The emergence of chatbot programs is driving increased interest in AI tools and solutions.

Key takeaways

AI can help companies control costs and extract more value from systems and supply chains.

The barrier to entry is lower, and the middle market can access the power of many platforms.

The acceptance of AI-related tools has accelerated significantly, driven by the emergence of chatbot programs with advanced language processing capabilities. Middle market companies will have extensive opportunities to optimize and enhance existing processes with the help of AI. Imagine if overnight every person in your office or on your team were exponentially more proficient with the Microsoft Office suite than the most capable person you’ve ever met. How would it affect productivity, work-life balance, morale and, of course, profit margin? Natural language processing advancements mark a huge step toward shrinking the digital divide.

Over the past five years, the adoption and application of AI has largely been quiet and driven by cost savings pressures or the quest for a competitive advantage. Mobile map applications haven’t broadcast their use of AI, but they routinely use it to suggest how users can save time by taking an alternate route. The integration of AI into end-user-facing applications has been more subtle, and the value derived has historically manifested through growing user counts and platform traffic.

TAX TREND: Software development

Technology companies that spend significant sums on research or software development likely are affected by the unfavorable change in the required tax treatment of R&D expenses. Businesses might minimize this burden by analyzing their costs to ensure proper treatment and carve out those that may not require capitalization under the new law. Once they identify and quantify their R&D costs, they may find they are eligible for an R&D tax credit or other incentives.

However, in the first few months of 2023, AI seems to have emerged from the shadows and grown to become a focal point worthy of marketing. Everyone is talking about AI, and talking about it a lot. According to Bloomberg, in the first quarter of 2023, news articles written on AI were more prevalent than those about the metaverse, EV batteries and blockchain technology combined. AI has also grown to be a more popular article topic than semiconductors, which is noteworthy coming on the heels of an unprecedented semiconductor shortage. To some extent, the broader sentiment around AI appears to have transformed from Terminator to an anticipated future prerequisite for doing business.

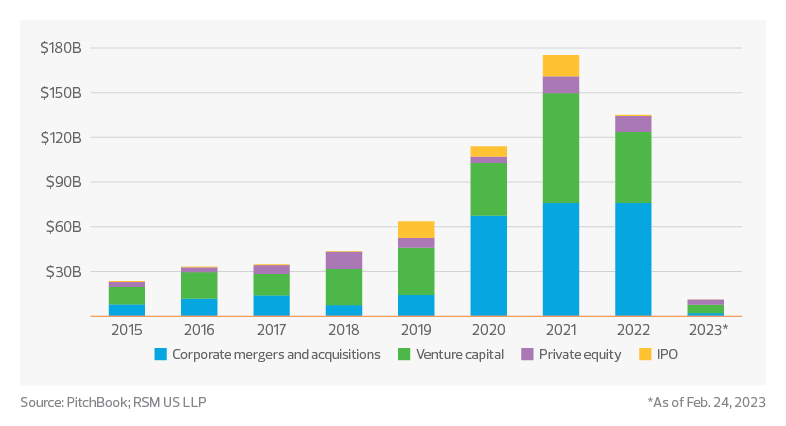

With all the attention around AI, one might expect investment in the space to be somewhat equitable across the various investor classes. However, according to PitchBook data, private equity has yet to open its coffers to emerging tech, which attracted less than 10% of capital invested over the past four years. As these innovative AI companies grow, they tend to be targeted by large corporate buyers that fold them into an existing service offering or scale their technology for offerings to larger markets. The tech is so new that perhaps the lack of private equity investment is driven by the current life-cycle stage of many AI companies.

Capital raised by North American artificial intelligence companies

Breakthroughs in AI are so significant that they’ve captured the attention of boardrooms across corporate America, beyond just the technology space—though technology and communication companies are talking about it the most.

Why is AI receiving so much more attention than other digital technologies? The short answer is timing, and it could not be better for the unveiling of a next-generation cost-saving, labor-reducing technology. The pandemic and related fallout have catapulted the U.S. tech sector into a period of uncertainty. This has resulted in volatility and cooled the tech investment environment just when many middle market tech companies are battling margin pressures and fighting to preserve attractive valuations achieved in 2020 and 2021. At a time when almost every measure of tech-related deal activity is down, middle market tech companies need to keep costs under control and extract as much value from systems and supply chains as possible to remain competitive and viable.

TAX TREND: Sell-side diligence

The new required tax treatment of R&D expenses is also affecting M&A by worsening the tax posture of targets. Transaction planning that includes R&D cost analyses may enable deals to proceed by reducing the cash tax rate. However, the utilization of favorable tax attributes, such as net operating losses, may be limited by a change in ownership, which must be taken into account.

Microsoft CEO Satya Nadella, in a recent Bloomberg Technology podcast, spoke about how the current generation of AI built into search engines, social media and streamers represents what he referred to as “autopilot.” “It dictates how our attention is focused,” he said. Examples include the recommendations from your favorite streaming service and the route suggestions from map applications.

The next generation of AI, Nadella said, represents a shift from autopilot to copilot, allowing us to program AI with “natural language.” He added that, after more than 30 years of upgrades in the Microsoft Office suite, the average user barely scratches the surface of the software’s capability. Natural language capabilities will help all users, not just savants, realize significantly more value by providing an easier way to access the power of the tools.

The middle market stands to gain both directly and indirectly from natural language advancements as the barriers to entry are lowered and middle market workforces can extract more value from technology tools and systems already in use. The door has been opened wider for enterprise adoption, allowing for faster uptick and a quicker return. There will undoubtedly be a cost to customers, but like any value proposition, it’s expected to provide a net benefit. Use cases similar to Microsoft Office can be expected across a wide range of enterprise technology tools and systems. The greatest variable continues to be timing. Companies will have to determine whether they will wait for this wave of natural language AI to wash over them, or paddle out and surf the wave in.