Project

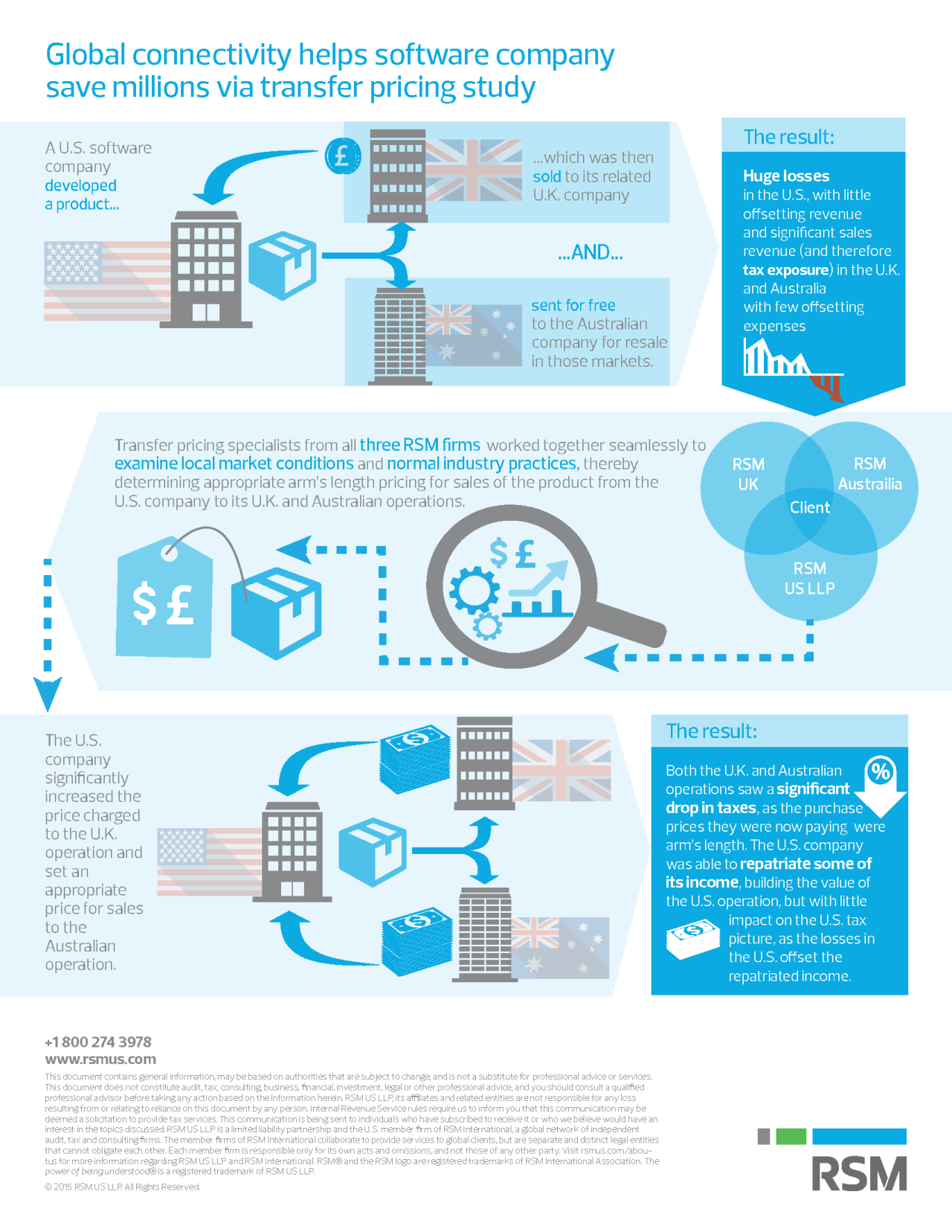

During the discovery process, RSM’s international tax team quickly assessed the company’s scenario and identified several areas of concern. Thanks to close working relationships with RSM’s international network, the U.S. team was able to get the U.K. firm on the phone immediately to participate in the conversation.

It was this collaborative team approach that convinced the company that RSM was right for them. Throughout the company’s previous experience with a large global accounting firm, no one had ever connected them with international service providers so seamlessly.

RSM’s international tax team balanced the profits of the software entity between the three countries to achieve a more even approach to tax liability in those jurisdictions. The delivery of the final product took place at the company’s annual meeting in the U.K., with all three affiliate firms participating in the project delivery.

Outcomes

As a result of the RSM team’s deep knowledge of transfer pricing regulations, the project saved the software company more than $2 million in tax. The investors in this company were pleased not only with the tax savings but also with the integrated global approach exhibited by the RSM team while working through this four-month analytical exercise. Following the sale of the software company, its investors engaged RSM to handle their tax compliance projects at another venture investment.