This article was updated on Sept. 11, 2024, to clarify structuring options for hotel or health care assets owned by a REIT.

What is a TRS?

A taxable REIT subsidiary (“TRS”) is a corporation that is owned directly or indirectly by a REIT and has jointly elected with the REIT to be treated as a TRS for tax purposes. A TRS is subject to regular corporate income tax which, pursuant to the Tax Cuts and Jobs Act (TCJA), is now a flat tax rate of 21%.

By way of background, the TRS was introduced by the Tax Relief Extension Act of 1999 to provide REITs with additional flexibility. Since a REITs income must be primarily from passive real estate investments, the TRS was created to perform activities that cannot be performed directly by the REIT without jeopardizing REIT status. Almost two decades after the introduction of the TRS, these corporations are now commonly embedded in REIT structures.

Why might a TRS be a desirable, or necessary, addition to an existing REIT structure?

As discussed in our prior article, a REIT can serve as a tax-efficient investment vehicle as long as it abides by strict compliance rules. In certain situations, a REIT may need a TRS in order to acquire a desired investment or perform certain tenant services without running afoul of the REIT restrictions.

A REIT may use a TRS to hold assets that it cannot or does not want to hold itself. For example, if the REIT wants to acquire a portfolio of properties but a handful of those properties are not a good long-term fit for the REIT, a TRS can acquire those assets with the intent to sell without running the risk of being subject to the REIT prohibited transaction tax (see prior article). It is important to note that no more than 20% of a REIT’s total assets may be represented by securities of one or more TRSs.

In addition to creating a TRS to hold certain assets, REITs may create a TRS to manage impermissible tenant service income. For purposes of the REIT’s annual income test, rents from real property generally include: basic rents for use of real property, charges for services customarily furnished in connection with rental real property and rent attributable to personal property (subject to applicable limitations). Typical and customary services generally include but are not limited to services such as utilities, security services, trash service, sprinkler/fire safety, common area cleaning, and application fees. Impermissible tenant service income includes receipts for services that are not typical and customary. Depending on the applicable market and asset class, examples of non-customary services may include: maid service, valet parking, childcare centers, personal training, food service operations or catering, and car wash/detailing. While a REIT is generally prohibited from performing such services, a TRS is generally allowed to perform these services and pay tax on any net income. Nonetheless, service-related fees paid by a REIT tenant to the TRS must be arm’s-length, or the REIT could find itself subject to a 100% penalty tax. Specifically, a REIT is subject to a tax equal to 100% of redetermined rents, redetermined deductions, excess interest and redetermined TRS service income. A REIT has several safe harbor provisions at its disposal to help mitigate penalty tax exposure.

Benefits of a TRS when acquiring hotel or health care assets?

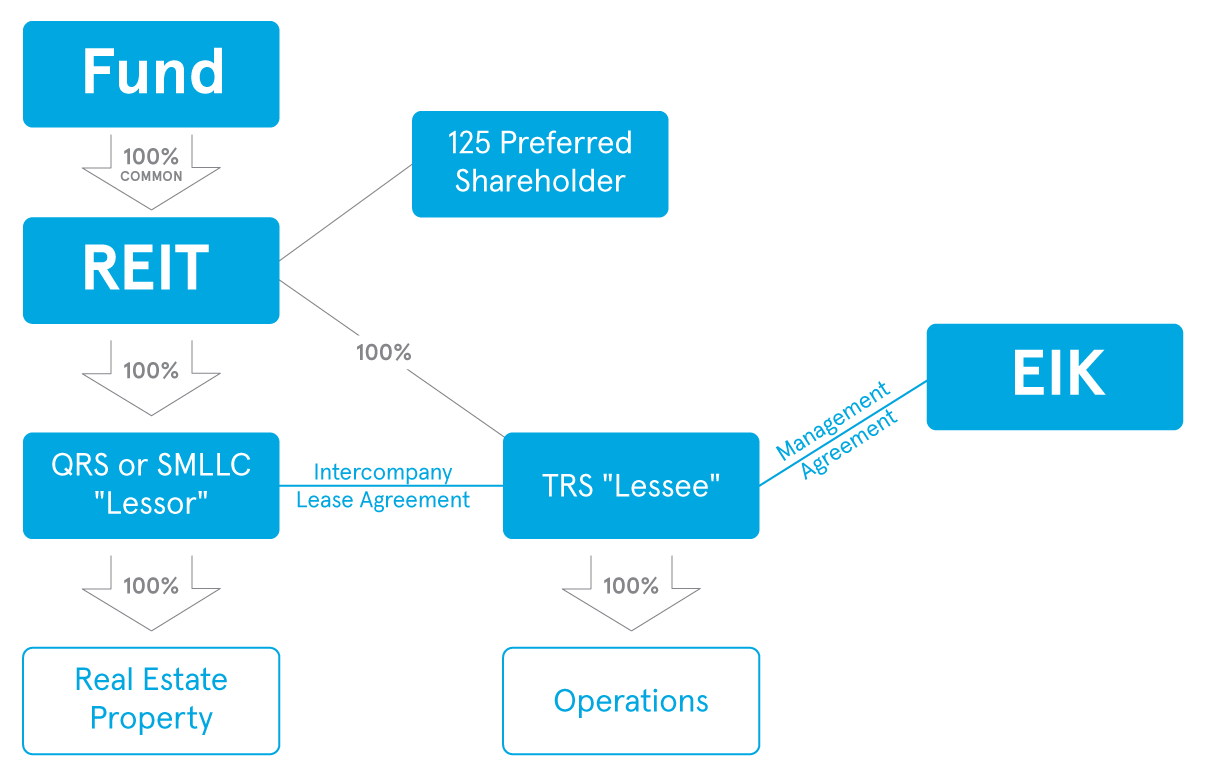

Based on the inherent level of services provided and operating nature of a hotel or health care asset, a REIT is generally prohibited from operating a hotel or health care facility. A REIT may own a hotel or health care asset if it leases the property to a third party or leases the property to a TRS (or its subsidiary), which engages an eligible independent contractor (EIK) to operate the property as described further below. For the avoidance of doubt, it should be noted that a TRS cannot directly or indirectly operate a hotel or health care asset without losing its TRS status. In order to avoid this detrimental result (which would likely cause the REIT to fail its security tests) the hotel and health care assets should be managed as follows:

- Health care and hotel facilities cannot be leased to a TRS unless an EIK is engaged by the TRS to manage the property. An EIK must not only satisfy the general independent contractor (IK) requirements, but must also be in the business of managing unrelated health care or hotel properties. While it is clear that the management of one unrelated property would not suffice, there is no “bright line” for how many properties are required. For large, diversified operators, there may be no cause for concern, but certain situations involving a limited number of unrelated properties may warrant a deep dive on the applicable facts and circumstances.

- Due to the potential for tax arbitrage between the nontaxable REIT and its taxable TRS, proper diligence should be done to ensure these intercompany lease arrangements reflect arms-length terms. In a worst-case scenario, if the terms are not considered arms-length, the REIT could find itself subject to a 100% tax as described above. In light of the potential for such a severe consequence, a best practice typically involves the REIT engaging a transfer pricing specialist to evaluate the economics of the intercompany lease terms to ensure those terms are in line with other comparable 3rd party arrangements. The results of such an analysis are generally memorialized in a transfer pricing study report, which provides support for the rent structure papered in the lease. RSM has dedicated transfer pricing specialists who understand the nuances of hotel and health care property lease arrangements. Note that the transfer pricing considerations discussed above are not limited to intercompany lease arrangements and can apply to a variety of intercompany payments between the REIT and the TRS.

Sample REIT/TRS hotel structure

Who can make a TRS election?

A corporation whose stock is owned directly or indirectly by a REIT may be eligible to make a TRS election. While a REIT can own 100% of the TRS stock, sole ownership is not a requirement. In fact, a REIT just has to own at least one share of corporate stock in order to move forward with a TRS election. Of course, this assumes the corporation is not otherwise disqualified (for reasons previously discussed).

How do I make a TRS election?

To make a TRS election, a REIT and a corporation that is either partially or wholly owned by the REIT, file a joint election via Form 8875. The effective date of the election cannot be more than 2 months and 15 days before the election is filed or more than 12 months after the date the election is filed. Extensions may be granted if the TRS entity acted reasonably and in good faith, but the related process can be costly and time consuming and should only be considered as a last result. Furthermore, if a TRS acquires more than 35%, by vote or value, of the stock of another corporation, the acquired corporation is also considered a TRS and the REIT and existing TRS should file an updated copy of Form 8875 to include the new subsidiary TRS. The TRS election is generally irrevocable unless written consent is provided by both the REIT and TRS via the filing of a “revocation” Form 8875.

Note that the TRS entity is often formed as a state law limited liability company (LLC). By default, a wholly owned LLC is treated as a disregarded entity for federal income tax purposes, unless it files a “check-the-box” election via Form 8832 to be taxed as a corporation. As such, an LLC that intends to be a TRS must also timely file Form 8832 (no later than 75 days after the desired effective date of the election).

Is a TRS the same as a qualified REIT subsidiary (“QRS”)?

In short – no. While both a TRS and QRS can be a wholly owned subsidiary of a REIT, the similarities generally end there (at least for tax purposes). As discussed above, a TRS is subject to regular corporate income tax. A QRS, on the other hand, is a corporation that is always wholly owned by the REIT and is disregarded for federal income tax purposes. Thus, the QRS is not separately subject to federal income tax. Moreover, it is worth noting that the direct attributes (assets, liabilities, income, deductions, etc.) of the QRS are deemed to be owned by the REIT for tax purposes, and therefore, merit consideration for purposes of the REIT’s quarterly asset and annual income tests.

A TRS sounds promising – where do I go from here?

With the increasing popularity of REITs and based on the increasingly service-oriented nature of the real estate assets, a TRS can be an effective structuring option to ensure a REIT maintains its REIT status. Any taxpayer considering the implementation of a REIT structure should consult with a trusted REIT tax specialist who is familiar with the nuances of the various qualification requirements for a REIT and its TRSs.