Consumers are turning to store or private label brands to save money.

Key takeaways

Sales of premium products have declined.

Understanding the consumer and monitoring sensitivity to pricing and promotion will be imperative to stay nimble.

The food and beverage ecosystem may experience reduced innovation and more persistent inflation.

Inflation and economic headwinds continue to shrink consumer spending, particularly in the food and beverage industry. After accelerating during the pandemic and staying resilient as consumers reverted to familiar spending patterns, the trend toward premium offerings in this sector is beginning to falter as consumers start to scale back and trade down to adjust to continually rising food prices.

Despite record spending in the food and beverage category, consumers have resorted to reducing their purchases in response to inflation, resulting in an 8% year-over-year decline in real spending. In addition, buyers are also turning to store brands to save money, with sales of private label products growing by 11.3% in 2022, outpacing national brands.

This shift toward private label brands is not limited to lower-income consumers, as middle- and upper-income shoppers also opt for these products to save money and focus on value. Private label market share has increased significantly for items showing the highest inflation, including eggs, salad dressings and oils, and beverages.

Consumers are also adopting new shopping behaviors, with increased foot traffic and smaller basket sizes indicating they are visiting multiple outlets to find the best deals. Sales through the club channel, a popular savings avenue for upper- and middle-income consumers, have also increased. These behaviors suggest that consumers are changing where they shop to address the higher cost of food.

Food businesses that have invested in premium and natural products have initially seen success but are now feeling the pressure of rising costs. While these products were able to absorb more input cost inflation due to higher demand, they are now experiencing price increases that deter consumers from purchasing. In fact, premium product sales have declined for the first time since 2022, signaling additional challenges to growth going forward.

The resumption of student loan payments and continued cost of living increases could further restrain the premium food and beverage category’s upper- and middle-income target demographic. Therefore, businesses must remain vigilant and adapt to changing consumer behaviors and preferences to remain competitive in the market.

Consumers unlikely to see relief from improving supply chains

Businesses across the supply chain dealt with inflation by trading volume growth and household penetration for margin protection and profitability. The lack of a meaningful trade down from consumers allowed brands and distributors to continue raising prices and demonstrate to stakeholders their ability to manage inflationary pressure. This reprioritization and resulting higher prices to retailers may mean consumers won’t see the relief from rising grocery bills and restaurant receipts.

Consumer and producer price year-over-year change

The price of commodities critical for food and beverage ingredients, packaging and logistics have normalized from peak levels in the second quarter of 2022 which has slowed the increase in producer prices from a post-pandemic peak of 16% in November 2022.

TAX TREND: Inventory

Elevated inventory levels and decreased demand for goods amount to an opportunity for food and beverage companies to review their inventory accounting methods—which affect net earnings and the associated tax obligations. Companies should confirm their methods align with how their inventory is purchased, how they incur direct and indirect costs, and how quickly it is turning over.

However, food and beverage businesses have not totally passed on price increases, with consumer prices only once escalating faster than producer prices since 2020, meaning that some of these increases haven’t fully been absorbed by consumers. Moreover, the spike in commodity prices demonstrated the sensitivity of the food system to geopolitical and weather events. Food and beverage manufacturers will likely increase hedging and forward buying of commodities to protect against the supply chain risks they’ve experienced over the past two years, and incorporate those costs into pricing strategies going forward.

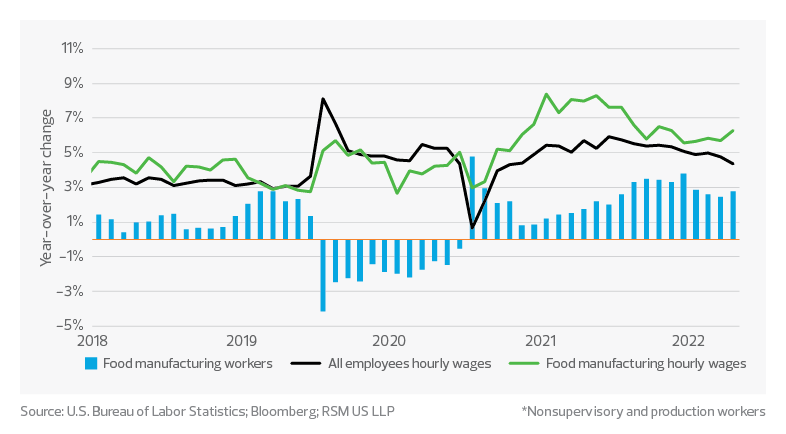

Slower wage growth affects headcount growth*

Increased labor costs will likely be stickier. Low-wage production employees remain critical to food and beverage manufacturing, particularly for midsize and smaller producers. Food manufacturers have experienced difficulty bringing workers back into production facilities following pandemic restrictions. Food manufacturers continue raising wages faster than the overall average for hourly and nonsupervisory employees. While wage increases remain higher than historical averages, the slower pace of hiring results in fewer jobs filled in warehouses and factories as employees opt for jobs with better wages, benefits and improved working conditions. With 328,000 job vacancies in the nondurable goods manufacturing space, according to the U.S. Bureau of Labor Statistics, more increases are likely required to draw employees into the industry. Advances in automation and its increased adoption should help to offset the labor imbalance long term.

TAX TREND: Workforce

For food manufactures seeking to attract entry-level employees, developing a compensation philosophy centered on total rewards instead of just cash salary may help to balance costs with offerings that match workers’ preferences. Education opportunities or assistance, subsidized transportation benefits, and retirement programs are just a few of many common offerings with tax implications.

Already heavily regulated food and beverage businesses will also need to account for increased regulatory pressure with mounting scrutiny and liability throughout the supply chain. While the avian flu outbreak in 2022 wreaked havoc on the poultry suppliers and led to soaring chicken and egg prices, fortifying factories and facilities against the future spread will be costly. Meanwhile, more states have adopted extended producer-responsibility laws that increase the cost of inputs for these businesses.

Promotional activity across the board has increased for edible consumer products through the week ending March 31 from a year ago, according to IRI market data. However, the depth of the promotion—

the discount the consumer sees—has been flat over the same time period. Brands are investing in getting their name in front of consumers but not giving in on price to drive increased in-store adoption. Grocers have added to pricing pressure on brands and distributors by introducing new promotional fees and short paying more often for rejected merchandise.

Large food and beverage companies, particularly those that are publicly traded, are demonstrating to stakeholders a focus on margin rather than market share. There is an opportunity for smaller brands to gain market share by making a margin sacrifice to play to an increasingly cost-conscious consumer. Brands that can convey a compelling message of quality and value are best poised to improve their brand positioning and sales. Understanding the end consumer and monitoring sensitivity to pricing and promotion will be imperative to staying nimble and not unnecessarily leaving margin on the table.

Innovation could be a casualty of rising rates

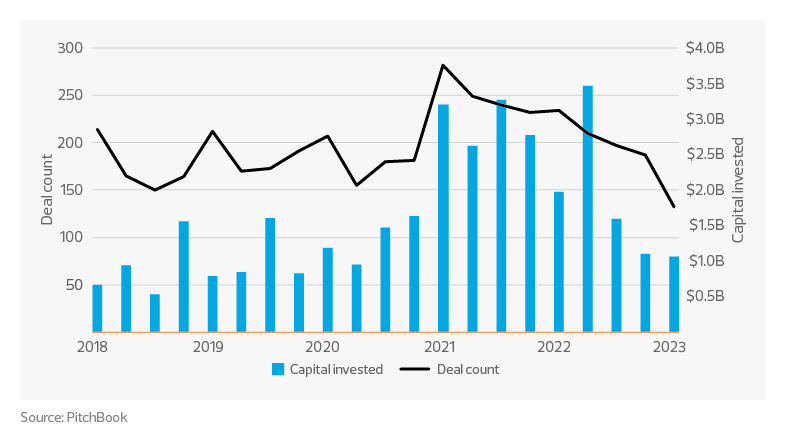

The recent uptick in interest rates has led to tightening financial conditions across the global economy. As a result, the food and beverage ecosystem may experience reduced innovation and more persistent inflation. During the early stages of the pandemic, venture capital firms heavily invested in food and beverage startups that offered unique solutions to address the emerging changes in consumer behavior. These innovators focused on enhancing the efficiency of grocery and meal delivery, automating manual labor and increasing safety in warehouse operations, among other improvements. They also introduced new processes for food production that garnered interest from investors seeking the next disruptive idea.

However, with rising interest rates venture capitalists have become more risk averse and have reduced their investments in the sector. The pullback may leave consumers bearing the cost of meaningful innovation or a lack of it.

Venture capital investment in North American food and beverage businesses

In some innovative categories, such as plant-based meat alternatives, the proliferation of new products, has driven overall prices lower. Venture capital played a significant role in fueling the expansion of these brands into new stores and geographies. Continued growth and market share protection will be challenging without additional sources of financing, leaving the door open for established national brands to dominate the category and leverage pricing power.

TAX TREND: Reformulating products

Food and beverage companies facing high input costs or seeking to meet consumer demand for quality may invest in reformulating their products. In doing so, these companies might be eligible for research and development tax credits. The process involves identifying and quantifying R&D activities and costs, compiling proper documentation and support, and developing an overall methodology to quantify and support past, current and future credits.

Venture capital played a significant role in large-scale innovations such as cell-based meats, agricultural tech, and vertical and regenerative farming, creating safer, more sustainable and efficient food and beverage supply chains. Higher interest rates and tighter credit conditions may change investors’ willingness to finance the long-term rewards of these big bet investments. Innovations with longer-term impacts on inflation may suffer as well.