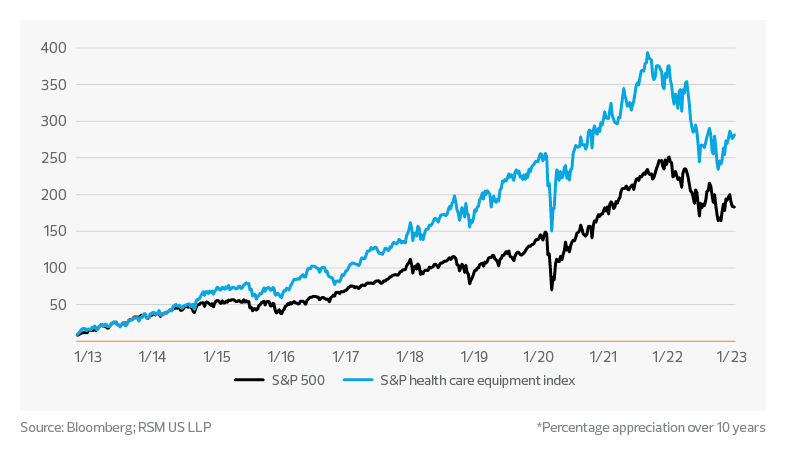

Capital markets remain volatile, but sector performance over the last decade relative to the S&P 500 remains ahead.

Key takeaways

Medtech M&A activity is expected to increase in 2023.

Digital health tech investment remains high, but further research proving safety and efficacy is needed.

Capital markets update

The past year has been difficult for the capital markets, as most major indexes were down due to inflationary, geopolitical and macroeconomic uncertainty. The S&P health care equipment select industry index, which includes all medtech, medical device and health care equipment companies, underperformed relative to the S&P 500.

Despite this pullback, the health care equipment index over the last 10 years has continued to outperform the S&P 500, with a compounded annual growth of 13.9% compared to 10.9%. We expect volatility across all sectors will remain high and that the health care equipment index will continue to underperform until inflationary concerns are alleviated. However, in the long term we expect the health care equipment sector will continue to outpace the S&P 500, supported by strong consumer demand for medical devices and an aging population in need of medical care.

Medtech market activity*

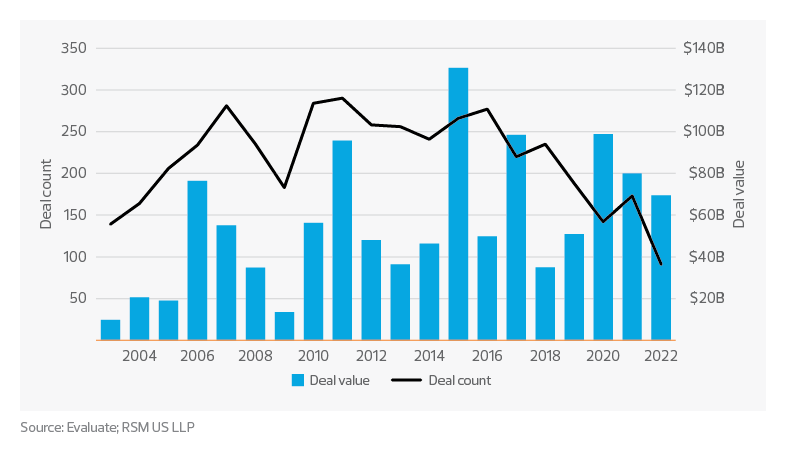

MedMedtech M&A activity remains slow but is expected to increase in 2023

Over the last decade, low interest rates have driven record high valuations, resulting in a trend toward larger and fewer merger and acquisition transactions. Recently, deteriorating capital markets and rising interest rates have slowed M&A activity further as buyers and sellers struggle to agree on a fair value. Buyers flush with cash are expressing interest, but sellers continue to resist. We expect valuations will recede in 2023 as economic headwinds continue to affect the industry.

Medtech mergers and acquisitions activity

Notable transactions this year include major spinoffs of Johnson & Johnson’s consumer health business and GE HealthCare. Focus has shifted toward organizations spinning off businesses that have low margins or that don’t align with the company’s long-term strategy.

During uncertain economic periods, capital markets typically reward companies that can capture value quickly and generate free cash flow to shareholders. We expect this trend will continue as economic uncertainty persists in 2023. The recent wave of spinoffs has created new businesses that are lean, well-capitalized and looking to grow. These companies will place a premium on targets that are closely aligned to their long-term strategy, are easy to integrate and can help bolster their digital capabilities.

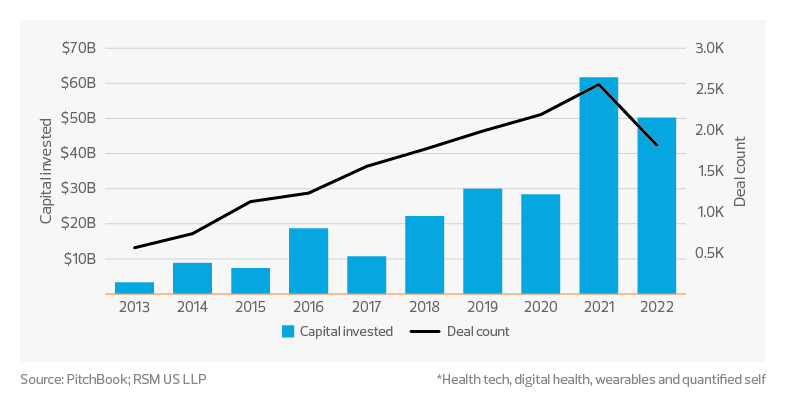

Investment in digital health tech slows, but demand remains strong

Advancements in semiconductors, sensor technology and artificial intelligence, combined with record levels of private investment, have spawned a plethora of new direct-to-consumer wearable devices and health care apps. These devices and apps target matters ranging from heart rate and blood oxygen to mental health. Exacerbated by the pandemic, consumer demand for these devices and apps exploded, and product development outpaced the number of clinical trials assessing their safety and efficacy.

Investment in 2022 slowed slightly compared to the record high in 2021, but we expect strong consumer demand will continue to drive investment in the sector as companies leverage accelerating technological improvements to provide affordable direct-to-consumer health care solutions.

In the long term, the growing health demands of an aging population, the increased emphasis on caring for patients and consumers at home, and shifting wellness trends, will guide innovative medtech companies toward development of much-needed new devices. Companies that have a focused business plan, a resilient supply chain strategy and a robust digital platform are best positioned for growth.

Private equity and venture capital investment in digitized health*