Labor challenges, along with the fact that capital is still readily accessible, have strengthened the case for companies to make investments in robotics and automation.

Automation in manufacturing key takeaways

The International Federation of Robotics projects the recent economic boom following the pandemic’s initial sharp downturn to have accelerated North American robot installations by 17% in 2021 and anticipates low double-digit growth rates in 2022 and beyond.

In addition to supplementing labor needs, robotics and automation can help balance cost in countries where labor is more expensive and enable regional supply chains..

Manufacturing companies have struggled to meet the post-crisis demand spike after the initial pandemic slump for many reasons, but perhaps most importantly because of labor shortages.

The sector’s labor challenges existed well before the pandemic but have become more painful over the last year; manufacturing job vacancies were at 858,000 in November 2021 compared to 385,000 in December 2019.

Workers have more negotiating power today as companies offer more competitive wages, bonuses, flexible schedules and other accommodations to attract and retain employees. The tight labor market has also increased the bargaining power of unions. These challenges, along with the fact that capital is still readily accessible, have strengthened the case for companies to make investments in robotics and automation.

There were a record 310,700 industrial robots operating in U.S. factories in 2020—an increase of 6% from 2019, according to a 2021 report by the International Federation of Robotics. The growth in 2020 was lower given the pandemic’s discouraging impact on capital investments. However, as employment fell in 2020, the manufacturing sector’s robot density—the number of robots per 10,000 human workers—increased to 255 from 176 in 2015, according to IFR data. That growth is just getting started; the IFR projects the recent economic boom following the pandemic’s initial sharp downturn to have accelerated North American robot installations by 17% in 2021 and anticipates low double-digit growth rates in 2022 and beyond.

Robots are here to stay

Some trends will sustain robotic growth even after the recent pent-up demand stabilizes, especially as today’s manufacturing sector focuses increasingly on speed and customization. More companies are accommodating a “batch size of one,” which is needed for customized variations for a growing number of products, and robots can help lower the costs of such customized units. Greater robotic density may reduce lead times and set new industry standards for all companies—whether or not they have made robotic investments.

There is still resistance among small and midsize manufacturers when it comes to adopting the technologies of the fourth industrial revolution. But once companies invest in automation, it will be permanent; organizations likely won’t roll back such investments even if the labor situation improves.

More and more, companies and their suppliers are considering regionalizing and localizing supply chains to be closer to customers and more resilient to trade, weather, geopolitical and other disruptions. In addition to supplementing labor needs, robotics and automation can help balance cost in countries where labor is more expensive and enable regional supply chains.

Microfactories and fully digitalized/lights-out facilities—so named because of their ability to run without humans on-site—that provide proximity to customers, minimal lead times and customization are possible due to advancement in robotics and adjacent technologies such as cloud computing, 5G, machine vision and artificial intelligence. A growing supply of low-cost robots and an increase in “robots-as-a-service” and “pay-as-you-use” models will also reduce the cost of robotic investments.

To be sure, robots are not going to completely replace human labor anytime soon. There is still resistance among small and midsize manufacturers when it comes to adopting the technologies of the fourth industrial revolution. But once companies invest in automation, it will be permanent; organizations likely won’t roll back such investments even if the labor situation improves. Given the increase in robotics on the shop floor, companies should view their robotic investments as part of their broader business and digital strategy if they want these investments to be successful. Here are some questions for leadership teams to consider:

- Is robotics only a labor solution for the company, or does integrating robotics require a change in the business model, too?

- In which workflows across the company can robotics create the most efficiencies and the greatest competitive advantage?

- How will robotics interact with other technological changes planned for the company, and where does it fit in the company’s broader digital strategy?

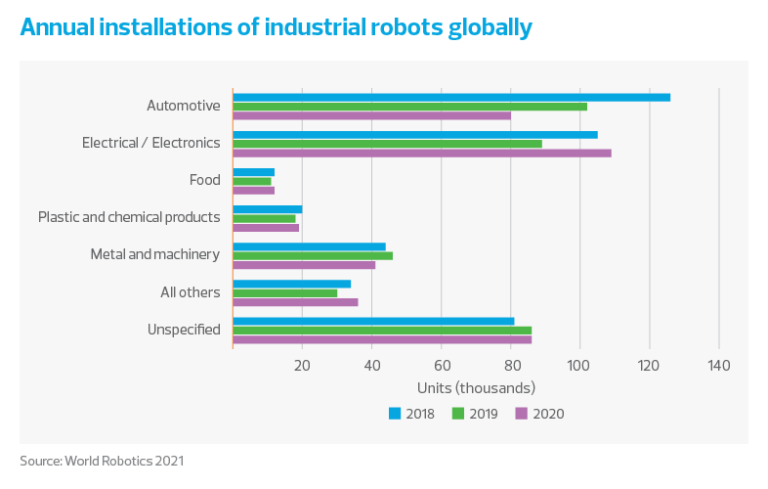

Companies should keep in mind future products, processes, and business and location strategies while structuring their investments. China, for instance, leads in number of robotic installations, according to IFR, and Japan and South Korea also figure in the top five countries. As companies think of expanding their global presence and being closer to customers, robotic density may become more important than lower-cost human labor in deciding where to locate manufacturing.

Subscribe to Manufacturing Insights

Sign up to receive our monthly tax, accounting and operational information, ranging from tips for addressing daily challenges to strategic and long-term planning initiatives.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.