Since the last economic recession, the industrial sector has lagged others in capital goods investments, but 2021 saw record industrial spending in this area as companies played catch-up.

Capex in manufacturing key takeaways

This elevated spending could have important implications for the industry’s future, especially on the labor front.

The question for 2022 is whether the industrial sector’s recent surge in capital expenditure investments will continue at its current pace, level off slightly, return to historically low pre-COVID-19 levels or sink even lower.

Rising capex investments require ‘new collar’ workers

Since the last economic recession, the industrial sector has lagged others in capital goods investments. This is especially true for productivity-enhancing and technological investments. However, the year 2021 saw record industrial spending on capital goods, with industrial companies playing catch-up. This elevated spending could have important implications for the industry’s future, especially on the labor front.

Capital goods spending on items like buildings, machinery, equipment, vehicles and tools that produce finished goods has fully recovered from the Great Recession and reached its highest level in decades during the pandemic. Excluding the aerospace sector, U.S. industrial companies are playing catch-up and investing in expansion and new capabilities that have experienced underinvestment since the last economic downturn.

Are manufacturing orders headed to a downturn?

As supply chain challenges ease and the availability of raw materials and components increases, the manufacturing momentum may continue, although at a slower pace than in 2021. Manufacturing companies continue to struggle with backlogs and fulfillment of new orders, which indicates elevated demand. The question for 2022 is whether the industrial sector’s recent surge in capital expenditure investments will continue at its current pace, level off slightly, return to historically low pre-COVID-19 levels or sink even lower.

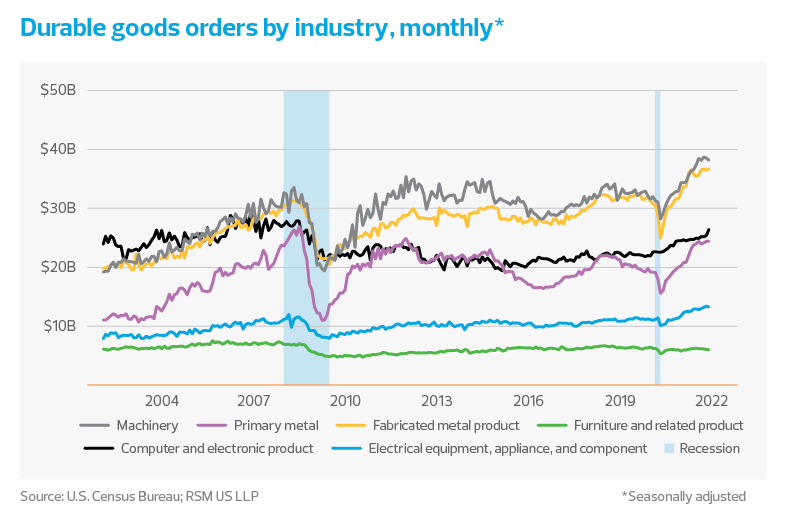

Elevated spending in the industrial sector hasn’t yet shown a broad-based slowdown (as seen in the accompanying chart on durable goods). In 2022 we expect demand will remain elevated but not as robust as 2021. This view is based on the still-elevated levels of unfilled orders and consumer demand from excess savings, as well as catch-up investments from the last economic recession, all of which will continue to provide a boost.

Headwinds from inflation, rising interest rates, new strains of COVID-19, a lack of ongoing government stimulus, and ongoing supply chain snarls will act as a speed brake in 2022, moderating growth. We expect this more sustainable pace than in the prior year should support the elevated capital expenditure investments.

Labor implications

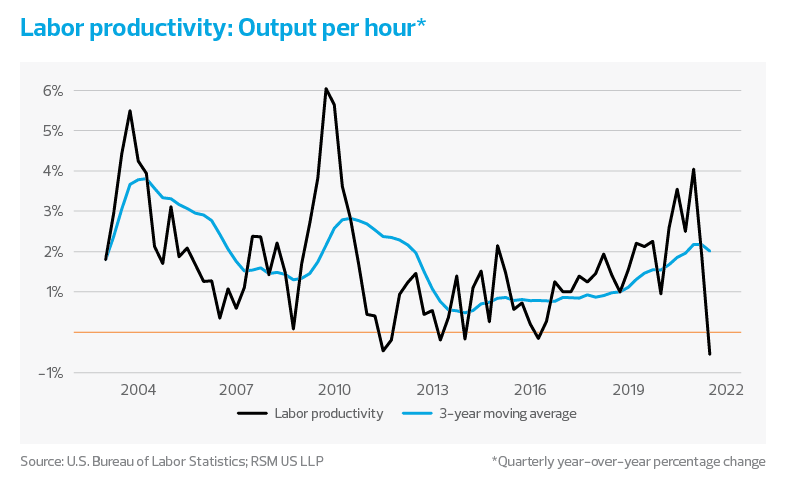

Business investment in capacity, enhancements and technology will almost certainly lead to an increase in labor productivity as measured by output per hour, due to efficiencies and increased output from newer equipment. Information technology investments will also drive productivity.

Overall production, however, will continue to be plagued by labor shortages. There are a total 10.5 million job openings in the United States, 858,000 of which are in manufacturing, according to the U.S. Bureau of Labor Statistics. Businesses must therefore make strategic investments that will boost worker efficiency

Information technology is one key area businesses should consider when it comes to such investments—and many of them are already doing so. According to the U.S. Census Bureau, information technology spend by industrial businesses has increased 21% since the onset of the pandemic, and that spending has only continued to grow as the pandemic has continued. We expect this focus on IT investment to continue, but—much like the sector’s capex investments overall—at a slower pace.

Ultimately, investments in robotics and automation will gradually help organizations address their labor shortages and lessen inflationary pressures.

Despite investments in IT and more efficient capital goods, however, American manufacturers are still facing skill shortages. Even with an unemployment rate of 3.9% in December, we expect the skill gap in manufacturing to grow if not addressed in the near term.

This environment has created a renewed emphasis on workers cultivating new skills around analytics and automation.

Today’s manufacturers need “new collar” workers who have more technical, advanced skills than traditional white-collar office workers or those in blue-collar jobs, especially in the areas of automation, analytics, robotics and the Internet of Things. While proficiency in machinery is essential, dual knowledge of analytics or advanced robotics is in high demand. As job requirements continue to change, manufacturers must develop recruiting and training strategies such as reskilling and upskilling to keep pace with this industry shift.

While introducing advanced technologies may further proliferate the talent shortage in the short run, greater automation will ultimately allow organizations to maintain a leaner workforce.

Lastly, investments in technology and more effective capital goods spending always have a deflationary effect in the long term. However, we do not expect this effect to have a meaningful impact in 2022, because much of today’s inflation is driven by supply chain issues not expected to resolve until late 2022 or early 2023.

The takeaway

For middle market organizations that invested heavily in areas such as advanced machinery and technologies, we can expect improved productivity in the years ahead. Organizations that have held off on these investments will increasingly find it difficult to stay competitive. Ultimately, investments in robotics and automation will gradually help organizations address their labor shortages and lessen inflationary pressures.

RSM contributors

Subscribe to Manufacturing Insights

Sign up to receive our monthly tax, accounting and operational information, ranging from tips for addressing daily challenges to strategic and long-term planning initiatives.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.