Recent ratings would indicate that the NFL is more popular than ever.

Key takeaways

Private equity investors will be limited to a 10% stake of a team’s equity.

One of the top operational challenges for most teams is managing cash flow.

Just days before the 2024 season kicked off, the National Football League voted to allow private equity investment in team ownership, joining several other major North American sports leagues that have opened their doors to such investors in the past five years.

The NFL is rolling out the private equity offering cautiously, with several requirements for potential investors. With the NFL hitting nearly $13 billion in revenue in 2023, institutional investors may now be asking themselves if sports team ownership makes sense.

Soaring valuations

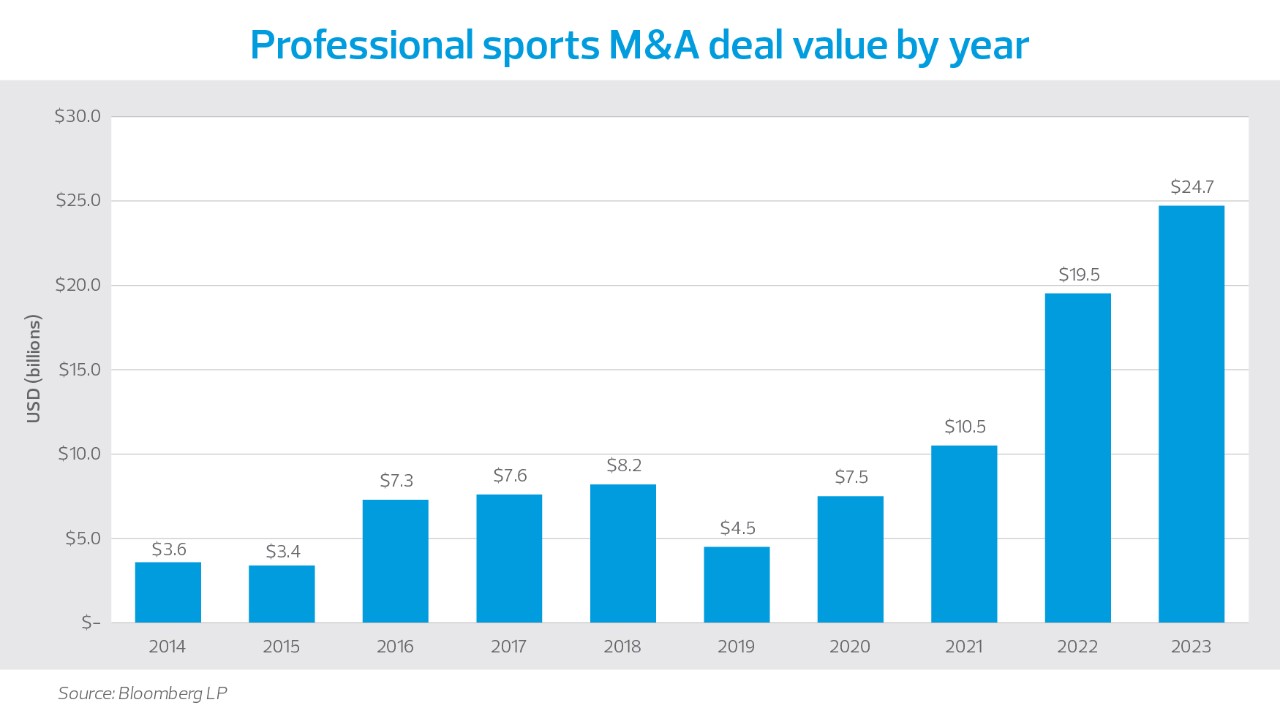

The most obvious upside to sports team investment is the continued ascension in valuations. Between 2018 and 2023, the combined value of the 50 most valuable sports franchises increased by approximately 90% to $256 billion, according to a Forbes analysis. NFL valuations in particular have grown 69% over the past three years alone, according to Bloomberg.

The Washington Commanders sold for $6 billion in 2023, despite not having won a playoff game in nearly 20 years. There has already been a successful private equity exit involving another team: the Phoenix Suns sold a stake at a valuation of $1.55 billion in 2021, and that stake then sold at a $4 billion valuation less than two years later.

While there may be a valuation cliff eventually, recent ratings would indicate that the NFL is more popular than ever. Of the 100 most-watched television programs in 2023, 96 were NFL broadcasts. Meanwhile, numbers for the first week of the 2024 season were up across the board, with the opener between the Kansas City Chiefs and Baltimore Ravens drawing the biggest kickoff game audience ever. The second game of the season, which was the NFL’s first game in Brazil and streamed on Peacock, reflected the league’s strategic investments in both streaming and international expansion. This could help to achieve NFL Commissioner Roger Goodell’s revenue goal of $26 billion by 2026.

A different type of investment

Recognizing the risks of an excessive focus on short-term growth, the NFL has imposed several restrictions for private equity investors. Most notably, private equity investors will be limited to a 10% stake of a team’s equity, and there is a minimum holding period of six years.

This would be a departure from the typical private equity holding period, which, despite an uptick in recent years due to economic and market factors, historically has been three to five years. Further, investors will not have voting or governance rights in the team. Any private equity investment would represent “a silent position that would give access to capital for the teams that wish to offer 10%,” Goodell said in a Barron’s news story.

The premium paid to join the exclusive NFL team ownership club is also significantly higher than in typical private equity deals. Whereas purchase price valuations in most industries are based on a multiple of operating profit (or EBITDA), the recent sales of NFL teams have been based on multiples of revenues. For example, the 2022 sale of the Denver Broncos for $4.65 billion reflected an 8.8x revenue multiple, while the recent Commanders sale discussed above jumped to an 11x revenue multiple, according to CNBC.

Not all teams are created equal

Despite the NFL’s $256 billion dollar valuation, individual teams operate as much smaller independent entities that vary greatly in maturity, assets, structure and even revenue models. One example of that is the relationship with the stadium. Only four teams own and operate their stadiums; the other 28 pay rent. Teams also have distinct ways of generating revenue outside of NFL revenue sharing. Each team also makes independent decisions about their enterprise resource planning systems, accounts payable, data analytics platforms and other back-office functions.

In 2023, the 32 NFL teams generated an average of $127 million in EBITDA. However, there was significant variability across the league in this metric, ranging from the Dallas Cowboys ($564 million) to the Detroit Lions ($56 million), according to Forbes. EBITDA remains one of the key metrics that private equity firms use in analyzing prospective investments, as it provides insights into the operating performance and cash flow of the business by removing nonoperational impacts to determine the true value of the company.

Making the call

Like any investment decision, investors will look to understand which targets have the highest growth potential. This may include the traditional operational efficiencies related to people, process and technology, alongside implications related to media deals, revenue sharing between large and small markets, salary caps, and competition for championships.

One of the top operational challenges for most teams is managing cash flow. Teams receive large payments from the NFL as their primary revenue engine, but simultaneously have large outflows of cash. This can make investments into nonfootball operations challenging. Private equity investment will increase the available capital for underfunded teams to improve operating revenue and margins. Additionally, many family-owned franchises that have relied on legacy corporate habits will now be influenced by new investors with different ideas on how to optimize the business.

As private equity places their bets in the NFL, institutional investors will look far beyond wins, losses or recent draft picks. We anticipate they will use the playbook of betting on underachievers to increase valuations through improved efficiencies.