shared values and a common mission and vision must underpin the strategies for both business governance and family office governance so that these branches reflect and support the family’s goals and objectives.